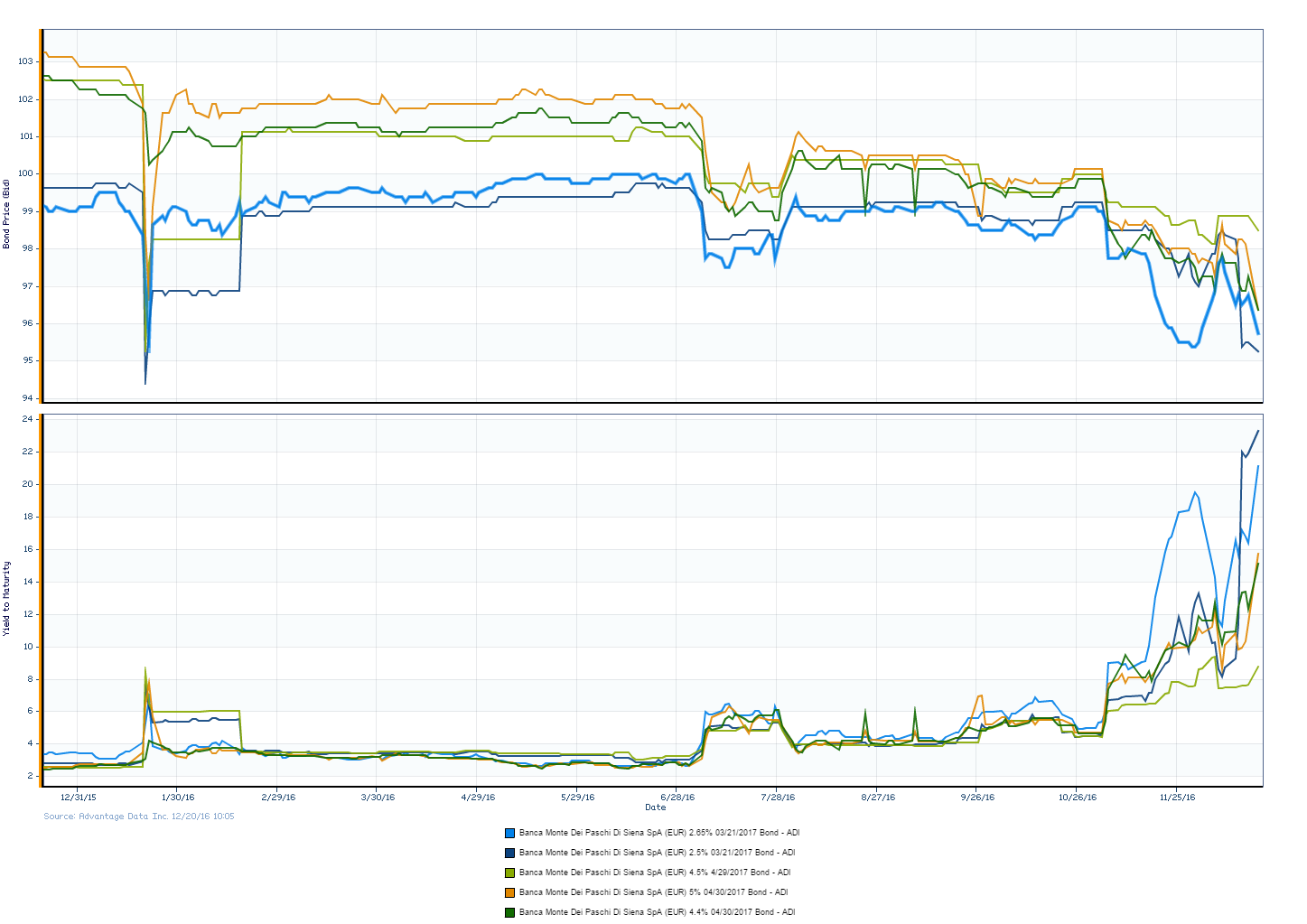

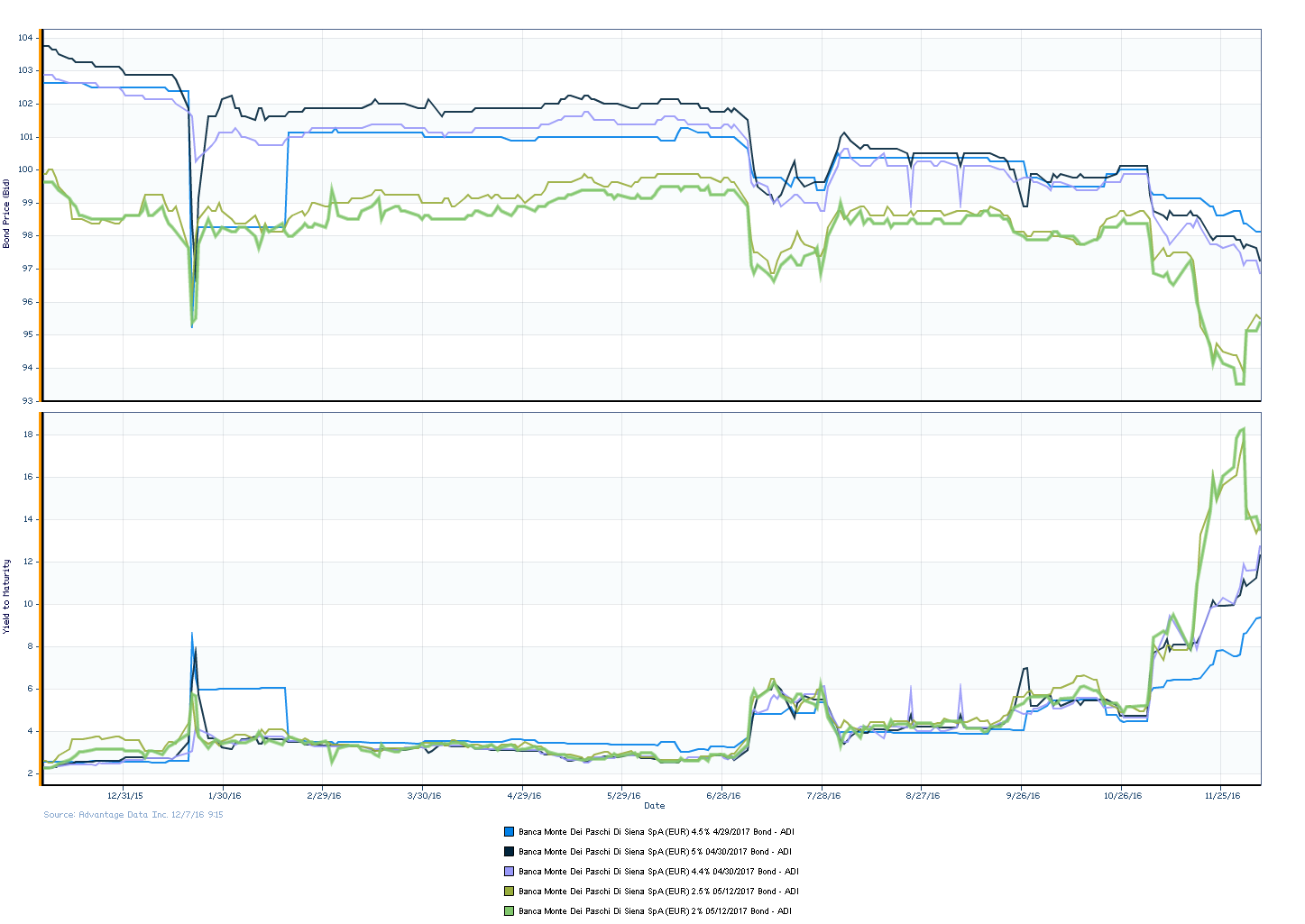

Italian government has decided to request approval from parliament for a 20 Billion Euro bail-out to stabilize its banking sector. A priority of this capital raise will be to bail-out the world's oldest bank and number three lender, Banca Monte dei Paschi di Sienna (IT: BMPS). In the beginning of December, BMPS, was in the news as it sought out 5 Billion Euros in order to cover debts and to dispose of toxic loans. Prior to the government meeting, BMPS, had formally attempted to raise the needed capital injection from private investors to avoid government intervention. The bank would need to secure the funds from private investors prior to the end of the year to avoid action from the government.

Italy Seeking 20 Billion Euros to Save Banking Sector

Topics: bonds, BMPS, Distressed Debt

Banca Monte dei Paschi di Siena (IT: BMPS) has been in the headlines the past few months over concerns that it wouldn't be able to cover its bad outstanding debts. In November, the bank announced that it was seeking a 5 billion euro capital injection in order to cover these debts in December, but the plan is currently at risk following the recent government referendum decision. Investors have been skeptical about the banks recapitalization, but reports on Tuesday have suggested that the Italian government will participate in the capital relief. It is crucial that BMPS receive aid quickly to avoid a collapse of the bank and possible contagion to others.

The world's oldest lender experienced a scare with bad loans earlier this January, but was able to avoid disaster through an accounting restatement and help from the government to repackage non-performing loans into bonds.

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)