BDC Filing season is in full swing. This report will analyze BDCs that have filed in the last 2 weeks. Last week’s analysis is available here.

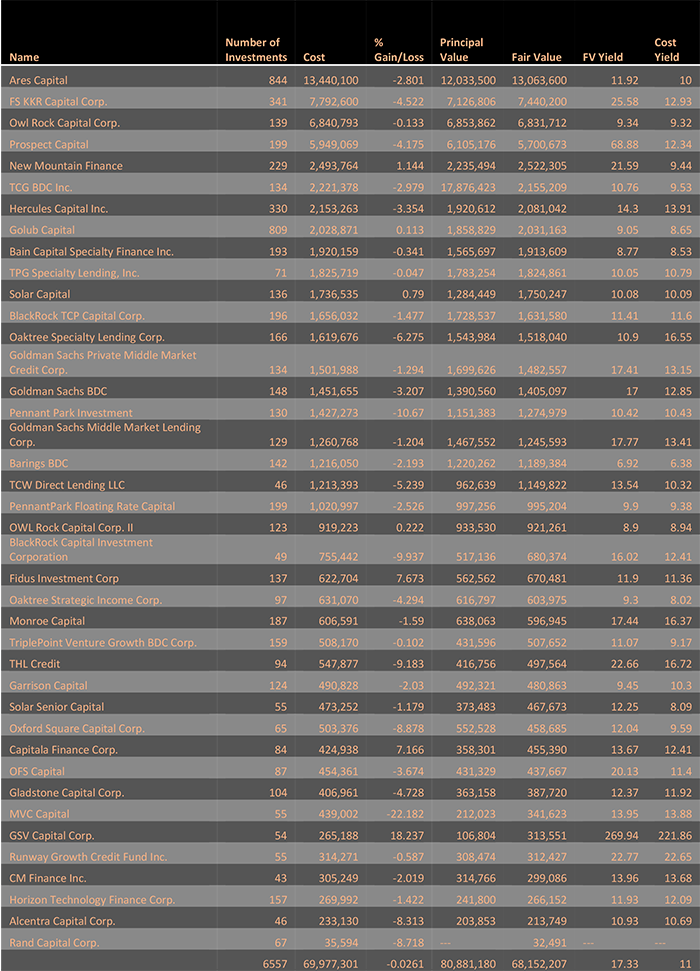

Aggregate Fair Value reported by BDCs that have filed in Q1 2019 is 68.1 Billion USD which is approximately 70% of aggregate AUM of all BDCs. BDCs have reported 48.8 Billion USD AUM in this week alone.

Read More

Topics:

Analytics,

BDC,

AUM,

market analytics,

business development company,

Non-accruals,

BDC Filings,

fair value,

market update,

top 5,

adds & exits

BDC Filing season is in full swing. This report will analyze nine BDCs that have filed this week. Aggregate Fair Value reported by these BDCs is 19.3 Billion USD which is approximately 20% of aggregate AUM of all BDCs.

Read More

Topics:

Analytics,

BDC,

AUM,

market analytics,

business development company,

Non-accruals,

BDC Filings,

fair value,

market update,

top 5,

adds & exits

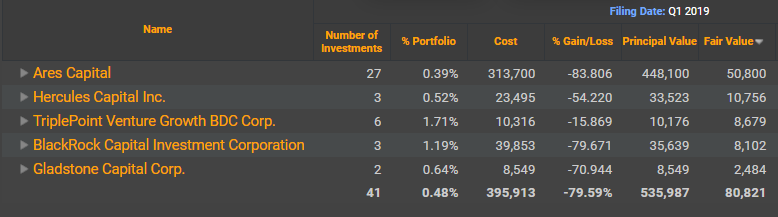

Top 5 Portfolio companies by Fair Value held by BDC’s account for 25 percent of aggregate BDC’s assets under management. Please click below to download List of Top 5 Portfolio Companies by Fair Value held by all BDCs.

Read More

Topics:

BDC,

business development company,

fair value,

portfolio

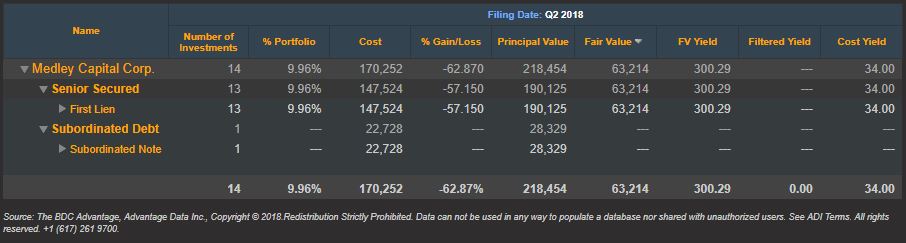

Last month we shared a list of the top 10 BDC non-accruals based on first quarter 2018 SEC filings. Now that we are mid-way through August and second quarter filings are readily available, let’s take a fresh look at the first quarter’s worst performer.

Read More

Topics:

BDC,

First Lien,

Non-accruals,

Distressed Debt,

Restructuring,

Second Lien,

Loan Default Rate,

BDC Filings,

Default Rate,

Fixed Income,

fair value,

portfolio,

download,

News

.png)