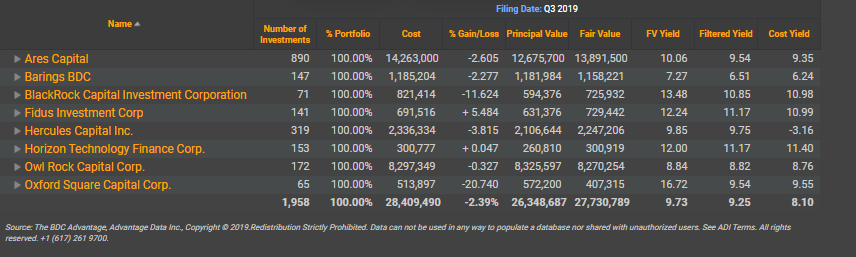

BDC Filing season is in full swing. This report will analyze 8 Public BDCs that have filed this week. Aggregate Fair Value reported by these BDCs is 27.7 Billion USD which is approximately 26% of aggregate AUM of all BDCs.

Topics: Analytics, BDC, AUM, market analytics, business development company, Non-accruals, BDC Filings, fair value, market update, top 5, adds & exits

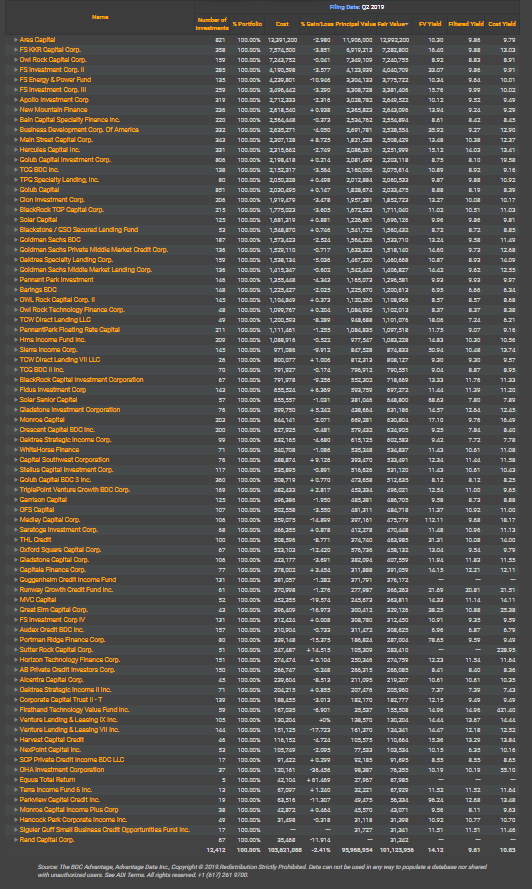

BDCs Filing season is in full swing. This report will utilize Advantage Data’s BDC workstation to analyze Q2 2019 filing data. As of Friday, August 16th, 2019 Aggregate Fair Value reported by BDCs that have filed in Q2 2019 is at 101.1 Billion USD (Fair Value) which is approximately 97% of aggregate AUM of all BDCs.

Topics: Analytics, BDC, AUM, market analytics, business development company, Non-accruals, BDC Filings, fair value, market update, top 5, adds & exits

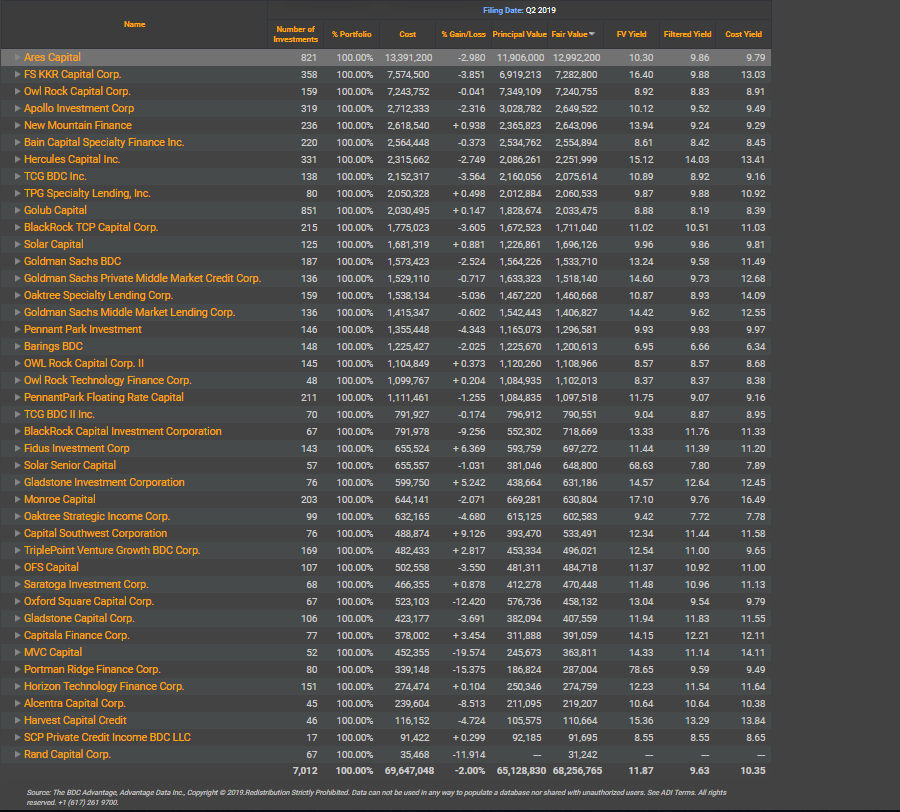

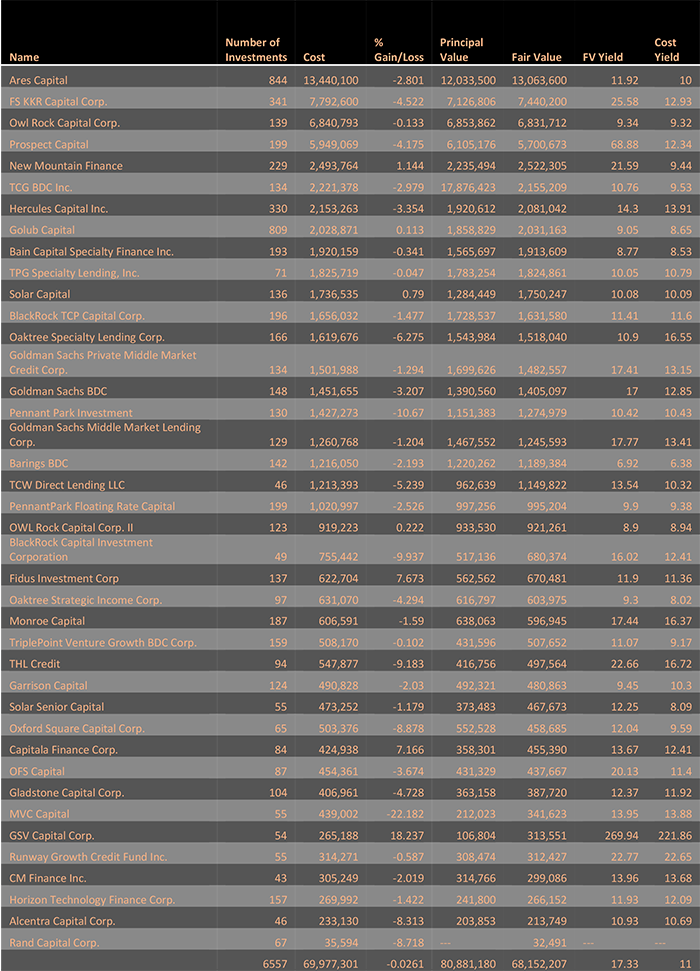

BDCs Filing season is in full swing. This report will utilize Advantage Data’s BDC workstation to analyze Q2 2019 filing data. As of Friday, August 9th, 2019 Aggregate Fair Value reported by BDCs that have filed in Q2 2019 is at 68 Billion USD (Fair Value) which is approximately 65% of aggregate AUM of all BDCs.

Topics: Analytics, BDC, AUM, market analytics, business development company, Non-accruals, BDC Filings, fair value, market update, top 5, adds & exits

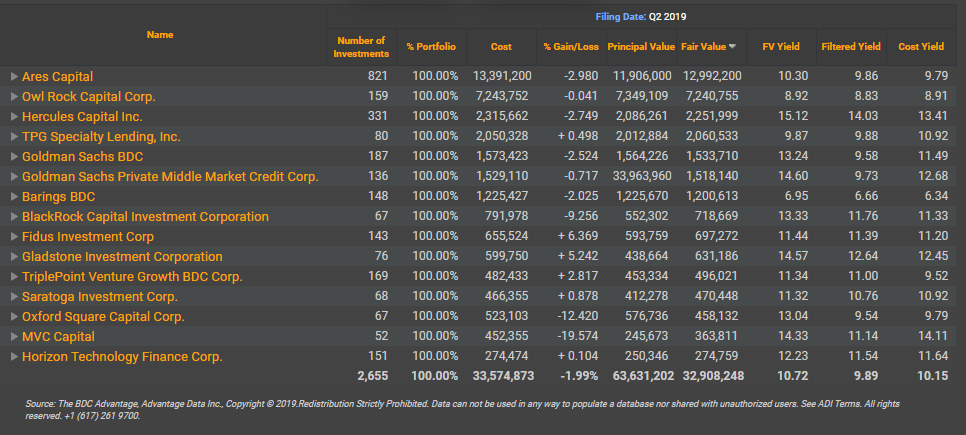

BDCs Filing season is in full swing. This report will utilize Advantage Data’s BDC workstation to analyze Q2 2019 filing data. As of Friday, August 2nd, 2019 Aggregate Fair Value reported by BDCs that have filed in Q2 2019 is at 33 Billion USD (Fair Value) which is approximately 31% of aggregate AUM of all BDCs.

Topics: Analytics, BDC, AUM, market analytics, business development company, Non-accruals, BDC Filings, fair value, market update, top 5, adds & exits

BDC Filing season is in full swing. This report will analyze BDCs that have filed in the last 2 weeks. Last week’s analysis is available here.

Aggregate Fair Value reported by BDCs that have filed in Q1 2019 is 68.1 Billion USD which is approximately 70% of aggregate AUM of all BDCs. BDCs have reported 48.8 Billion USD AUM in this week alone.

Topics: Analytics, BDC, AUM, market analytics, business development company, Non-accruals, BDC Filings, fair value, market update, top 5, adds & exits

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)