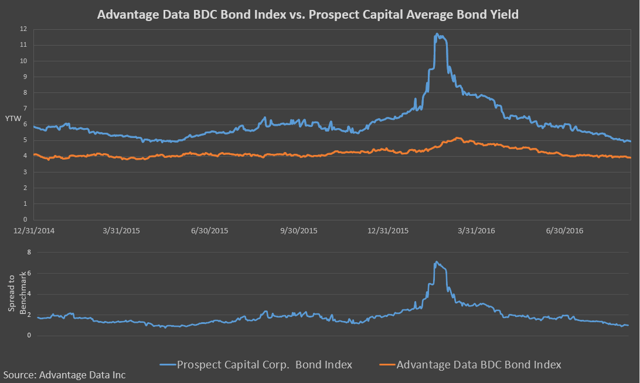

Prospect Capital (PSEC): Comparing a market-weighted custom index of 25 Prospect Capital bonds to the industry benchmark shows spread declining from a high of over 690bps in February to just 102bps as of the end of 3Q 2016.

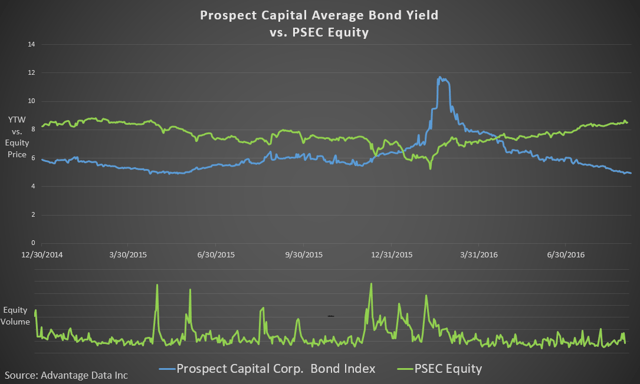

PSEC equity hit a new 52-week high in August and has rebounded over 50% from it's bottom in February.

Want to learn more about Advantage Data's BDC and High Yield coverage?

Subscribe to THINK for more credit market updates and request a free trial of Advantage Data.

.png)