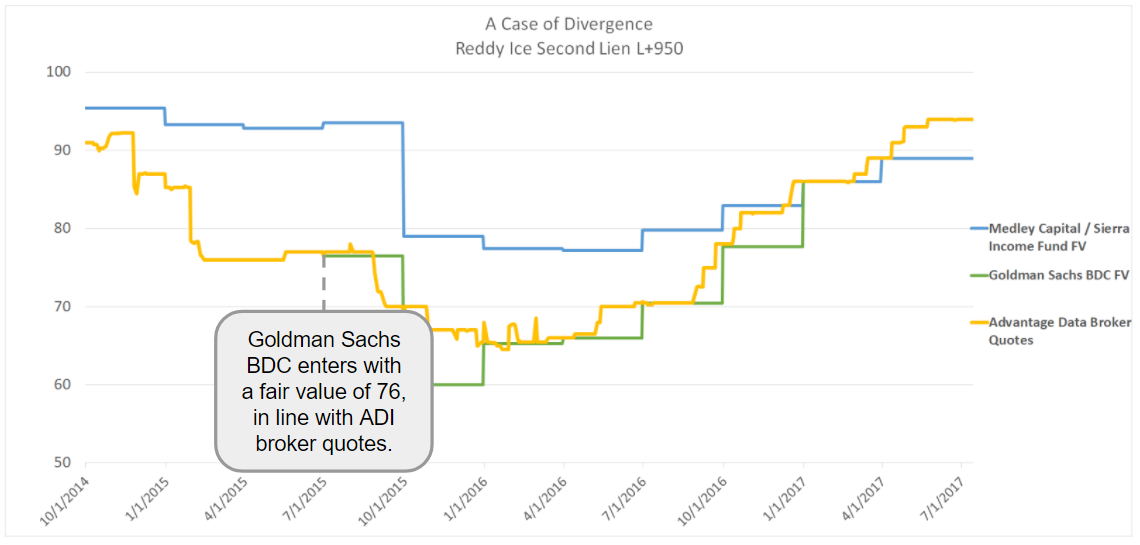

In this summary Advantage Data aims to highlight the challenges faced in sourcing and utilizing market data for valuation of illiquid and middle market loans. We will consider the overall methods of aggregating and applying data to loans in this space and how the issues surrounding the lack of readily available information can be overcome.

Recent Posts

Sourcing and Utilizing Market Data for The Valuation of Middle Market and Illiquid Loans

Topics: Middle Market, Valuation

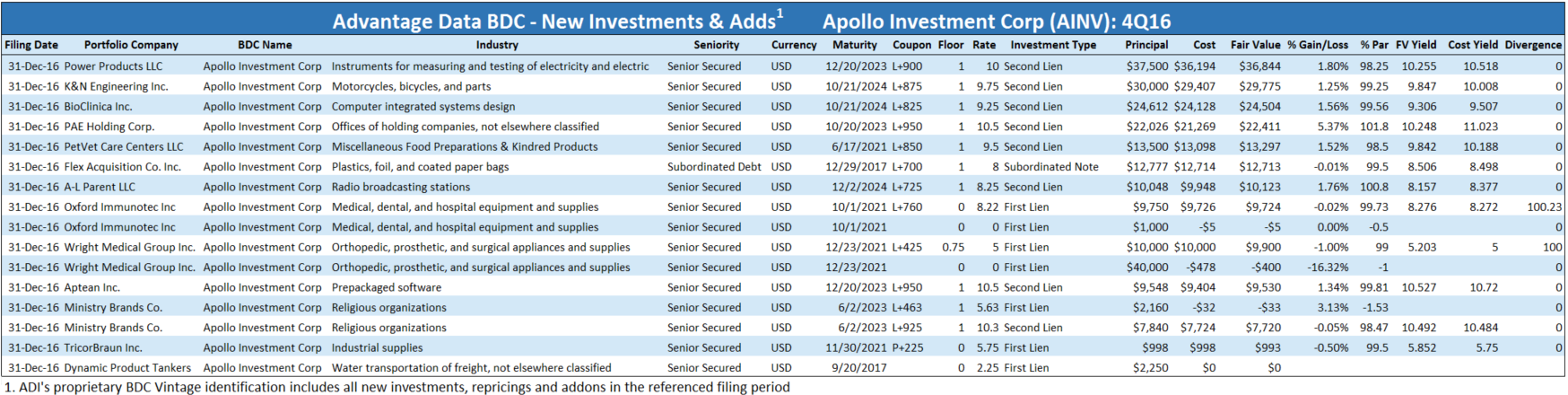

Apollo Investment Corp. (AINV) filed 4Q16 results yesterday including debt investments at 13 new portfolio companies. Click here to dive into Apollo New Investments courtesy of our BDC Database.

Topics: BDC, business development company, New Issues

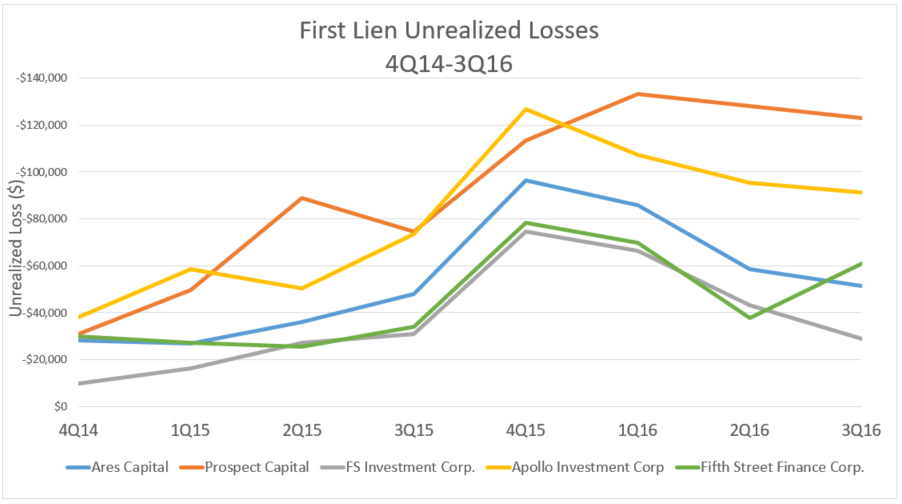

BDC Unrealized Losses and Percentage Loss - First Liens

Topics: Middle Market, BDC, First Lien

BDC First Lien Marks Rise While Non-Accruals Stay Relatively Flat

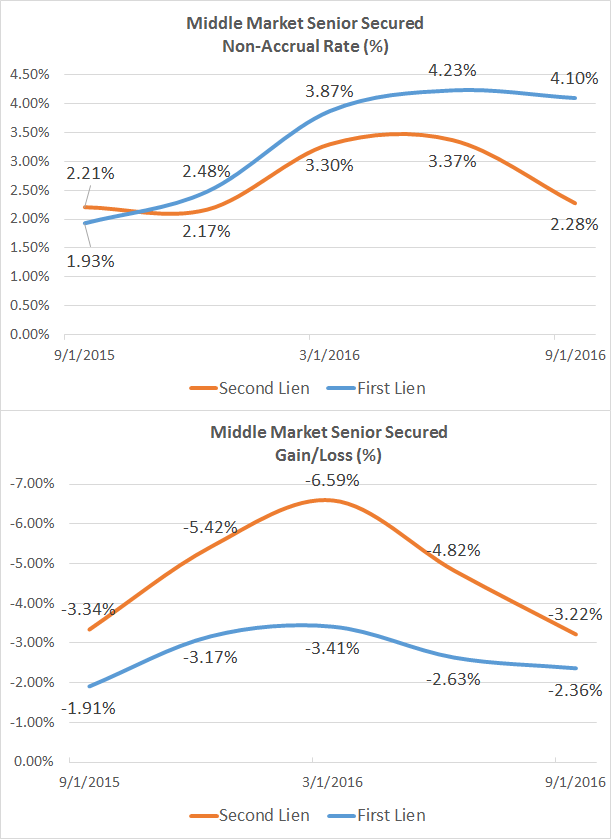

Interesting divergence between the first and second middle market liens on non-accrual vs. percentage loss over the 12 months from Q4 2015 through Q3 2016. In BDC portfolios, first lien non-accruals as a percentage of cost exceed second liens, while on a percentage loss basis second liens exceed first liens.

Topics: Middle Market, First Lien, Non-accruals

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)