JUNK BONDS LAGGED INVESTMENT-GRADE NAMES in European trading, as global investors perceived a less hawkish Janet Yellen 'across the pond'. Indications from Federal Reserve Chair Yellen that rate increases will maintain a gradual clip sent a spectrum of European equities higher, while global bond yields fell. A rally in oil prices on a bigger-than-expected drop in U.S. crude-oil inventories bolstered the oil-and-energy group, while upbeat sales by Burberry Group PLC sent luxury firms higher, lending additional sector cues to corporate-bond traders.

A 3.3% jump in Burberry Group PLC shares led Gucci subsidiary Kering SA and LVMH Moet Hennessy Louis Vuitton higher, along with others in the luxury sector. Investment-grade debt drew favor, however, as U.S. Treasuries beyond the 1-year T-note extended a rally after Yellen's testimony. ADI (Advantage Data Inc.) extensive corporate-bond index data showed a net daily yield increment for investment-grade over high-yield constituents. Investment-grade bonds outpaced high-yield debt in net prices. Among European investment-grade bonds showing a concurrence of topmost price gains at appreciable volumes traded, BNP Paribas 3.25% 3/3/2023 made some analysts' 'Conviction Buy' lists.

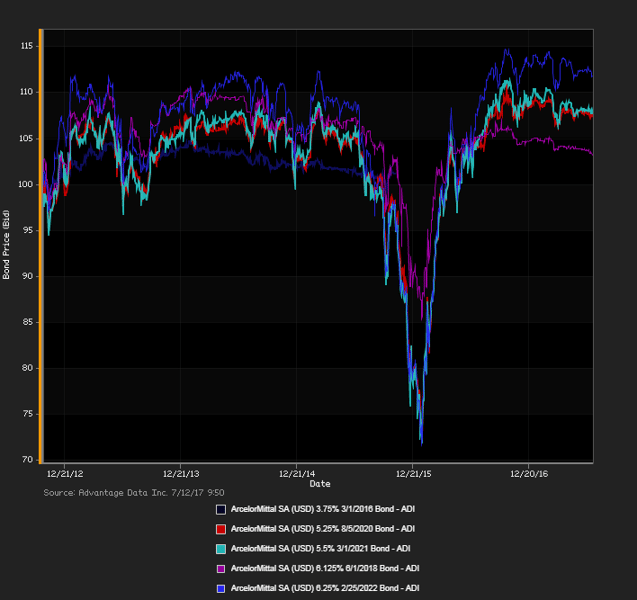

.png)