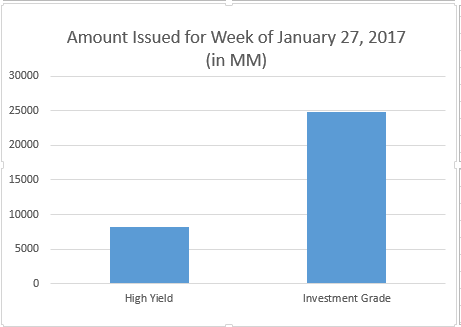

North American Investment Grade debt was more than triple the amount of that issued in high yield this week, with investment grade debt totaling $24.85 billion and high yield debt totaling $8.26 billion. JPMorgan Chase & Co. (NYSE: JPM) and The Goldman Sachs Group Inc (NYSE: GS) led investment grade deals with JPMorgan having one issue of senior unsecured notes totalling $2.75 billion and Goldman Sachs with three new issues of senior unsecured notes totalling $5.0 billion. This represented 31.2% of total investment grade debt issued this week. Other stocks in the financial sector also had a big week as Capital One Financial Corporation (NYSE: COF) had two new issues of senior unsecured notes totaling $2.0 billion, BB&T Corporation (NYSE: BBT) with three new issues of senior unsecured notes totaling $2.6 billion, Royal Bank of Canada (NYSE: RY) with two new issues of senior unsecured notes totaling $1.75 billion, and SunTrust Banks Inc (NYSE: STI) with two new issues of senior unsecured notes totalling $1.3 billion. International Business Machines Corporation (NYSE: IBM) also had a busy week with four new issues of senior unsecured notes totalling $2.75 billion.

Vedanta Resources PLC and Smithfield Foods Inc led high yield deals this week with Vedanta having one issue of senior unsecured notes (144A / Reg S) totaling $1 billion, and Smithfield Foods having one issue of senior unsecured notes (144A / Reg S) totalling $600 million, about 19.4% of total high yield debt issued this week.

High Yield New Issuance - Largest Deals this Week (USD):

- Vedanta Resources PLC (USD) 6.375% 7/30/2022 (144A / Reg S) - 1,000 MM

- Smithfield Foods Inc. (USD) 4.25% 2/1/2027 (144A / Reg S) - 600 MM

- Rusal Capital Dac (USD) 5.125% 2/2/2022 (144A / Reg S) - 600 MM

- Airxcel Inc. (USD) 8.5% 2/15/2022 (144A / Reg S) - 500 MM

- Nielsen Company (Luxembourg) Sarl (USD) 5% 2/1/2025 (144A / Reg S) - 500 MM

Investment Grade New Issuance - Largest Deals this Week (USD):

- JPMorgan Chase & Co. (USD) VAR% 2/1/2028 - 2,750 MM

- Goldman Sachs Group Inc. (USD) 3% 4/26/2022 - 2,250 MM

- Goldman Sachs Group Inc. (USD) 3.85% 1/26/2027 - 1,750 MM

- Capital One NA (USD) 2.35% 1/31/2020 - 1,500 MM

- Nordic Investment Bank (USD) 2.125% 2/1/2022 - 1,250 MM

For access to all High Yield and Investment Grade new issues, request a free trial of AdvantageData today.

.png)