HIGH-YIELD BONDS DREW INCREASED FAVOR in Europe, widening their lead over investment-grade debt in net price gains linked to actual trades. A rebound from 7-week lows in a spectrum of stocks tracked by the Stoxx 600 lifted parallel bids in European high-yield debt, as the tech sector took back a solid layer lost in the sell-off of the previous two sessions. As an upturn in Apple Inc. by 0.45% transpired, Dialog Semiconductor moved up 4.7%, while Ingenico Group rose 1.73%, as of 4:40 PM, London time. The financial sector also fared well, as RBS PLC shares notched 2.5% higher, before profit-taking set in.

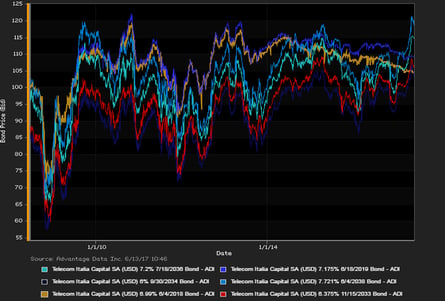

ADI (Advantage Data Inc.) extensive corporate-bond index data showed a net daily yield increment for high-yield over investment-grade constituents. High-yield bonds easily outpaced investment-grade debt in net prices. Among European high-yield bonds showing a concurrence of top price gains at appreciable volumes, Vedanta Resources PLC 8.25% 6/7/2021 made some analysts' 'Conviction Buy' lists. (See the chart for Shell International bonds, next page.)

.png)