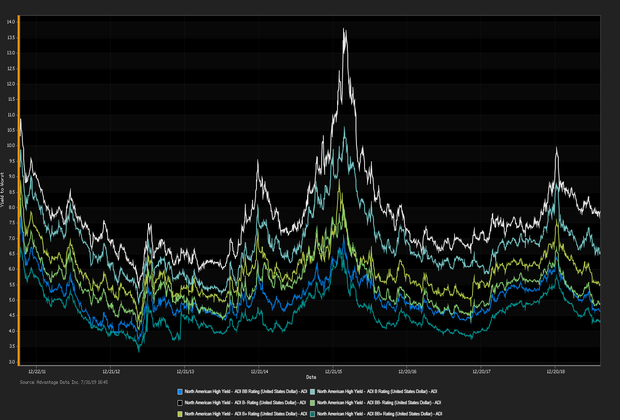

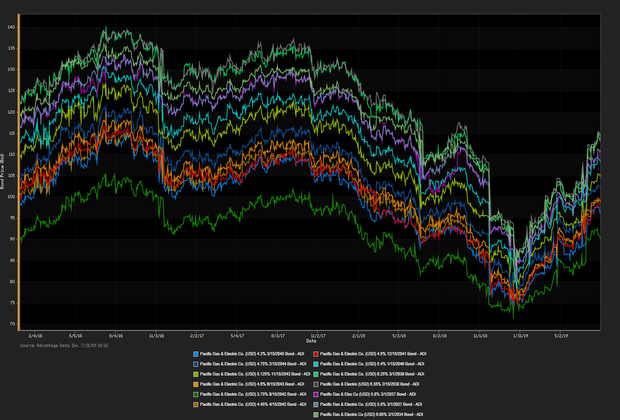

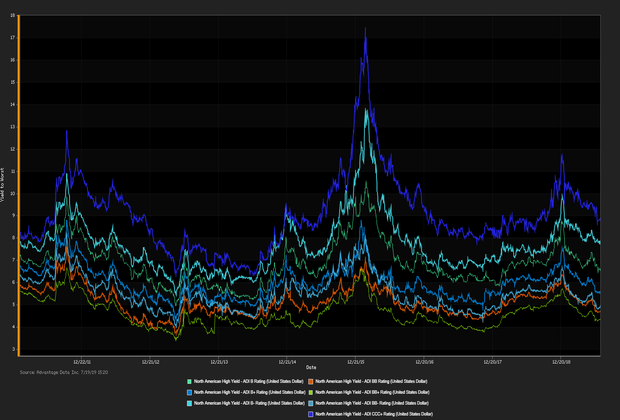

IN THE CORPORATE BOND SPACE, Las Vegas Sands Corp. recently announced its pricing of $3.5 billion in senior notes. The notes are broken up into 3 separate tranches yielding 3.2% due 2024, 3.5% due 2026, and 3.9% due 2029. The casino and resort company will use the proceeds to repay outstanding term loans and for general corporate purposes. ADI proprietary index data showed a net yield increment for high-grade versus high-yield bonds. High-grade edged out high-yield. Among high-grade bonds showing topmost price gains at appreciable volumes traded, Comcast Corp (USD) 6.5% 11/15/2035 made analysts' 'Conviction Buy' lists. (See the chart for ADI indexes above.) Andrew Robartes

| Key Gainers and Losers | Volume Leaders | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Tenet Healthcare Corp. 0% 6/15/2023 Genesis Energy LP 6.25% 5/15/2026 |

| Industry Returns Tracker | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New Issues | Forward Calendar |

|---|---|

|

1. NBM US Hldg, Inc. (USD) 6.625% 8/6/2029 144A (07/30/2019):500MM Senior Unsecured Notes, Price at Issuance 100, Yielding 6.63%. 2. AG Merger Sub II Inc. (USD) 10.75% 8/1/2027 144A (07/31/2019):350MM Senior Unsecured Notes, Price at Issuance 96.14, Yielding 11.49%. |

1. Diamondback Energy Inc.: High-yield notes, Expected Q3 2019 |

Additional Commentary

| Top Widening Credit Default Swaps (CDS) | Top Narrowing Credit Default Swaps (CDS) |

| Rite Aid Corp. (5Y Sen USD XR14) Weatherford International LTD (5Y Sen USD MR14) |

SuperValu Inc. (5Y Sen USD XR14) San Miguel Corp. (5Y Sen USD CR14) |

Loans and Credit Market Overview

Deals recently freed for secondary trading, notable secondary activity:

- Maxamcorp Holding SL, PLZ Aeroscience Corp., AIR Comm Corp. LLC, Nascar Holdings Inc.

- TED spread held below 19 bp (basis points), as of 07/31/19

- Net positive capital flows into high-yield ETFs & mutual funds

Copyright 2019 Advantage Data Inc. All Rights Reserved. http://www.advantagedata.com

Information in this document should not be regarded as an offer to sell or solicitation of an offer to buy bonds or any financial instruments referred to herein. All information provided in this document is believed to be accurate. However, Advantage Data and its sources make no warranties, either express or implied, as to any matter whatsoever, including but not limited to warranties of merchantability or fitness for a particular purpose. Opinions in this document are subject to change without notice. Electronic redistribution, photocopying and any other electronic or mechanical reproduction is strictly prohibited without prior written permission from Advantage Data Inc.

.png)