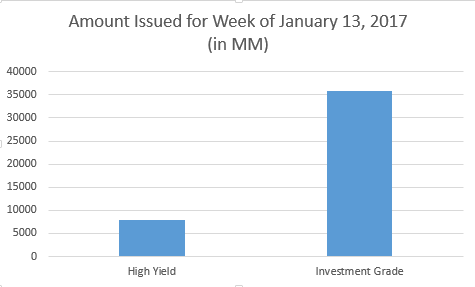

The amount issued in North American investment grade debt was more than quadruple the amount of that issued in high yield this week, with investment grade debt totaling $35.25 billion and high yield debt totaling $7.97 billion. Broadcom Corporation (NasdaqGS:AVGO) led investment grade deals with four new issues of senior unsecured notes totaling $13.55 billion to replace an old credit facility. This represented 38.4% of total investment grade debt issued this week. General Motors (NYSE:GM) led high yield deals with three new issues of senior unsecured notes totaling $2.5 billion, about 31.4% of total high yield debt issued this week.

High Yield New Issuance - Largest Deals this Week (USD):

- General Motors Financial Co. Inc. (USD) 3.45% 1/14/2022 - 1250 MM

- Standard Chartered PLC (USD) VAR% PERP 144A - 1000 MM

- Zayo Group LLC (USD) 5.75% 1/15/2027 - 800 MM

- General Motors Financial Co. Inc. (USD) 4.35% 1/17/2027 - 750 MM

- MEG Energy Corp. (USD) 6.5% 1/15/2025 144A - 750 MM

Investment Grade New Issuance - Largest Deals this Week (USD):

- Broadcom Corp. (USD) 3.875% 1/15/2027 144A - 4,800 MM

- Broadcom Corp. (USD) 3% 1/15/2022 144A - 3,500 MM

- Inter-American Development Bank (USD) 2.125% 1/18/2022 - 3,000 MM

- Broadcom Corp. (USD) 2.375% 1/15/2020 144A - 2,750 MM

- Broadcom Corp. (USD) 3.625% 1/15/2024 144A - 2,500 MM

For access to all High Yield and Investment Grade new issues, request a free trial of AdvantageData today.

.png)