Hub holdings, LLC announced that it will increase its senior secured term loan by $375 million to refinance current oustanding debt. The proceeds will be mainly used to make payments on $300 million of second-lien secured notes and around $60 million of revolving credit. Following the announcement, Moody's announced that it would affirm the B3 corporate family rating and change the outlook on the debt from negative to stable. This outlook is based on the company's EBITDA growth and the feeling that they will be able to continue to reduce their leverage in 2017.

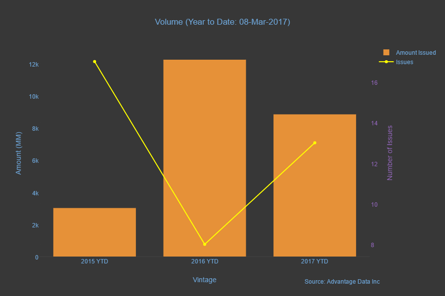

This loan will add to the 13 senior secured and rougly $8.84 billion in issues within the Finance, Insurance, and Real-Estate sector this year. Year to date, there have been 5 more issues at this point than there were in 2016. In those 8 issues in 2016, however, there were around $12.24 billion issued. Along with those datapoints, the average coupon spread of last years loans YTD was 401.56 while this years issues have averaged a spread of 463.46.

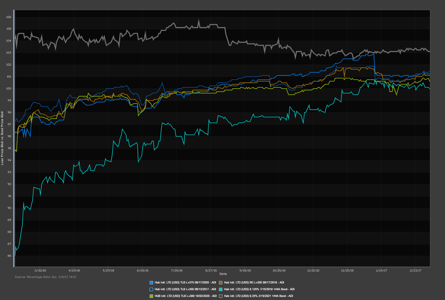

Monitor the daily movement of Hub Holding's new Term Loan as well as the trends in the Loan Issuance Market by requesting a free trial of AdvantageData today.

.png)