BDC COMMON STOCKS

Out Of The Ordinary

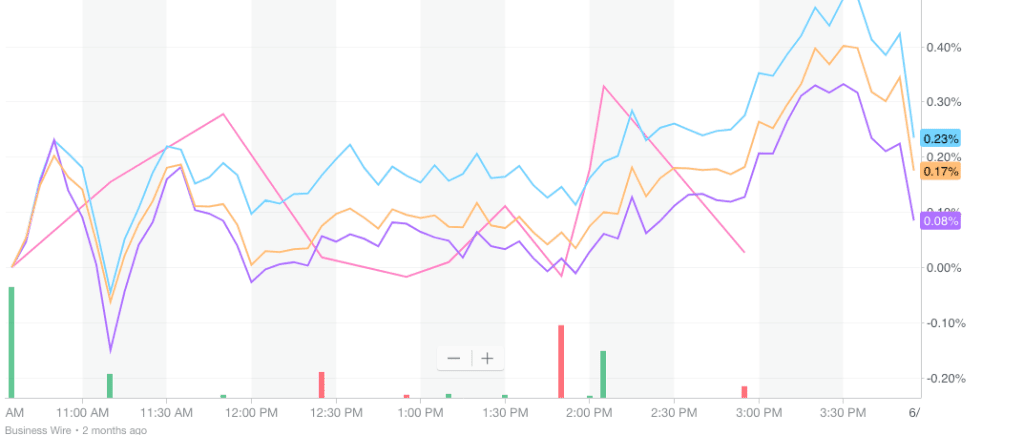

Unusually, the BDC sector outstripped the major indices in the week ended June 14, 2019. As the chart below illustrates, BDCS – the UBS Exchange Traded Note which includes most of the 45 public public funds we track – was up 1.4%, to $19.92. BDCS is in blue.

Both Sides Now

That other measuring tape of BDC performance – the Wells Fargo BDC Index was up by the same percentage.

Both measures have been up for two weeks in a row.

Supporting Data

Other indicators all suggest a BDC sector on the move upward.

29 BDCs were up in price versus 16 down, only a little less buoyant than last week when 33 were in the green.

Of the individual BDC stocks up in price, 6 were up 3.0% or more in the period, compared to 8 last week.

Best Of the Best

These Winners Of The Week were a motley crew, including GAIN, PTMN, CPTA, MVC, FSK and ABDC.

We noted that CPTA – down in the dumps for a long time following 2 dividend cuts – hit a new 52 week high.

(As we’re on the subject of new 52 week records: both popular MAIN and ARCC hit the high water mark in the week as well).

MVC’s stock was probably boosted by high reported earnings in the week.

The BDC Reporter did point out to readers that credit quality remains questionable at this small sized BDC, which has been re-making itself for years.

Moreover, those superior results were loaded with one time items, including the repayment by one of its portfolio companies followed by new, higher advances from MVC.

Then there’s the problem that much of the earnings booked are in non-cash form, as we noted on our Twitter feed.

(The BDC is the only one we cover that does not have a Conference Call after earnings are released, so no chance to dig deeper into that unusual transaction or anything else).

Still, despite that boost to the stock price, MVC is (6.9%) down over a 12 month time frame.

Gathering Steam

After the BDC sector seemed to falter as recently as May ended, there has been a definite change in June.

As of Friday, 21 BDCs were trading above their 50 Day Moving Average and 27 above the 200 Day Moving Average – a favorite metric of investors.

Over the level of 4 weeks ago a substantial minority of BDC stocks are up in price: 17 versus only 9 last week.

Still most BDCs (32) continue to trade below the level in February 2019 – when the sector reached its 2019 high, so there’s plenty of room for improvement.

As last week, 14 BDCs are trading above book, versus 17 back at the height.

We’ll have to wait and see if the BDC sector is having a short respite from a broader downward trend, or has made a sustainable turn.

Busy, Busy

Given that the only BDC reporting earnings was MVC, this was a busy week for BDC news.

We’ve already noted the new highs.

Frequent Subject

That was accompanied by a new low after Medley Capital (MCC) formally announced the results of its shareholder vote for directors.

(Spoiler alert for any Rip Van Winkles amongst our readers: the incumbents were re-elected).

That did nothing to help MCC’s stock price which dropped as low as $2.41, before closing the week at $2.48.

Since the stock peaked a few days after MCC first announced the proposed merger with its two sister companies in August of last year, the price has dropped by (40%).

Our decision to exit MCC last August – which we shared with our readers at the time in an article entitled “Why We Sold Medley Capital” – has been validated by what has transpired since.

Even now, what will happen next at and to MCC is what Winston Churchill described as a riddle wrapped up in an enigma.

Money, Money, Money

On a more positive note, there was plenty of capital raising this week.

Hercules Capital (HTGC) – unfazed by the loss (or is it just a short term hiatus ?) of its CEO – issued new common stock in a secondary and at a nice premium to par.

WhiteHorse Finance (WHF) – and its largest shareholder – is going in a different direction.

The ever steady BDC (26 quarters in a row of unchanged distributions) announced that its major shareholder would be selling a portion of its stock at $14.00 a share.

This was no great surprise to all the other shareholders, and the stock closed at $13.97.

Even with the sale of 2.350mn shares, the shareholder is left with three quarters of their position, so this is but a way station on the ultimate sell-off.

This story – like most everything else of importance that happens in the BDC sector – was covered in real-time on the BDC Reporter’s Twitter feed.

More Debt

Also covered on the Twitter feed – and in much greater detail shortly when we undertake the BDC Fixed Income Market Recap – was Great Elm’s (GECC) debt issuance.

The smaller BDC issued its third Baby Bond this week, after weeks of delay, at a pretty good yield of 6.5%.

Promoted

Finally, there was the announcement that Solar Capital (SLRC) and Solar Senior Capital (SUNS) now both have co-CEOs.

As we said: busy week.

Neck Out

Looking forward, we remain skeptical that this fortnight long BDC upsurge (too early to call an official rally) will continue.

However, the BDC Reporter is far from infallible on such matters.

We explained last week in great detail why we are looking through a glass darkly, and nothing that has occurred since has changed our minds.

The 10 Year Treasury yield continues to drop and the chances of Fed rate cuts still seem high.

Ever Lower

LIBOR is already sliding down.

The 1 month rate dropped this week from 2.41213% to 2.38175%.

At the end of May, the rate was 2.4400%.

That continues to be a threat to net BDC earnings.

More Than Usual ?

Likewise, there are plenty of credit troubles in the BDC space to cause investors to shudder.

This week, we noted a big setback at a Prospect Capital (PSEC) borrower: United Sporting Companies, which has received a lot of press.

Also, problems loom at Frontier Communications and 99 Cents Only Stores, LLC.

Not Alone

These names are just the tip of the troubled company iceberg.

As we mentioned this week – when taking a break from our compilation of the BDC Credit Reporter – there are 16 BDC companies we’ve identified in Chapter 11.

(We’ve added two since to bring the number to 18).

On our Worry List – performing companies that seem more likely than not to fail – we counted 36 companies and over $1.8bn in investment assets at cost at risk.

We’ll be updating these numbers in the weeks ahead as we get closer to logging every BDC portfolio company into our database.

Just about every BDC is represented there, and some have long lists of under-performing companies in portfolio.

Not reason enough to go running for the exits yet, but if credit trends materially worsen, watch out below !

.png)