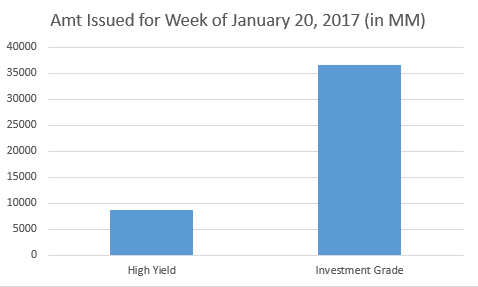

North American Investment Grade debt was more than quadruple the amount of that issued in high yield this week, with investment grade debt totaling $36.55 billion and high yield debt totaling $8.649 billion. The International Bank for Reconstruction and Development (IBRD) led investment grade deals with a new issue of unsecured notes totaling $5 billion. This represented 13.7% of total investment grade debt issued this week. Financial sector stocks also had a big week with Morgan Stanley (NYSE: MS) having three new issues of senior unsecured notes totaling $7.0 billion, Bank of America (NYSE: BAC) with four new issues of senior unsecured notes totaling $6.75 billion, and Wells Fargo Securities (NYSE: WFC) with two new issues of senior unsecured notes totaling $5.0 billion.

Charter Communications (NasdaqGS: CHTR) and Ardagh Packaging Finance PLC led high yield deals this week, with both companies issuing senior unsecured notes totaling $1 billion, about 30% of total high yield debt issued this week.

High Yield New Issuance - Largest Deals this Week (USD):

- CCO Holdings LLC (USD) 5.125% 5/1/2027 (144A / Reg S) - 1,000 MM

- Ardagh Packaging Finance PLC (USD) 6% 2/15/2025 (144A / Reg S) - 1,000 MM

- Vector Group LTD (USD) 6.125% 2/1/2025 (144A / Reg S) - 850 MM

- Terex Corp. (USD) 5.625% 2/1/2025 (144A / Reg S) - 600 MM

- Koppers Holdings Inc. (USD) 6% 2/15/2025 (144A / Reg S) - 500 MM

Investment Grade New Issuance - Largest Deals this Week (USD):

- International Bank Recon & Dev. (USD) 2% 1/26/2022 - 5,000 MM

- Wells Fargo & Co. (USD) 3.069% 1/24/2023 - 3,750 MM

- Morgan Stanley (USD) 3.625% 1/20/2027 - 3,000 MM

- Bank of America Corp. (USD) 3.824% 1/20/2028 - 2,500 MM

- Morgan Stanley (USD) 4.375% 1/22/2047 - 2,500 MM

For access to all High Yield and Investment Grade new issues, request a free trial of AdvantageData today.

.png)