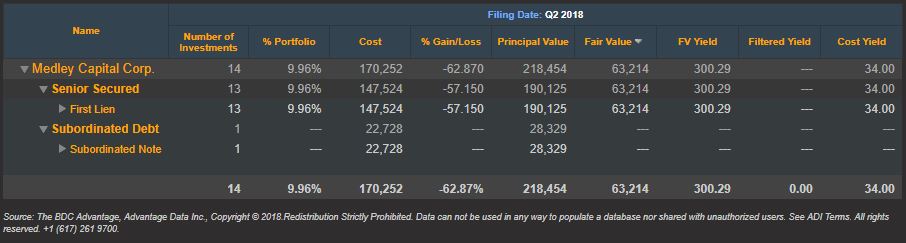

Last month we shared a list of the top 10 BDC non-accruals based on first quarter 2018 SEC filings. Now that we are mid-way through August and second quarter filings are readily available, let’s take a fresh look at the first quarter’s worst performer.

Q2 2018 BDC Non-Accruals: Medley Capital Corp No Longer Worst Performer

Topics: BDC, First Lien, Non-accruals, Distressed Debt, Restructuring, Second Lien, Loan Default Rate, BDC Filings, Default Rate, Fixed Income, fair value, portfolio, download, News

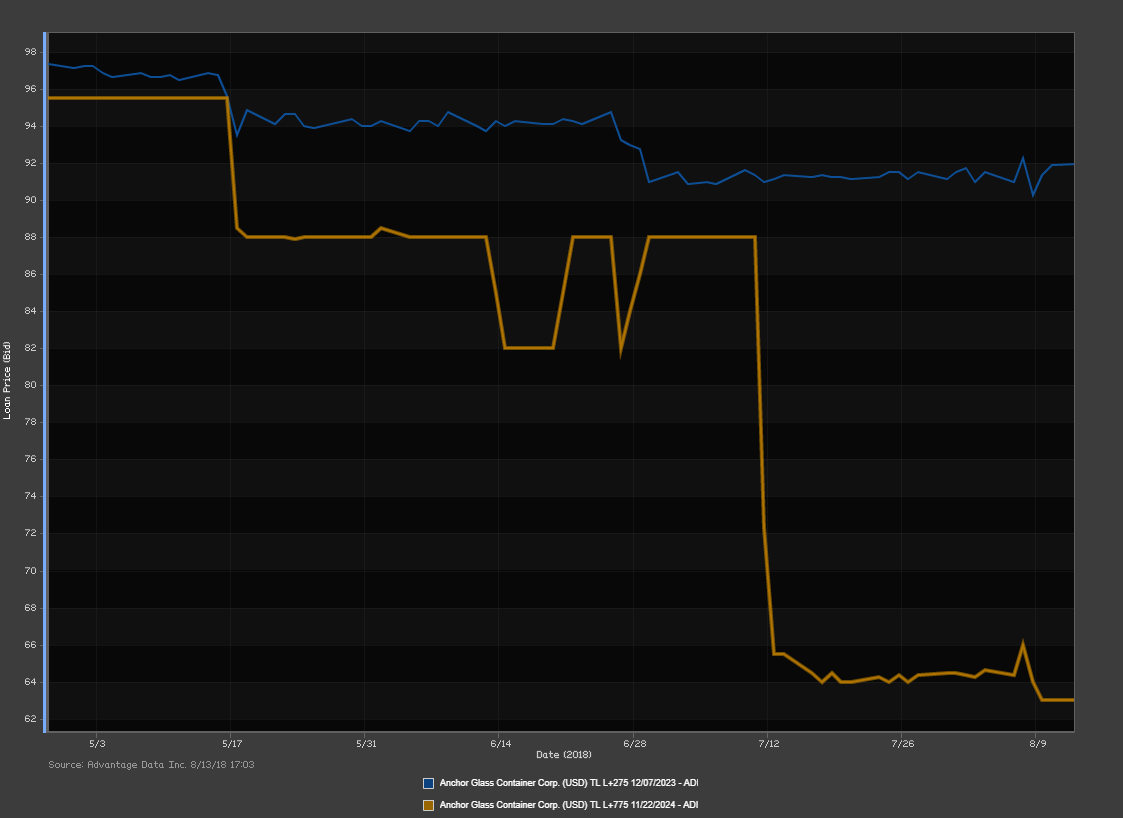

Newly Distressed Loans: Anchor Glass Container Corporation

We all know that companies in distress tend to have a harder time meeting their financial obligations, which translates to a higher probability that they will default. A company in this position has pretty straightforward options: either raise enough cash through asset sales, operating improvements, and new financing, or reduce or postpone interest and principal payments on the debt by negotiating with creditors.

For restructuring or turnaround experts, identifying distressed companies is the first hurdle to deal sourcing and business development. Using the AdvantageData workstation, we’ve compiled a list of distressed loans that you might want to be aware of.

Topics: Loans, First Lien, market analytics, Distress, Distressed Debt, Restructuring, Second Lien, Loan Default Rate, Default Rate, Fixed Income, download

Fitch: US High Yield TTM Default Rate Falls to Lowest Level Since March 2014

The U.S. trailing 12-month (TTM) high yield default rate dipped below 2% for the first time since March 2014, according to Fitch Ratings in a new report.

Topics: High Yield, Loan Default Rate

Fitch: Retailers' Struggles Propel Sector Loan Default Rate Above 5%

The trailing 12-month (TTM) retail institutional leveraged loan default rate climbed above 5% in July from 2.8% at end-June, according to Fitch Ratings. This year five retailers, including True Religion Apparel and J.Crew Group this month, have defaulted on $3.8 billion of loans. The retail sector loan default rate is now well above the non-recessionary average of 1.4%.

Topics: Loans, Loan Default Rate

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)