BDC COMMON STOCKS

Finished

Nothing lasts for ever – including BDC common stocks winning streaks – which ended this week in the red after 5 consecutive weeks in the black.

The UBS Exchange Traded Note with the ticker BDCS – which includes most of the sector’s public companies and which we use to measure price changes – was down (0.44%), closing at $20.16.

Likewise, the related Wells Fargo BDC Index – which provides a “Total Return” picture was off (1.01%).

31 individual BDCs dropped in price in the week while 15 were up or unchanged.

Read More

Topics:

Loans,

Analytics,

BDC,

market analytics,

business development company,

News,

bdc reporter,

research

DuBois Chemicals LBO to take out debt held by Audax, GSBD; ION Corporates to refi Wall Street Systems debt held by AINV

The crush of September loan and bond launches finally brought matters to a head in a week that offered the good, the bad and the just plain ugly. In particular, Friday brought deadlines for issuers working high-profile deals, especially those with concurrent bond executions, including LBO deals for Inmarsat, Shutterfly and Sotheby’s. Like a lot of current business, these deals are coming down to the wire — or heading into overtime — as accounts have been loath to commit early as they grapple with the full calendar of as many as 45 transactions on the go all at once.

Read More

Topics:

High Yield,

Analytics,

BDC,

market analytics,

business development company,

LevFin Insights,

News,

research

BDC COMMON STOCKS

On A Run

For the fifth week in a row, the BDC sector ended up in price on the week. The upward push appeared to have taken on a life of its own.

In prior weeks, the hike in BDC prices seemed to be tied to the upward direction of the broader markets. This week, however, BDCS – the UBS Exchange Traded Note which includes most BDC stocks and which we use as our gauge of price change – was up 0.9% while the S&P 500 was down (o.5%).

Since Friday August 16, the last time the BDC sector was down for the week till this last Friday, BDCS is up 2.6% and the S&P 500 2.3%. We don’t know what’s more intriguing: that the two indices are so close or that BDCS is (slightly) ahead of the S&P. (That’s not traditionally the case: YTD the gap is 5% in favor of the latter and over 5 years 69%! Of course, distributions are much higher for BDCs than the S&P 500).

Read More

Topics:

Loans,

Analytics,

BDC,

market analytics,

business development company,

News,

bdc reporter,

research

Increase in market activity brings wave of add-ons to BDC-held credits

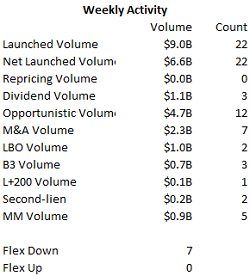

New-issue activity ramped up last week in both loans and bonds as increasingly robust conditions paved the way for well-rated and/or well-regarded issuers to speed through the market quickly despite the crowded calendar. For bonds, it was the busiest week this year with $15.5 billion of issuance, while loan arrangers rolled out another $8.1 billion in a mix of M&A and opportunistic business, much the same as the previous week.

Read More

Topics:

High Yield,

Analytics,

BDC,

market analytics,

business development company,

LevFin Insights,

News,

research

The $945M financing for Integrity Marketing that was put away quickly and quietly last month not only shows how direct lenders continue to log wins for larger mandates, but also the wider premiums they earn bypassing the syndicated market.

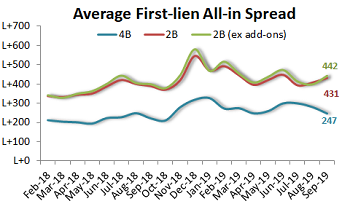

Pricing on the unitranche loan that Owl Rock Capital, Crescent Capital and Antares Capital put together for the company closed at L+575, according to sources. That's 150 bps higher than the L+425 on the insurance broker’s previous first-lien debt. It's also well above current averages in the more broadly syndicated market.

According to S&P Global LCD, the average all-in yield is 5.9% across large borrowers this month. With 3-month Libor at 2.14%, that puts the average spread at roughly L+375 for syndicated issuers.

Against other unitranche loans — the tool of choice for many direct lenders —the Integrity Marketing credit is right in the wheelhouse of where the majority of unitranches have priced in 2019, based on data provided by Advantage Data.

Read More

Topics:

Loans,

Middle Market,

BDC,

First Lien,

debt,

business development company,

Non-accruals,

portfolio,

Direct Lending,

syndicated,

underperformers,

Direct Lending Deals

.png)