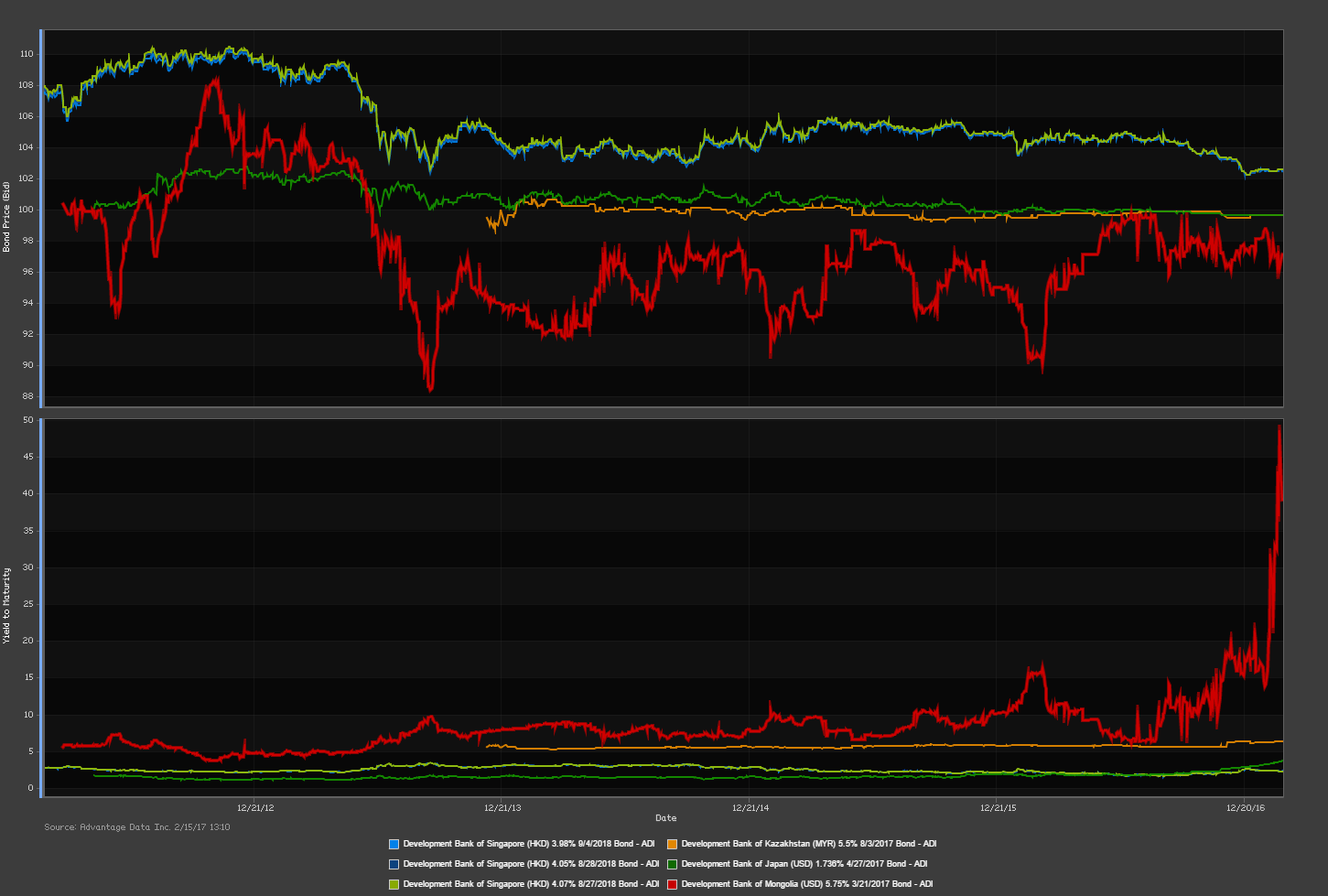

Development Bank of Mongolia may have its 5.75% 3/21/2017 bond rating cut over concerns it may not be able to make its $580 million repayment by maturity. The mining and infrastructure financer currently does not have the liquidity to finance the repayment itself and is looking for outside help. Mongolian government has reportedly contacted China and the International Monetary Fund for assitance in the matter, but investors have their doubts that a bailout will be resolved within a month's time.

Development Bank of Mongolia Under Review for March 2017 Debt

Posted by

Nick Buenaventura on Feb 15, 2017 1:58:24 PM

0 Comments Click here to read/write comments

Topics: bonds, emerging markets, Development Bank

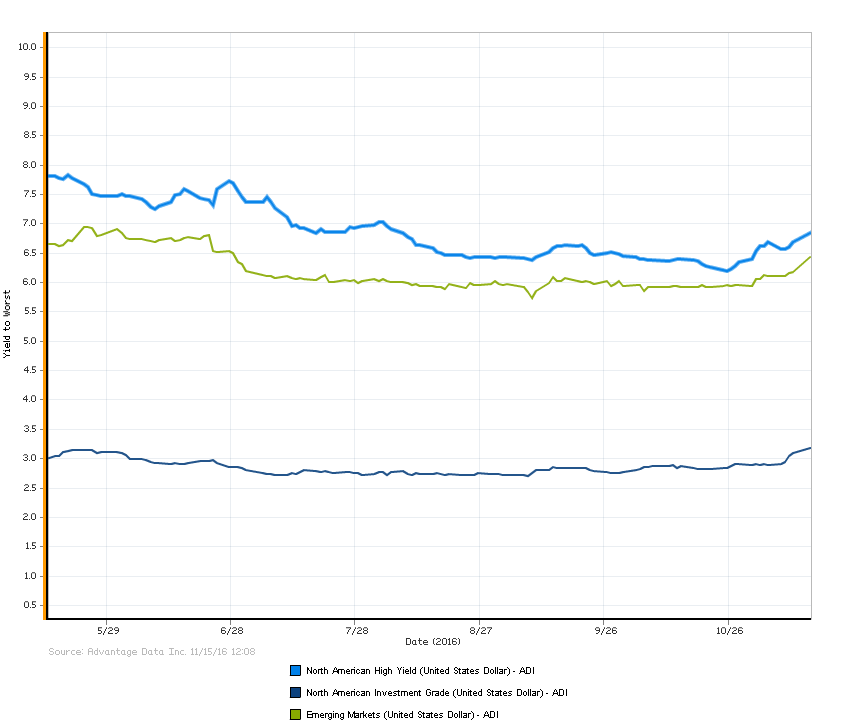

Corporate yields increased considerably following an upset victory from U.S. Presidential-elect Donald Trump on November 8th. This increase can be attributed to investors fleeing for the post-election rally in stocks due to Trump's promise of deregulation. This corporate bond sell-off is captured by the AdvantageData North American High Yield and High Grade Corporate Bond Indices.

0 Comments Click here to read/write comments

Topics: High Yield, Investment Grade, emerging markets

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)