BDC COMMON STOCKS

All Done

With the big drop in the broader markets – and in the BDC sector – the BDC rally is done. BDCS dropped (2.9%) this week to $19.18. That level of BDCS is (5.2%) off the February 22, 2019 high.

By our self imposed rules any drop over (5%) from a high point ends a rally, so there you are. That means this latest rally – in the volatile up and down world of BDC common stocks – lasted from December 24, 2018 to May 31, 2019. That’s 5 months and 1 week. From lowest to highest (using intra-day numbers) BDCS moved up 18.12%.

Asterisk

BDCS, though, tracks price only.

The Wells Fargo BDC Index, which is a total return calculation, was down (2.6%) on the week.

By our numbers, the WF Index topped out on May 2, 2019.

As of Friday, that measure is down (3.9%).

In that way, the BDC rally lives on !

Like Nostradamus

In any case, the BDC Reporter did suggest last week items like how many that the BDC sector was fragile, despite having been largely untouched by the prior drops in the major indices.

Outside of the headline number – the level of BDCS – there were a multitude of other signs of weakening.

We discussed items like how many stocks were up on the week.

There were only 18, out of the 45 we track.

This week that metric only got worse: dropping to just 4.

We noted that 3 BDCs dropped (3.0%) or more.

This week, the number jumped to 15 !

We have not had that high a number since March 1.

Another favorite metric: the number of BDCs trading within 5% of their 52 week high or low was worrying us last week.

This week the number trading off the high – which had dropped to 12 at May 24 – fell to 7.

The number of stocks trading up to 5% off the bottom increased from o to 1.

Even Nostradamus Was Wrong Sometimes

We were wrong in one respect.

The BDC Reporter had expected any downward shift in sector prices to disproportionately affect the weaker BDCs.

At least this week, while everybody was affected the better performing stocks appear to have been hardest hit.

Profit taking probably, a natural enough reaction to a broad based shift in sentiment.

Not So Bad

Still, everything is relative.

There are still 20 BDCs trading within 10% of their 52 week highs, and 7 trading over book value, unchanged from last week.

(A few weeks ago, though, there were 17 trading above book value).

Few Winners

The market drop has deprived BDC shareholders in much of the way of anything to cheer about in recent weeks.

Over a 4 week period, only 6 BDCs are up in price and 39 are down.

At the moment only 8 stocks trade above their 50 Day Moving Average.

One More

We’ve also added a new data point: calculating how many BDCs are trading above the February 22, 2019 market high point.

Last week – the first time we had all the numbers in place – the number in the green was already low: 14.

This week, the number dropped to 10.

(That means there are 3.5 stocks down in price for every one going up).

Top Dogs

We can’t list all 10, but using a 3.0% or more cut-off there are 3 stocks worth noting.

ABDC is up 18.5% thanks to high hopes of an M&A transaction, rather than because of fundamentals.

SAR is up 5.3% since February 22, presumably helped by its entirely predictable dividend increase this week.

Finally, NEWT – which seems to a fount of new business development – is on one of its upward sallies and has increased 3.4%.

Better Leave

Generally speaking, though, if you’d decided to sell on February 22 and go away – although it’s not as alliterative as the better known May version – you’d have been right.

No less than 9 stocks (a fifth of the total) have dropped by (10%) or more since February 22.

Some of that seems to be profit taking (GSBD,HRZN) but most affected are under-performers (TCRD,PTMN,OXSQ,PFLT and PNNT).

Unique

In a category all by itself is MCC, down (21%) in this brief period, as the BDC continues to twist in the wind.

Next week is the first of two crucial votes: the election of 2 directors to the Board, scheduled for June 4.

NexPoint hopes to appoint two independent directors to replace the incumbents and has been making its case through the Proxy process.

MCC made its own case by press release on June 1 to shareholders.

Just Keeps Going And Going

As we’ve explained before, the decision about directors will not firmly resolve anything.

NexPoint may get its directors appointed – who supposedly will consider all options – but not get handed the investment advisory contract.

NexPoint may get rebuffed but MCC’s insiders may not get the sweetheart merger with its sister company which they crave.

Still up in the air is where the new BFF relationship between MCC and FrontFour stands, as well as the status of several other lawsuits.

If you see the parallels between the MCC situation and Brexit, that makes two of us.

Breaking News

While we don’t know what is happening behind the scenes – most of the parties have gone remarkably quiet – we do know something not broadly reported.

The owners of MCC Israeli-issued bonds met last week and – according to an insider – came away frustrated and likely to bring action in court.

In Israel.

That means more costs for MCC and its long suffering shareholders and a big black eye for the just developing Israeli market for BDC bonds.

Will the Israeli bond holders actually lose money ? My insider thinks so. We are more optimistic but it’s a close run thing and one that could take some time to resolve.

High Hill To Climb

After all, MCC has suspended its dividend; cancelled its Revolver; been stripped of its SBIC licenses; racked up huge legal and professional costs and there is no end in sight.

Not to mention – according to most analysts and the BDC Reporter – MCC still has multiple under-performing loans in its shrinking portfolio.

No wonder that MCC closed at $2.78 on Friday, not far off the $2.62 All Time Low reached during the last market crisis in December.

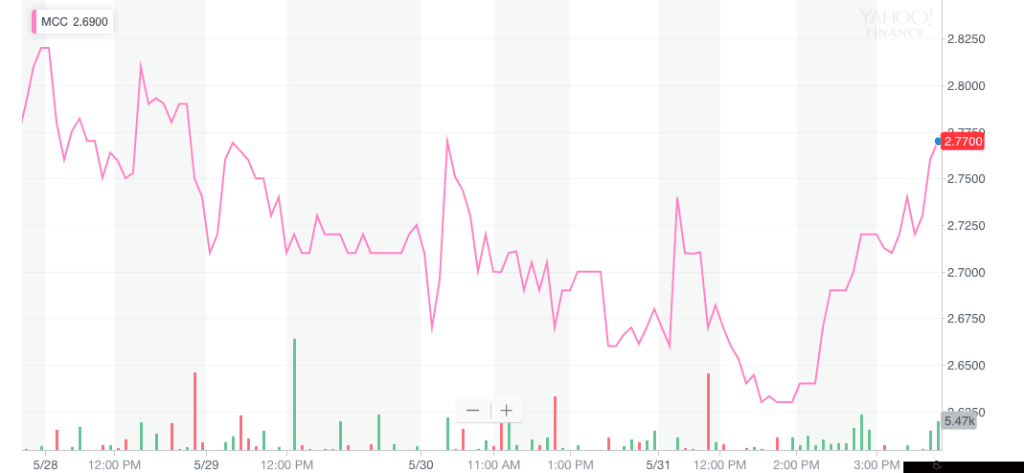

Volatile

At last, speculative investors, who’ve been calmly seeking the best entry point to benefit from the MCC imbroglio, are beginning to hyper-ventilate.

This has caused the BDC’s stock price to oscillate – as the chart below shows – and the daily volume of shares traded to change drastically.

In May alone the number of shares trading hands has ranged from 42,000 to 353,000.

War. What Is It Good For ?

Up to a point, the BDC sector is a hostage of what happens next where the tariffs issue goes.

Presumably, if this already declared “war” expands the markets will swoon.

Who’s next ? Europe ? Canada ? California ?

Less Obvious

However, even if the rhetoric and the reality settle down, there are other factors that could keep BDC prices from bouncing back even if a truce is announced.

As we’ve been covering this week on our Twitter feed, the government is worrying ever more about the state of the leveraged lending market.

That has become a more urgent concern as we hear of fast slowing EBITDA growth at the larger highly leveraged companies.

Or, at least a 19% sample, according to an S&P study.

Lower For Longer ?

In a related development that ties in to the tariffs and government concern, there’s the ever higher possibility of the Fed lowering interest rates.

There’s talk of 2 or even 3 rate cuts. And soon.

No less than a luminary than J.P. Morgan projects two rate cuts in 2019.

LIBOR Lowering

The future is already here where LIBOR is concerned.

We looked up the 3 month rate at the beginning of 2019 and as of last Friday.

The rate has moved from 2.794% to 2.503%, or 0.291%.

That’s a (10%) move down and a potential – if another 0.50% reduction is coming – 2.03% LIBOR rate on the horizon.

That would cause LIBOR to drop by 25% from the January 1, 2019 level.

Lost Income

Given that there are – and we’re ballparking here – well over $60bn in BDC floating rate assets between on balance sheet and off balance sheet vehicles – this could be impactful.

A 0.75% drop in LIBOR could result in $450mn in lower investment income.

Of course that would be offset – to a degree – by lower interest expense on floating rate pegged BDC debt facilities.

Nonetheless – and we’re sorry we don’t have the data to properly calculate a net number – the impact would be substantial to BDC bottom lines.

After all, most other BDC expenses such as management fees and operating costs remain fixed, but incentive fees might drop modestly.

Already in the IQ 2019 BDC Conference Calls analysts have been asking about the subject and some BDCs even blamed lower than anticipated results on rates.

Underway

In the IQ of 2019, 3 month LIBOR dropped from 2.794% to 2.600% and has fallen another 0.100%.

Given the way LIBOR resets work, these changes will be felt with a delay suggesting there’s more pain to come even if LIBOR drops no further.

Analysts and investors will have to update their models and – we fear – might find their prior expected results to have been overblown.

Escape Room

Most BDCs are hoping to offset any loss of income by ramping up assets, thanks to the new leverage rules allowed by the Small Business Credit Availability Act.

Using June 30, 2019 as a cut-off date, 35 BDCs will be subject to the new, lower asset coverage regulations.

Problem

Adding new assets – whatever one thinks of the strategy so late in the cycle and with so much competition – may not be so easy to accomplish.

When we get the uncertainties that abound today, buyers and sellers of companies tend to retrench, shrinking the supply of leveraged buyouts to finance.

(That’s what happened in December 2018 when we had the melt-down, and that carried through into the first weeks of 2019).

Hard Choice

That might make boosting portfolio size very difficult unless BDCs choose (consciously or otherwise) to loosen lending standards to meet their targets.

We would be very concerned about any BDC that continued to book large increases in asset formation in such an environment.

However, the proof of the pudding – given the nature of credit – will take several years to show up in the under-performing and non-performing columns.

No Gain

Finally – to add a cherry to this bitter cake – loan spreads are unlikely to change much at first as a still very large group of lenders fights over lending to a smaller group of new borrowers.

These tectonic shifts happen quietly and don’t get the attention they deserve because they are so difficult to ascertain but can be as important as any other factor in BDC lending.

Conclusion

Maybe we’ll get some “good news” next week and a relief rally.

Nonetheless, the BDC Reporter – admittedly timid folk – advise that caution is warranted whatever happens in the “tariffs war”.

There’s a reason the BDC sector – despite undergoing a mighty rally between December 2018 and February 2019 – never reached back to its August 2018 high.

As we’ve posited before, chances are the long term trends for BDC prices remains down until we get that long threatened recession.

Then we’ll have a massive cleaning out of the weaker credits and a new BDC low.

Dismal as that sounds, it’s more likely than a sudden and unexpected climb upwards for BDC sector prices.

Chances are we’ll be lucky if distributions can keep up with BDC prices in the months ahead and achieve a positive “total return”.

We’ll be tracking that Wells Fargo Index weekly and letting our readers know.

In any case, this next week will be worth watching even as you make your holiday plans.

.png)