Topics: bonds, bond market, corporate bonds

Topics: bonds, CDS, New Issues

With BDC earnings season underway, here is a repost of the BDC Reporter's regular recap of the current state of the market for the sector's common stocks and Baby Bonds. They have a look at where these two segments of the 46 publicly traded BDCs they track every week, in a series that began months ago.

Topics: bonds

EUROPEAN HIGH-YIELD BONDS RETAINED FAVOR, easily outpacing investment-grade debt in net price gains linked to actual trades. Multiple factors conspired to keep investors with a 'risk-on' bias - including the afterglow of victory by France's centrist Emmanuel Macron, upbeat trade data out of Germany, and a pullback in the euro. A string of gains in European shares rounded out the risk-tolerant tone, as the pan-European Stoxx 600 equities index moved to the solid green.

Topics: bonds

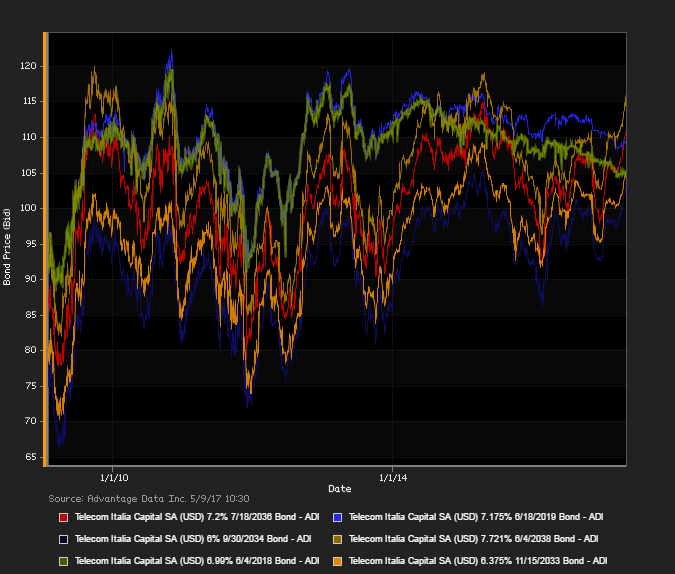

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)