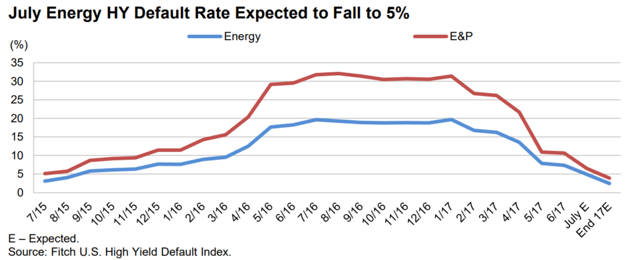

July HY TTM Default Rate Dips Below 2%; Energy Rate Lowest Since August 2015

July Default Rate Below 2%: The July U.S. TTM high yield default rate stands at 1.9%, down from 2.2% at June 30. This represents the seventh straight month the rate will have fallen and marks the lowest level since March 2014. Chinos Intermediate Holdings’ (J. Crew Group Inc.) distressed debt exchange (DDE) and Armstrong Energy Inc.’s missed payment were the two July defaults registering $766 million. The month’s total is well below the $4.7 billion rolling off the TTM universe.

Default Rate Pick Up: The final five months of 2016 produced just $11.2 billion of defaults and a filing by iHeartCommunications Inc. would nearly equal that amount. The company extended its DDE for an eighth time to July 21, as acceptance remains minimal. Fitch Ratings expects the default rate to end 2017 just below 3%, with retail and iHeart adding defaults later this year. Retail Update: The July TTM retail default rate climbs to 2.9% from 1.8% following J. Crew’s

DDE. Fitch’s Bonds of Concern list (see page 2) highlights several retail names with a high risk of defaulting over the next 12 months, including newly added Guitar Center and David Bridal’s Inc. Anticipated defaults from Claire’s Stores Inc., Sears Holdings Corp. and Nine West Holdings Inc. later this year contribute to Fitch’s 9% sector forecast. The timing on Sears and Claire’s is more uncertain, and our retail forecast would finish the year at 5%, absent these filings.

Energy Default Rate Slides: The July TTM energy default rate declines to just below 5% from 7.3% at the end of June. This month’s rate represents the lowest since August 2015. Fitch believes we have passed the peak of the default cycle for high yield energy bonds and are forecasting the 2017 sector rate to finish at 2.5%.

DDE Update: DDEs comprise 45% of the June TTM total defaults on an issuer basis. For the 146 DDEs completed since 2008, 40% subsequently defaulted (59 issuers) averaging 13 months, with 33 of those issuers filing for bankruptcy (see page 3). More recently, the average time frame has been shorter (seven months), as energy companies did not sufficiently address

their capital structures with commodity prices remaining low for an extended period of time. Post-Default Prices Keep Rising: The June TTM 30-day post-default price stands at 56% of par, the 12th straight month levels have improved. Better recovery prospects for the more recent defaults coupled with weaker energy and metals/mining bid names dropping out of the one-year sample contributed to the recent rise. The post-default price was at its nadir last June, at 22%.

Visit fitchratings.com for more trends in new issuance, portfolio credit quality, and defaults and recovery for leveraged finance in the US.

.png)