TODAY MARKED THE END OF A STRONG WEEK for US stocks, after news of a potential federal interest rate cut boosted investors’ sentiment. Federal Reserve chairman Jerome Powell hasn’t set any parameters on the cut, but analysts are predicting it will be more than 25 basis points. The next monetary policy committee meeting will be held on July 31st. 10-Year Treasury note yields rose 3.5 basis pointstoday, after dipping below 2% yesterday. S&P -0.13%, DOW -0.13%, NASDAQ -0.24%.

Click Here for a Free Trial to Advantage Data Charting

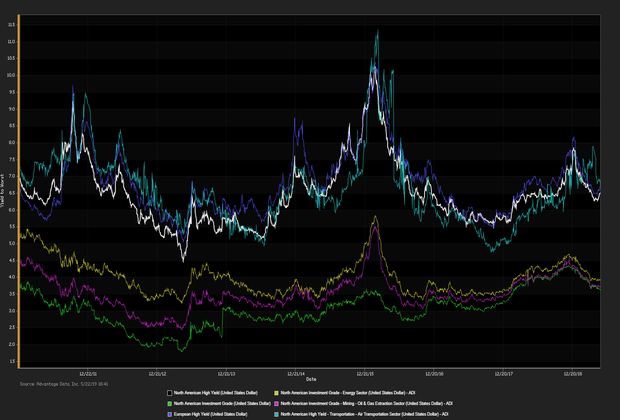

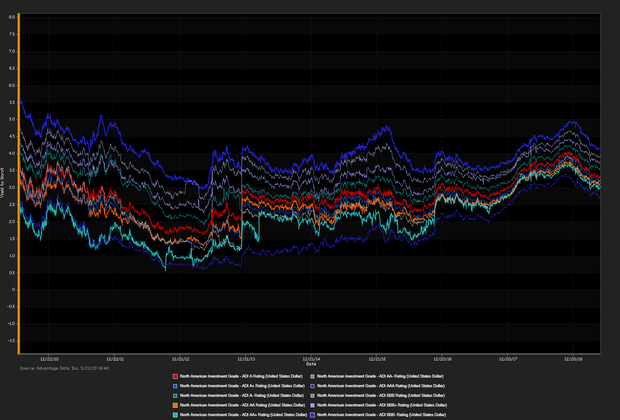

IN THE CORPORATE BOND SPACE, news of an interest rate cut from the Federal Reserve indicates a positive environment for issuing new debt. As Treasury yields have declined,

corporate bond spreads have remained relatively low, inspiring optimism among investors. John Sheehan, a fixed-income portfolio manager at Osterweis Capital Management stated, “In this environment, where financial assets are all moving in the same direction,

it’s incredibly beneficial to [debt] issuers”.

ADI proprietary index data showed a net

yield increment for high-yield versus high-grade bonds.

High-yield edged out high-grade. Among high-yield bonds showing topmost price gains at appreciable volumes traded,

Pacific Gas & Electric Co. (USD) 3.5% 6/15/2025 made analysts' 'Conviction Buy' lists. (See the chart for

ADI Indices above.)

Andrew Robartes (

arobartes@advantagedata.com).

| Key Gainers and Losers |

Volume Leaders |

| + |

CVS Health Corp. 5.05% 3/25/2048 |

+ 0.1% |

| |

Pfizer Inc. 1.95% 6/3/2021 |

+ 0.2% |

| - |

Citigroup Inc. 4.65% 7/23/2048 |

-0.9% |

| |

Verizon Communications Inc. 4.125% 3/16/2027 |

-0.2% |

|

Tyson Foods Inc. 5.1% 9/28/2048

Comcast Corp. 4.7% 10/15/2048

|

| Industry Returns Tracker |

| Industry |

Past Day |

Past Week |

Past Month |

Past Quarter |

YTD |

Past Year |

| Agriculture, Forestry, Fishing |

0.17% |

0.65% |

2.89% |

4.38% |

8.30% |

5.26% |

| Mining |

0.39% |

0.86% |

2.12% |

3.90% |

8.33% |

8.71% |

| Construction |

0.10% |

0.74% |

2.54% |

3.79% |

5.99% |

7.13% |

| Manufacturing |

0.34% |

0.80% |

2.48% |

4.14% |

6.92% |

7.63% |

| Transportion, Communication, Electric/Gas |

0.38% |

1.03% |

2.96% |

5.15% |

8.67% |

10.39% |

| Wholesale |

0.26% |

0.64% |

2.13% |

4.23% |

7.64% |

7.97% |

| Retail |

0.37% |

0.92% |

2.63% |

4.26% |

7.55% |

8.04% |

| Finance, Insurance, Real-Estate |

0.22% |

0.56% |

1.91% |

3.38% |

6.26% |

7.74% |

| Services |

0.32% |

0.79% |

2.56% |

4.19% |

6.96% |

8.31% |

| Public Administration |

0.04% |

0.23% |

1.33% |

2.21% |

3.22% |

5.03% |

| Energy |

0.37% |

0.80% |

2.04% |

3.84% |

8.37% |

10.53% |

| |

| Total returns (non-annualized) by rating, market weighted. |

|

| New Issues |

New Issues [Continued] |

|

1. Spirit Realty LP (USD) 4% 7/15/2029 (06/20/2019): 400MM Senior Unsecured Notes, Price at Issuance 99.924, Yielding 4.01%.

2. HCP Inc. (USD) 3.25% 7/15/2026 (06/20/2019): 650MM Senior Unsecured Notes, Price at Issuance 99.906, Yielding 3.26%.

|

|

Additional Commentary

NEW ISSUANCE WATCH: on 6/21/19 participants welcome a $165MM new corporate-bond offering by NorthShore Re LTD. The most recent data showed money flowed out of high-yield ETFs/mutual funds for the week ended 6/14/19, with a net outflow of $1.7B, year-to-date $8.3B flowed into high-yield.

| Top Widening Credit Default Swaps (CDS) |

Top Narrowing Credit Default Swaps (CDS) |

Hertz Corp. (5Y Sen USD CR14)

Hovnanian Enterprises Inc. (5Y Sen USD MR14) |

San Miguel Corp. (5Y Sen USD CR14)

Atmos Energy Corp. (5Y Sen USD MR14) |

Loans and Credit Market Overview

SYNDICATED LOANS HIGHLIGHTS:

Deals recently freed for secondary trading, notable secondary activity:

- Vidrala SA, Hilton Worldwide Finance LLC, US Renal Care Inc., Perforce Software Inc.

OVERALL CREDIT MARKET:Long-term bond yields are expected to hit a cyclical peak in 2019 given tight fiscal policy and lagging global economies. Europe remains checked by stubbornly low inflationary forces. Positive effects remained in force:

- TED spread held below 22 bp (basis points), as of 06/21/19

- Net positive capital flows into high-yield ETFs & mutual funds

Copyright 2019 Advantage Data Inc. All Rights Reserved. http://www.advantagedata.com

Information in this document should not be regarded as an offer to sell or solicitation of an offer to buy bonds or any financial instruments referred to herein. All information provided in this document is believed to be accurate. However, Advantage Data and its sources make no warranties, either express or implied, as to any matter whatsoever, including but not limited to warranties of merchantability or fitness for a particular purpose. Opinions in this document are subject to change without notice. Electronic redistribution, photocopying and any other electronic or mechanical reproduction is strictly prohibited without prior written permission from Advantage Data Inc.

.png)