Ares Capital yesterday reported a big quarter for new issues, $2.4 billion across 50 borrowers, compared to $1.3 billion in the previous quarter and $1.9 billion in the same period last year.

3Q19 Portfolio Highlights: Ares Capital books big quarter for new issues, at $2.4B

Topics: Loans, Middle Market, BDC, First Lien, debt, business development company, Non-accruals, portfolio, Direct Lending, syndicated, underperformers, Direct Lending Deals

Golub plans private party for Parts Town; Deal is latest large-cap to forgo wider distribution

Parts Town is coming to market next week via Golub Capital with a $788 million unitranche financing to back the add-on acquisition of Heritage Foodservice Group. The lender meeting, however, isn’t taking place in a fancy midtown hotel auditorium that can seat hundreds of investors. Instead, Golub is hosting a small group of invites to sell down only about half the deal.

Topics: Loans, Middle Market, BDC, First Lien, debt, business development company, Non-accruals, portfolio, Direct Lending, syndicated, underperformers, Direct Lending Deals

Unitranche: Integrity Marketing loan highlights better pricing for direct lenders

The $945M financing for Integrity Marketing that was put away quickly and quietly last month not only shows how direct lenders continue to log wins for larger mandates, but also the wider premiums they earn bypassing the syndicated market.

Pricing on the unitranche loan that Owl Rock Capital, Crescent Capital and Antares Capital put together for the company closed at L+575, according to sources. That's 150 bps higher than the L+425 on the insurance broker’s previous first-lien debt. It's also well above current averages in the more broadly syndicated market.

According to S&P Global LCD, the average all-in yield is 5.9% across large borrowers this month. With 3-month Libor at 2.14%, that puts the average spread at roughly L+375 for syndicated issuers.

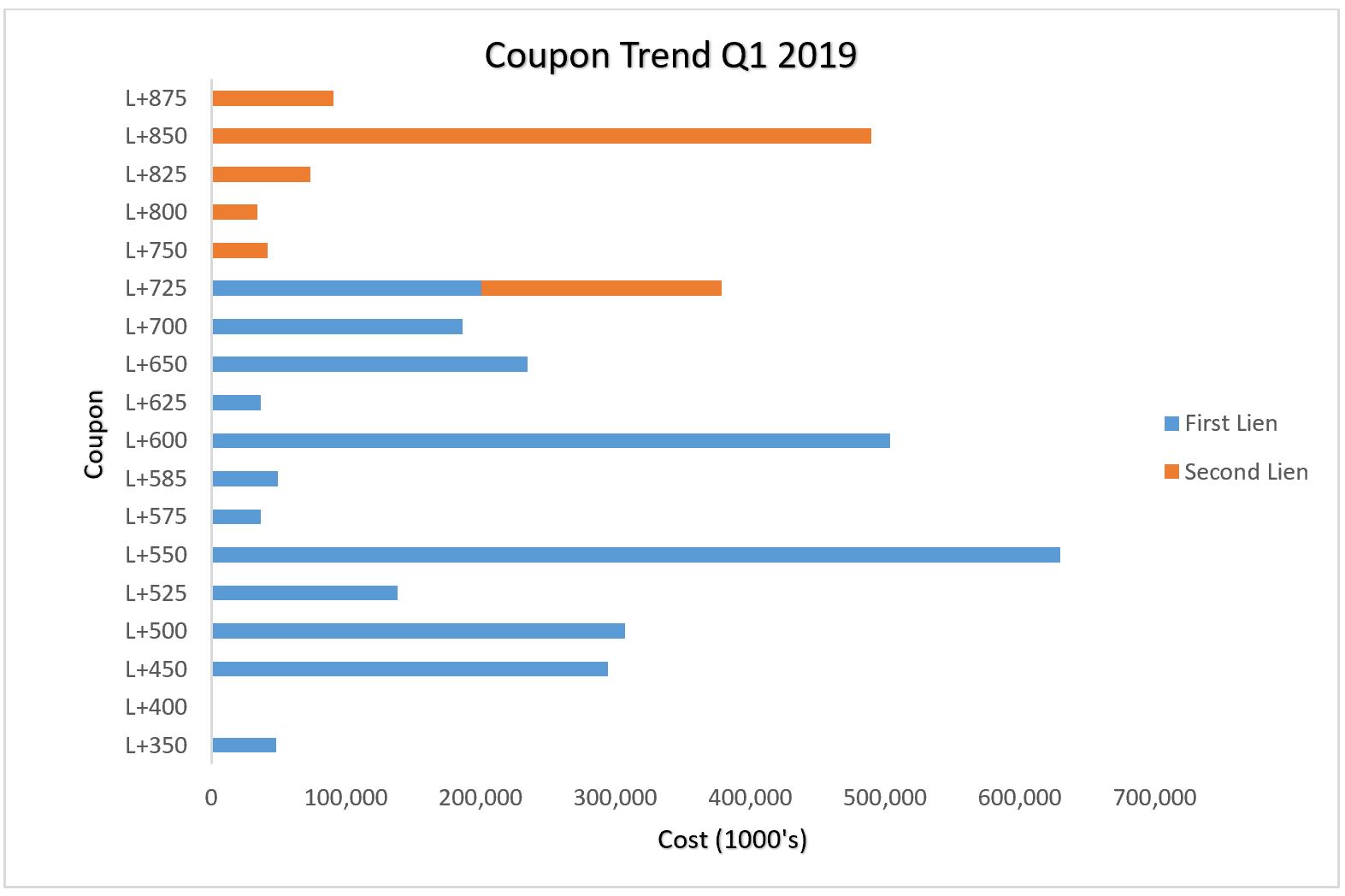

Against other unitranche loans — the tool of choice for many direct lenders —the Integrity Marketing credit is right in the wheelhouse of where the majority of unitranches have priced in 2019, based on data provided by Advantage Data.

Topics: Loans, Middle Market, BDC, First Lien, debt, business development company, Non-accruals, portfolio, Direct Lending, syndicated, underperformers, Direct Lending Deals

BDC Filing season is almost over. This report will analyze BDCs that have filed in the last 3 weeks. Last week’s analysis is available here.

Aggregate Fair Value reported by BDCs that have filed in Q1 2019 is 104 Billion USD. BDCs have reported 36 Billion USD AUM in this week.

Topics: BDC Index, BDC, First Lien, business development company, Non-accruals, New Issues, Second Lien, BDC Filings, fair value

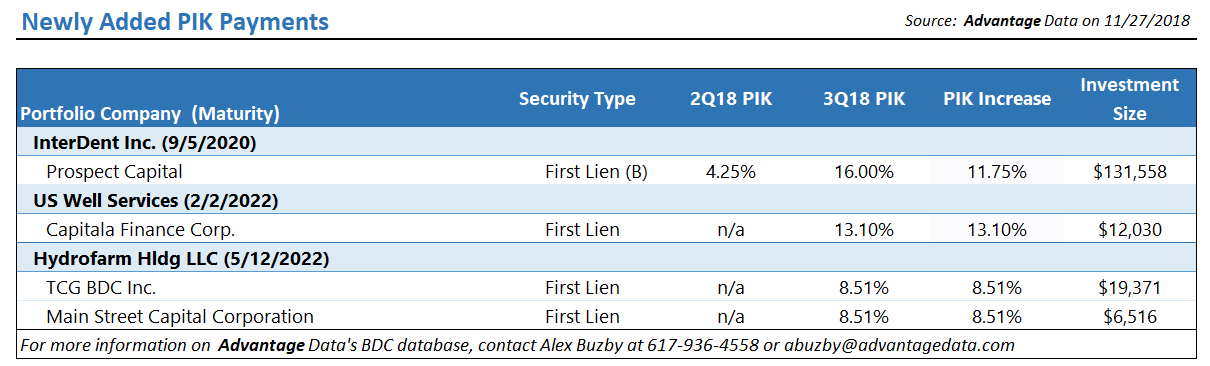

One Step Ahead: Identifying Distress In The Middle Market

Analyzing PIK and Coupon Spread changes can be a great way to identify middle market companies that are beginning to feel pressure from lenders. Whether you're sourcing investments, consulting distressed borrowers or analyzing BDCs, utilizing alternative signs of distress as leading indicators is a great way to get ahead of the market - Download the data sample below!

Topics: Middle Market, BDC, Spreads, First Lien, Distressed Investments, debt, business development company, Distress, Distressed Debt, Finance, Restructuring, Fixed Income, download

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)