Nicholas Marshi, BDC Reporter

BDC COMMON STOCKS

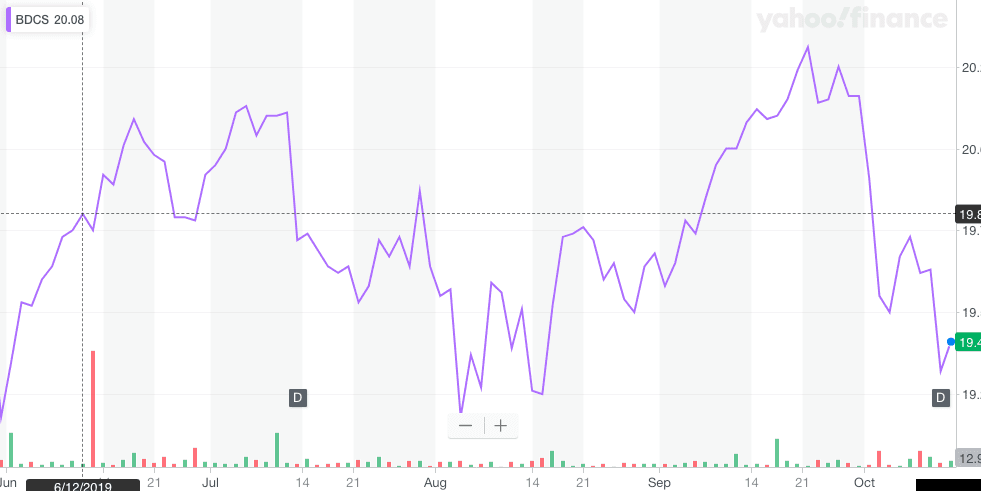

The S&P 500, Dow Jones and NASDAQ all moved up in the week ended October 25, 2019 so the BDC sector did as well.

That’s been the pattern of late, and nothing occurred to make things different.

The S&P 500 was up 1.22% and the UBS Exchange Traded Note with the ticker BDCS, which we use a proxy for price change, jumped 0.77%.

For reasons that are not clear, the Wells Fargo BDC Index moved up only 0.22%.

(Still, the Wells Fargo index has been up for three weeks in a row, just like the S&P 500).

Read More

Topics:

Loans,

Analytics,

BDC,

market analytics,

business development company,

News,

bdc reporter,

research

BDC COMMON STOCKS

Yoked Together

Another week and another instance of the BDC sector being synced to the S&P. Or so the numbers seem to show.

For the week, the S&P 500 index was up 0.54%. The UBS Exchange Traded Note which owns most of the publicly listed BDCs – ticker BDCS – was up 0.52%. In the approach to earnings season, there’s little else that can move the BDC sector, so why not?

Read More

Topics:

Loans,

Analytics,

BDC,

market analytics,

business development company,

News,

bdc reporter,

research

BDC COMMON STOCKS

Proof Positive

Once again, the weekly performance of the BDC sector demonstrated that its ups and downs are tied to the broader markets.

We’ve watched for weeks now BDC prices rise and fall with the major indices, which are themselves apparently fixated on the progress of the trade war.

This week was no exception.

The S&P 500 moved up 0.62%, mostly late in the 5 day period, due to the promise of a trade armistice or partial deal of some sort.

“Hurrah” said the markets, but as CNBC is reporting, second and third thoughts are already running rife so the trade tease is likely to continue.

This week at least, though, the late-in-the-week optimism brought the Wells Fargo BDC Index up 0.73%, after two prior weeks in the dumps.

Read More

Topics:

Loans,

Analytics,

BDC,

market analytics,

business development company,

News,

bdc reporter,

research

BDC COMMON STOCKS

Surprised

Halloween is still a month away but the broader markets were spooked this week by a series of negative economic reports.

That caused all the major indices to drop in unison for several days.

Appropriately enough, a positive payroll report (unemployment at its lowest level in 50 years !) brought investors back in.

At the end of the 5 business day period the S&P was barely down: (0.33%).

Read More

Topics:

Loans,

Analytics,

BDC,

market analytics,

business development company,

News,

bdc reporter,

research

BDC COMMON STOCKS

Finished

Nothing lasts for ever – including BDC common stocks winning streaks – which ended this week in the red after 5 consecutive weeks in the black.

The UBS Exchange Traded Note with the ticker BDCS – which includes most of the sector’s public companies and which we use to measure price changes – was down (0.44%), closing at $20.16.

Likewise, the related Wells Fargo BDC Index – which provides a “Total Return” picture was off (1.01%).

31 individual BDCs dropped in price in the week while 15 were up or unchanged.

Read More

Topics:

Loans,

Analytics,

BDC,

market analytics,

business development company,

News,

bdc reporter,

research

.png)