A dissection of the latest quarter’s BDC portfolios by LevFin Insights and Advantage Data shows that non-accruals dropped significantly over the past year. For the 24 public and nonpublic BDCs with at least $1 billion in assets under management, the non-accrual rate has retreated to an average of 1.77% for the three-month period ending June 30, down from 3.31% in the same period last year.

LevFin Insight: BDC non-accruals drop as energy falls away, credit cycle still has several innings left

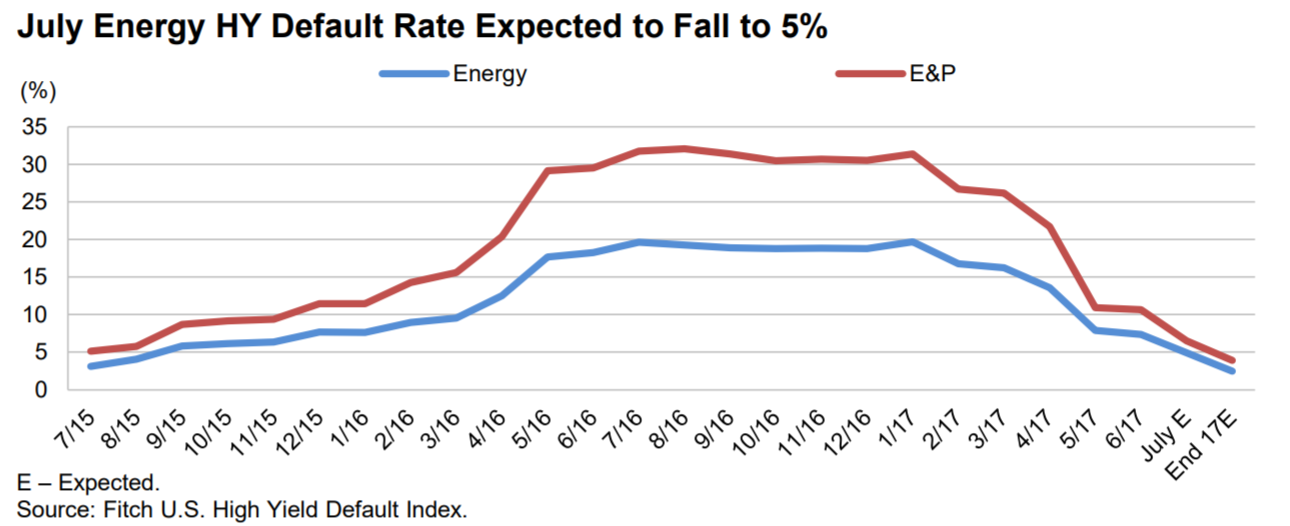

July HY TTM Default Rate Dips Below 2%; Energy Rate Lowest Since August 2015

July Default Rate Below 2%: The July U.S. TTM high yield default rate stands at 1.9%, down from 2.2% at June 30. This represents the seventh straight month the rate will have fallen and marks the lowest level since March 2014. Chinos Intermediate Holdings’ (J. Crew Group Inc.) distressed debt exchange (DDE) and Armstrong Energy Inc.’s missed payment were the two July defaults registering $766 million. The month’s total is well below the $4.7 billion rolling off the TTM universe.

Topics: High Yield, energy

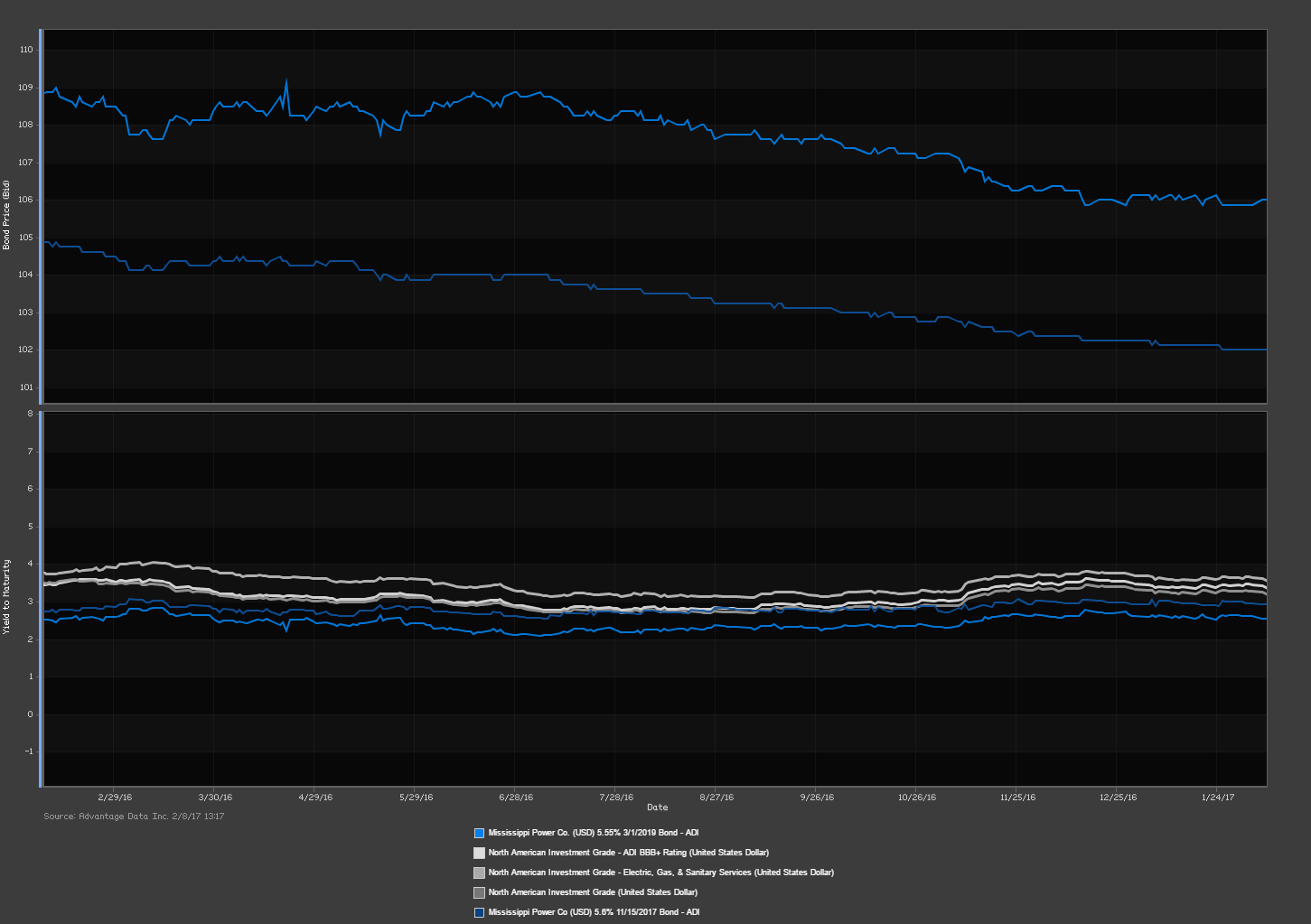

Mississippi Power Co. (NYSE: MP-D) is under review for a credit downgrade as a result of an ongoing investigation of continued delays and cost overruns for its coal gasification plant in Kemper County. The energy company last experienced a downgrade of its debt in November 2015, which brought its Moody's rating down to near junk status of Baa3. If the review goes poorly for the plant, Mississippi Power Co. will be in danger of crossing over into non-investment grade status.

Topics: energy, junk bonds, Downgrade, Crossover

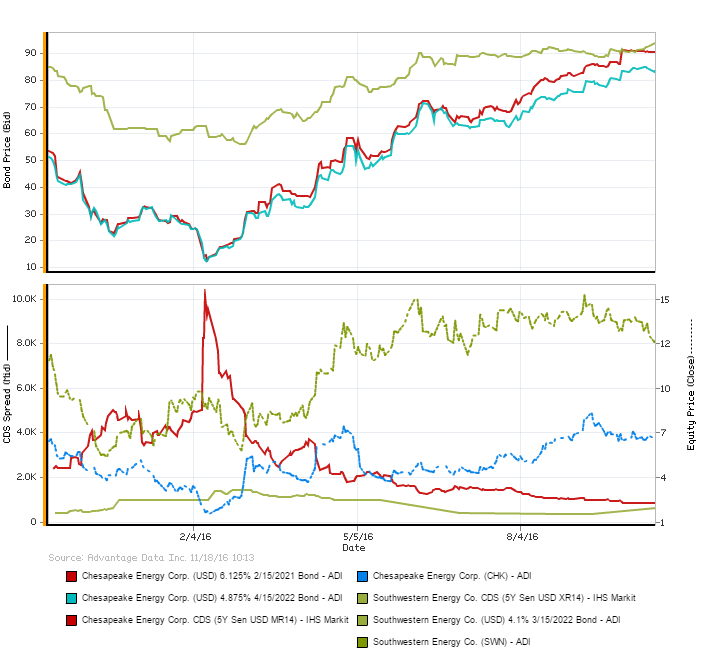

Divergence in Southwestern Energy and Chesapeake Energy bond and equity prices hit a high in Q1 2016 with the spike in Chesapeake 5 Year Senior USD MR14 CDS spread. Thereafter and through to present, equity prices remain divergent while bond prices converge.

Topics: credit default swaps, energy, CDS

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)