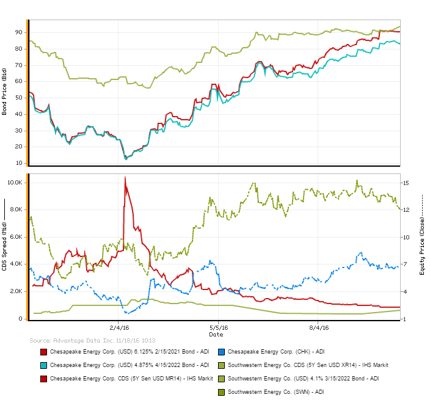

Divergence in Southwestern Energy and Chesapeake Energy bond and equity prices hit a high in Q1 2016 with the spike in Chesapeake 5 Year Senior USD MR14 CDS spread. Thereafter and through to present, equity prices remain divergent while bond prices converge.

For more AdvantageData insights, and to access to pricing, analytics and research, simply request a free trial.

.png)