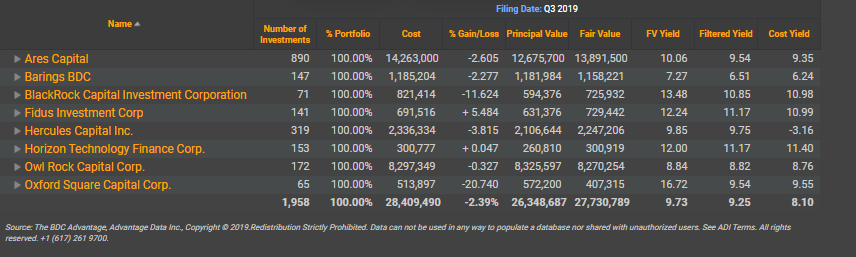

BDC Filing season is in full swing. This report will analyze 8 Public BDCs that have filed this week. Aggregate Fair Value reported by these BDCs is 27.7 Billion USD which is approximately 26% of aggregate AUM of all BDCs.

Topics: Analytics, BDC, AUM, market analytics, business development company, Non-accruals, BDC Filings, fair value, market update, top 5, adds & exits

3Q19 Portfolio Highlights: Ares Capital books big quarter for new issues, at $2.4B

Ares Capital yesterday reported a big quarter for new issues, $2.4 billion across 50 borrowers, compared to $1.3 billion in the previous quarter and $1.9 billion in the same period last year.

Topics: Loans, Middle Market, BDC, First Lien, debt, business development company, Non-accruals, portfolio, Direct Lending, syndicated, underperformers, Direct Lending Deals

Edgewood Partners, GoodRx adding to term debt; existing holders include AB Private Credit, SUNS, OCSI, OCSL

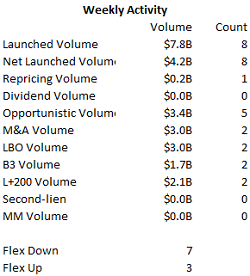

Last week’s loan market largely offered more of the same — more pushback on aggressive terms on sponsored M&A transaction and more opportunistic business with an emphasis on maturity extension — though late in week, issuer-friendly revisions on a string of well-known credits suggested that in the absence of a big uptick in volume, the market may be turning their way for all but the most challenging transactions. Bonds offered a mixed bag across ratings and purposes, but the themes were clear: oversubscribed offerings and strong performance on the break.

Topics: High Yield, Analytics, BDC, market analytics, business development company, LevFin Insights, News, research

BDC Common Stocks Market Recap: Week Ended October 25, 2019

BDC COMMON STOCKS

The S&P 500, Dow Jones and NASDAQ all moved up in the week ended October 25, 2019 so the BDC sector did as well.

That’s been the pattern of late, and nothing occurred to make things different.

The S&P 500 was up 1.22% and the UBS Exchange Traded Note with the ticker BDCS, which we use a proxy for price change, jumped 0.77%.

For reasons that are not clear, the Wells Fargo BDC Index moved up only 0.22%.

(Still, the Wells Fargo index has been up for three weeks in a row, just like the S&P 500).

Topics: Loans, Analytics, BDC, market analytics, business development company, News, bdc reporter, research

Belk to extend maturity on 1L credit held by OCSL, Guggenheim and FSK-related entities; BDVC holds debt targeted for refi by Blackboard

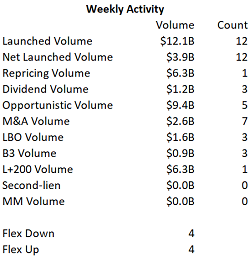

A more stable secondary helped move loan transactions across the goal line and even tighten terms, but the holiday-shortened week proved to be another grind as many transactions continued to lag, driving multiple rounds of changes as underwriters chased investor dollars. Flex activity, at least officially, was even at four each tightening and widening, though the undercurrent among deals in process favors investors.

Topics: High Yield, Analytics, BDC, market analytics, business development company, LevFin Insights, News, research

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)