Market signals cautious tone as it enters 4Q; little activity in credits held by BDCs

Global market volatility on the heels of an active September in loans and the biggest high-yield calendar in two years has injected a further air of caution into new issues heading into the final three months of 2019, particularly with respect to the mid-to-lower single-B segment of the market.

The average bid price of the Credit Suisse Leveraged Loan Index ended Thursday at 95.86% of par, down 29 bps since the beginning of October for a month-to-date return of negative 0.28%. As was the case in September, lower-rated credits underperformed the broader market, as the month-to-date market value returns demonstrate, what with double-B loans at negative 0.15%, single-B loans at negative 0.37% and triple-C/split triple-C loans at negative 0.78%.

In another sign of investor jitters, an approximately $642.8 million BWIC—the largest such portfolio sale since August 2018—hit the market Friday morning, with bids due late in the morning. The portfolio was rumored to be a separately managed account liquidating and moving into Treasuries. It contained positions in 621 tranches of debt, including some bonds, as well as equity in several reorganized companies.

U.S. Treasuries surged again last week, suppressing yields further, amid data showing more moderate job creation and expectations of another rate cut by the FOMC at the regular meeting at the end of the month. That’s likely to bring more bonds into the financing mix, a trend that’s already evident as underwriters look for an escape valve on lower-rated deals underwritten amid more robust market conditions.

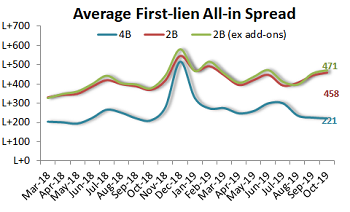

Meanwhile, the continuing bifurcated conditions in new-issue loans once again drove flex activity and higher single-B all-in spreads. Five issuers flexed wider as three deals tightened. As for all-in spreads, where BBs were virtually unchanged at L+222, single Bs gapped wider again, hitting L+471, from the prior week’s L+453 reading. Moreover, single B all-in spreads have widened by 74 bps over the August average.

Portfolios in brief: Holds reflect most recent reporting period available

SLRC: Garda World Security (B3/B/B+) — LBO

A J.P. Morgan-led arranger group launched the $1.438 billion, seven-year B term loan backing BC Partners’ acquisition of Garda World Security, setting a lender call meeting for 11 a.m. ET today. Ahead of today’s call, the arrangers are circulating price talk of L+400, with a 0% floor and a 99 OID, with six months of 101 soft call protection. The financing commitment also provided for a $335 million five-year revolver and up to $779 million in senior unsecured notes. As reported, J.P. Morgan, Bank of America Merrill Lynch, Barclays, TD Securities, Jefferies, RBC Capital Markets, Scotiabank and UBS have committed to provide financing. The company previously said the size of the proposed new issue of notes under Rule 144A would be directly linked to the amount of participation on a typical change-of-control provision on the $625 million of 8.75% 2025 senior notes, and that otherwise the 7.25% 2021 would be full redeemed. Solar Capital holds $2.6M of the company’s 8.31%-8.77% equipment financing debt maturing between July 2023 and October 2023.

BDVC: Iridium Communications (B2/B) — refi

A Deutsche Bank-led arranger group set talk of L+425-450 with a 0% floor at 99 on the $1.45 billion term loan B for Iridium Satellite that will be used along with cash on hand to refinance its $1.55 billion export credit facility. Lenders are offered six months of 101 soft call protection on the seven-year covenant-lite term loan. The issuer also is putting in place a $100 million five-year revolving credit. The arranger group includes Deutsche Bank, Barclays, Credit Suisse, Wells Fargo and Societe Generale. Commitments are due at noon ET Thursday, Oct. 17. The mobile satellite services provider lined up the export financing in 2010 that was guaranteed by Bpifrance Assurance Export, the French export credit agency and arranged by a Deutsche Bank-led consortium. That agreement was amended and restated last year, allowing for the issuance of $360 million issue of five-year (non-call two) 10.25% holdco senior notes that were used to repay bills of exchange to supplier Thales, fund milestone payments to that supplier, fund debt services reserves under the credit facility, and fund general corporate purposes. The bond deal was led by Deutsche, Societe Generale and Santander. Leverage is marketed at 4.6x and 5.7x through the holdco notes. Iridium is seeking a 12-month sunset on 75 bps of MFN protection. Business Development Corp. of America holds $3.5M of 10.5% subordinated notes due April 2023.

Download LFI BDC Portfolio News 8-12-19 for BDC investment details provided by Advantage Data; click through links to view stories by LFI.

thomas.dunford@levfininsights.

212.205.8552

.png)