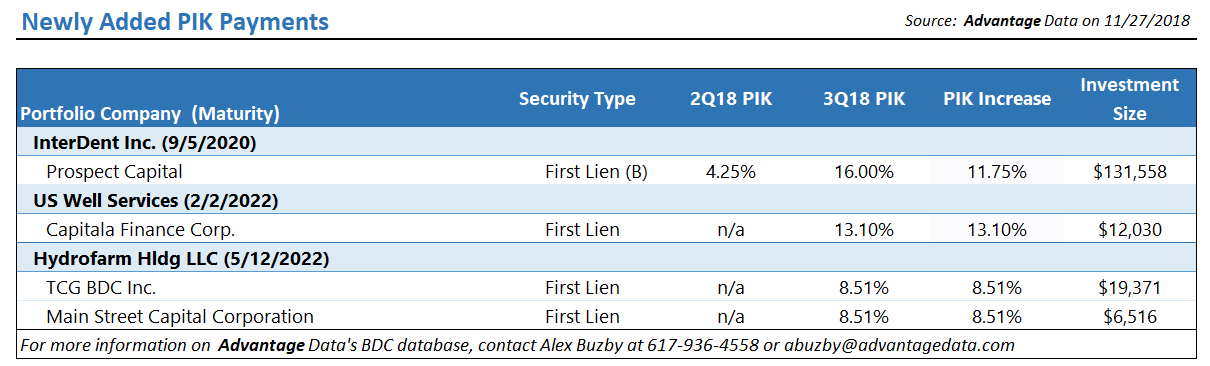

Analyzing PIK and Coupon Spread changes can be a great way to identify middle market companies that are beginning to feel pressure from lenders. Whether you're sourcing investments, consulting distressed borrowers or analyzing BDCs, utilizing alternative signs of distress as leading indicators is a great way to get ahead of the market - Download the data sample below!

One Step Ahead: Identifying Distress In The Middle Market

Topics: Middle Market, BDC, Spreads, First Lien, Distressed Investments, debt, business development company, Distress, Distressed Debt, Finance, Restructuring, Fixed Income, download

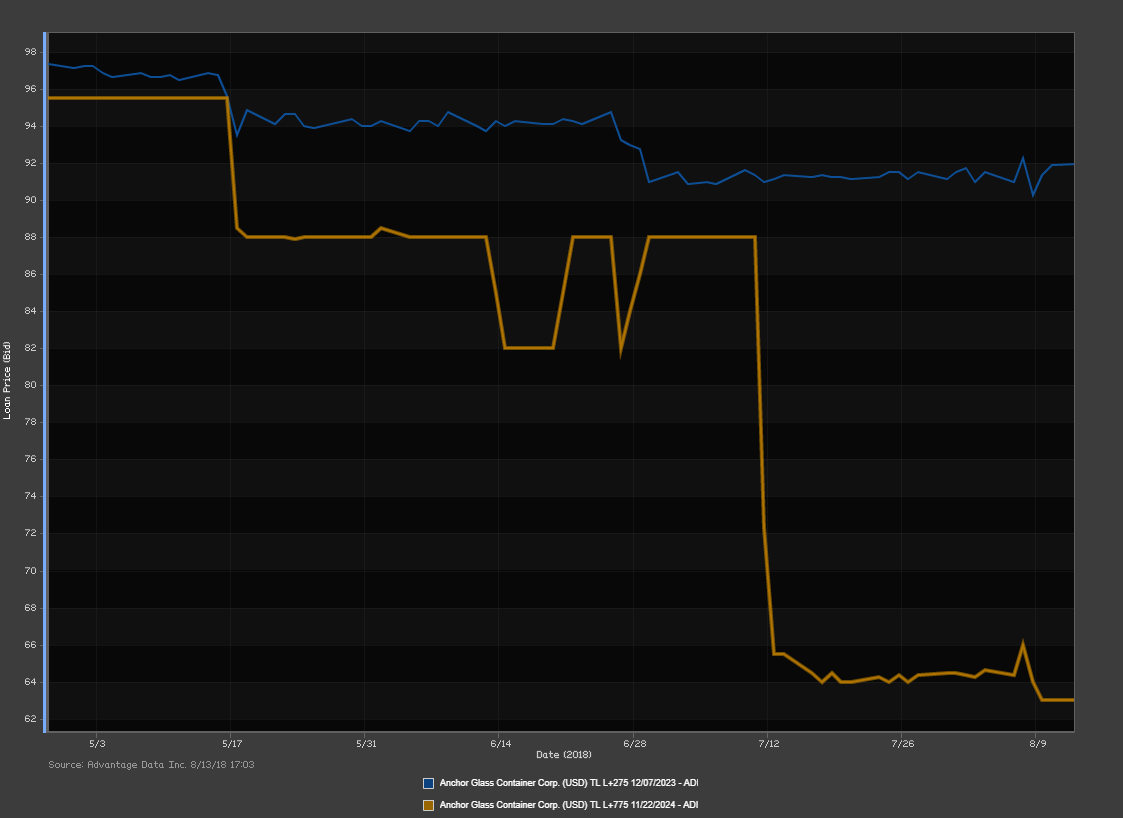

Newly Distressed Loans: Anchor Glass Container Corporation

We all know that companies in distress tend to have a harder time meeting their financial obligations, which translates to a higher probability that they will default. A company in this position has pretty straightforward options: either raise enough cash through asset sales, operating improvements, and new financing, or reduce or postpone interest and principal payments on the debt by negotiating with creditors.

For restructuring or turnaround experts, identifying distressed companies is the first hurdle to deal sourcing and business development. Using the AdvantageData workstation, we’ve compiled a list of distressed loans that you might want to be aware of.

Topics: Loans, First Lien, market analytics, Distress, Distressed Debt, Restructuring, Second Lien, Loan Default Rate, Default Rate, Fixed Income, download

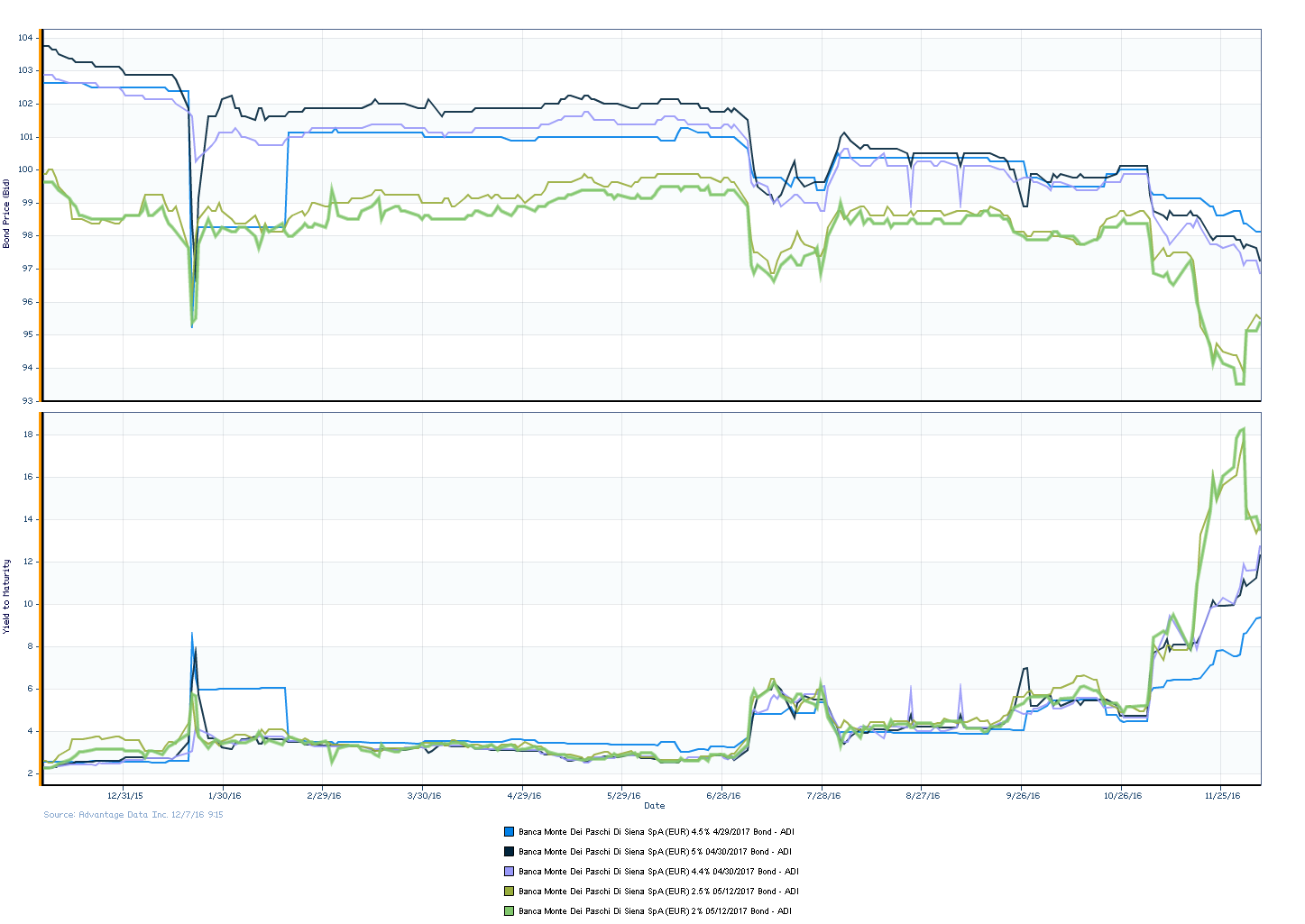

Banca Monte dei Paschi di Siena (IT: BMPS) has been in the headlines the past few months over concerns that it wouldn't be able to cover its bad outstanding debts. In November, the bank announced that it was seeking a 5 billion euro capital injection in order to cover these debts in December, but the plan is currently at risk following the recent government referendum decision. Investors have been skeptical about the banks recapitalization, but reports on Tuesday have suggested that the Italian government will participate in the capital relief. It is crucial that BMPS receive aid quickly to avoid a collapse of the bank and possible contagion to others.

The world's oldest lender experienced a scare with bad loans earlier this January, but was able to avoid disaster through an accounting restatement and help from the government to repackage non-performing loans into bonds.

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)