European indices closed higher on Tuesday, rebounding from previous declines. Germany's monthly economic sentiment index came in below analysts projections on Tuesday, while the U.K. saw its first July surplus in 15 years and defied analysts' expectations of a £1 billion deficit. Fed Chair Janet Yellen and European Central Bank President Mario Draghi are both set to speak in Jackson Hole at the 2017 Economic Policy Symposium on "Fostering a Dynamic Global Economy" later this week.

Recent Posts

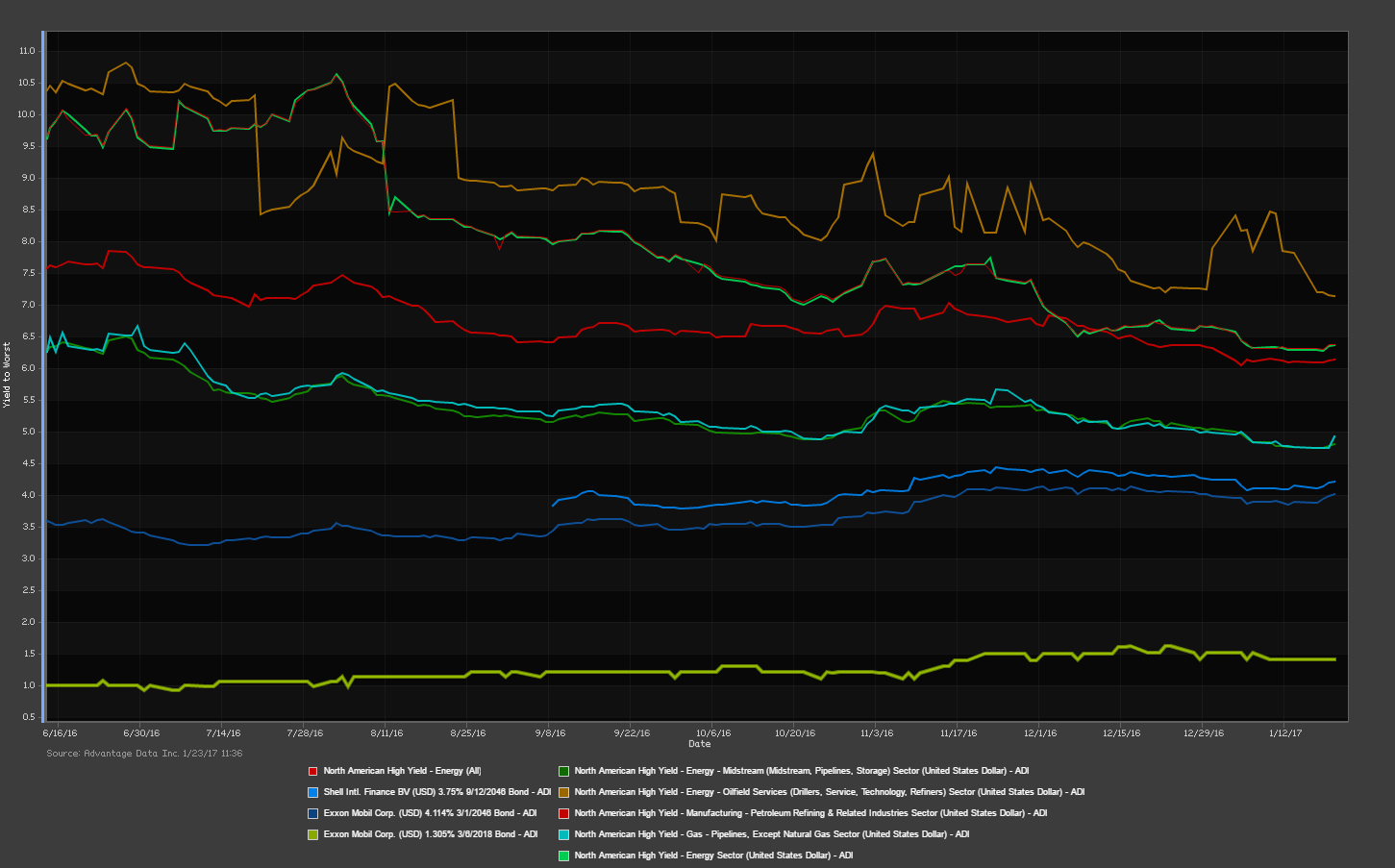

Oil futures fell on Monday after reports of an increase in U.S. crude production, defying the efforts of OPEC, as well as non-OPEC producers' goals to reduce output levels. The global benchmark Brent crude prices dropped $0.49 to $55 per barrel, while WTI crude futures traded down 1.2%, at $52.58 per barrel. U.S. oil production has risen 6% since Q3 2016, and data suggests production will continue to rise. U.S. drillers added the most rigs in nearly 4 years last week [source], offsetting reduction efforts by OPEC. The offset could stir up some tensions with U.S. allied OPEC partners, who were showing "...'very good' compliance..." [source] to reach the goal, as described by Saudi Arabia's energy minister, Khalid al-Falih.

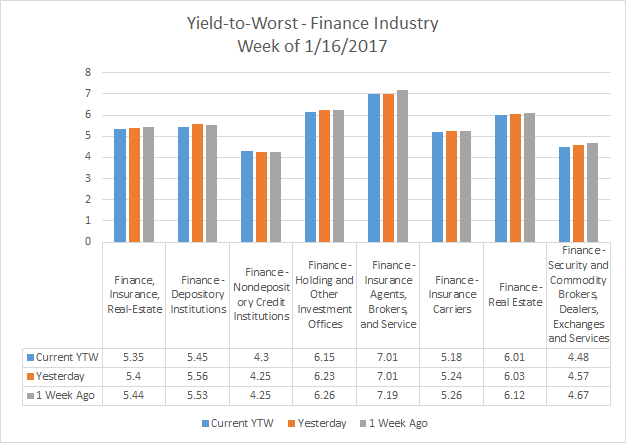

Finance Industry Analytics - Week of January 16, 2017

AdvantageData's (ADI) proprietary data shows low yield-to-worst statistics throughout the finance industry. With current yields being lower than yesterday’s and the previous week’s yields, investors are showing some signs of confidence for the financial sector. A better-than-expected earnings report by J.P. Morgan helped boost banking shares internationally, as discussed in Friday’s AdvantageData North American High Grade (HG) & High Yield (HY) summaries.

Topics: High Yield, YTW, Finance

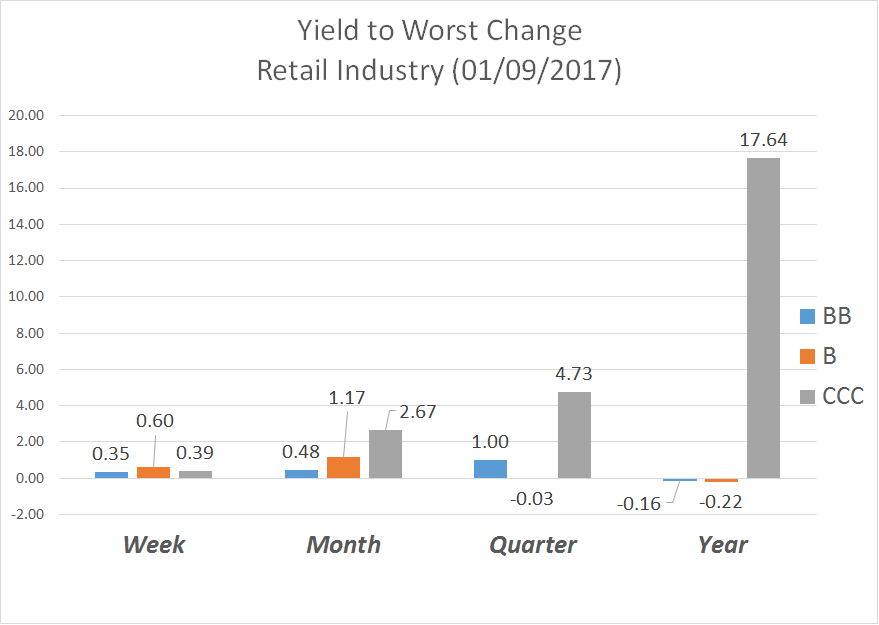

Shrinking historical “Yield to Worst” change shows that investor’s appetite for risk appears to be growing in the retail industry. This steady trend conforms with the post election rally that has taken place. The retail industry has been bolstered by a nice bump from a holiday season rush. While brick-and-mortar stores appear to be under acute pressure, many big retailers adapted and have established a strong online presence.

Topics: High Yield, retail, YTW

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)