THE FEDERAL RESERVE HOLDS THE CURRENT INTEREST RATES but suggests a rate cut on the horizon if the economy slows down. The Federal Reserve Chairman, Jerome Powell indicated they “will act as appropriate to sustain the expansion” going on 10-years and refrained from mentioning the word “patient”. Treasury yields dipped following the Feds announcement, the 10-year note fell 2.1 basis points. S&P +0.41%, DOW +0.29, NASDAQ +0.40%.

Click Here for a Free Trial to Advantage Data Charting

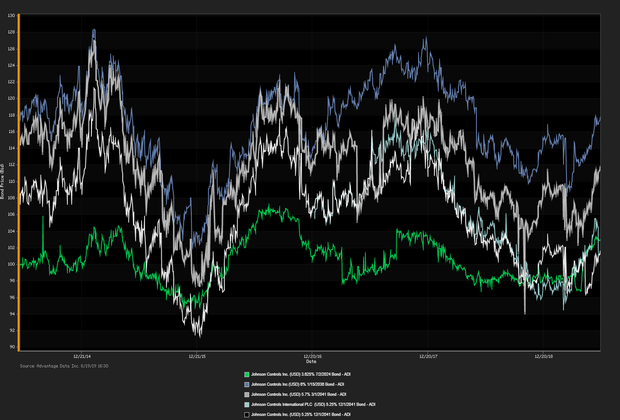

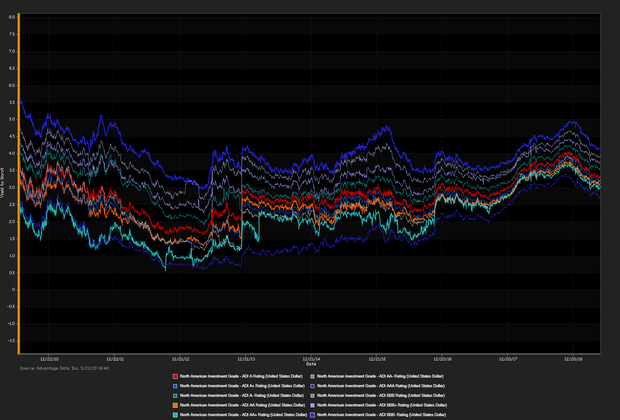

US CONSUMER DEBT EXCEEDS LEVELS SEEN DURING THE FINANCIAL CRISIS OF 2008. Analysts estimate in the first quarter of 2019 the total consumer debt hit $14 trillion. Student debt has ballooned over the past ten-years surpassing $1.486 trillion, more than doubling since 2008. The Fed’s dot plot revealed a shift in the Open Market Committee’s mindset as nine members expect the rate to near 2.1 percent by the end of 2020, contrary to 2.6 percent during the last update. “It appears that about half of the committee is starting to panic about the risks posed by trade tensions, while the other half wants to remain ‘patient’. ADI proprietary index data showed a net yield increment for high-yield versus high-grade bonds. High-grade edged out high-yield. Among high-grade bonds showing topmost price gains at appreciable volumes traded, Johnson Controls Inc. (USD) 5.25% 12/1/2041 made analysts' 'Conviction Buy' lists. (See the chart for Johnson Controls Inc. bonds below.) Corey Mahoney (cmahoney@

| Key Gainers and Losers | Volume Leaders | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

|

Vodafone Group PLC 4.375% 5/30/2028 CVS Health Corp. 4.78% 3/25/2038 |

| Industry Returns Tracker | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New Issues | New Issues [Continued] |

|---|---|

|

1. Hyundai Capital America (USD) 3.4% 6/20/2024 Reg S (06/18/2019): 400MM Senior Unsecured Notes, Price at Issuance 99.995, Yielding 3.4%. 2. Sodexo (GBP) 1.75% 6/26/2028 (06/18/2019): 250MM Senior Unsecured Notes. |

|

Additional Commentary

| Top Widening Credit Default Swaps (CDS) | Top Narrowing Credit Default Swaps (CDS) |

| Hertz Corp. (5Y Sen USD XR14) Hovnanian Enterprises Inc. (5Y Sen USD MR14) |

San Miguel Corp. (5Y Sen USD CR14) Atmos Energy Corp. (5Y Sen USD MR14) |

Loans and Credit Market Overview

SYNDICATED LOANS HIGHLIGHTS:Deals recently freed for secondary trading, notable secondary activity:

- Hilton Worldwide Finance LLC, US Renal Care Inc., Perforce Software Inc.

- TED spread held below 18 bp (basis points), as of 06/19/19

- Net positive capital flows into high-yield ETFs & mutual funds

Copyright 2019 Advantage Data Inc. All Rights Reserved. http://www.advantagedata.com

Information in this document should not be regarded as an offer to sell or solicitation of an offer to buy bonds or any financial instruments referred to herein. All information provided in this document is believed to be accurate. However, Advantage Data and its sources make no warranties, either express or implied, as to any matter whatsoever, including but not limited to warranties of merchantability or fitness for a particular purpose. Opinions in this document are subject to change without notice. Electronic redistribution, photocopying and any other electronic or mechanical reproduction is strictly prohibited without prior written permission from Advantage Data Inc.

.png)