BDC COMMON STOCKS

Proof Positive

Once again, the weekly performance of the BDC sector demonstrated that its ups and downs are tied to the broader markets.

We’ve watched for weeks now BDC prices rise and fall with the major indices, which are themselves apparently fixated on the progress of the trade war.

This week was no exception.

The S&P 500 moved up 0.62%, mostly late in the 5 day period, due to the promise of a trade armistice or partial deal of some sort.

“Hurrah” said the markets, but as CNBC is reporting, second and third thoughts are already running rife so the trade tease is likely to continue.

This week at least, though, the late-in-the-week optimism brought the Wells Fargo BDC Index up 0.73%, after two prior weeks in the dumps.

Read More

Topics:

Loans,

Analytics,

BDC,

market analytics,

business development company,

News,

bdc reporter,

research

BDC COMMON STOCKS

Surprised

Halloween is still a month away but the broader markets were spooked this week by a series of negative economic reports.

That caused all the major indices to drop in unison for several days.

Appropriately enough, a positive payroll report (unemployment at its lowest level in 50 years !) brought investors back in.

At the end of the 5 business day period the S&P was barely down: (0.33%).

Read More

Topics:

Loans,

Analytics,

BDC,

market analytics,

business development company,

News,

bdc reporter,

research

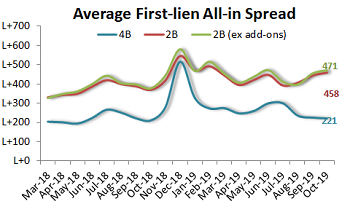

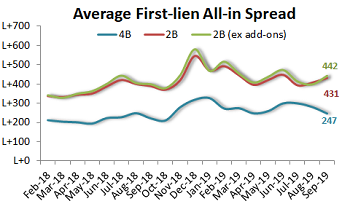

Market signals cautious tone as it enters 4Q; little activity in credits held by BDCs

Global market volatility on the heels of an active September in loans and the biggest high-yield calendar in two years has injected a further air of caution into new issues heading into the final three months of 2019, particularly with respect to the mid-to-lower single-B segment of the market.

Read More

Topics:

High Yield,

Analytics,

BDC,

market analytics,

business development company,

LevFin Insights,

News,

research

BDC COMMON STOCKS

Finished

Nothing lasts for ever – including BDC common stocks winning streaks – which ended this week in the red after 5 consecutive weeks in the black.

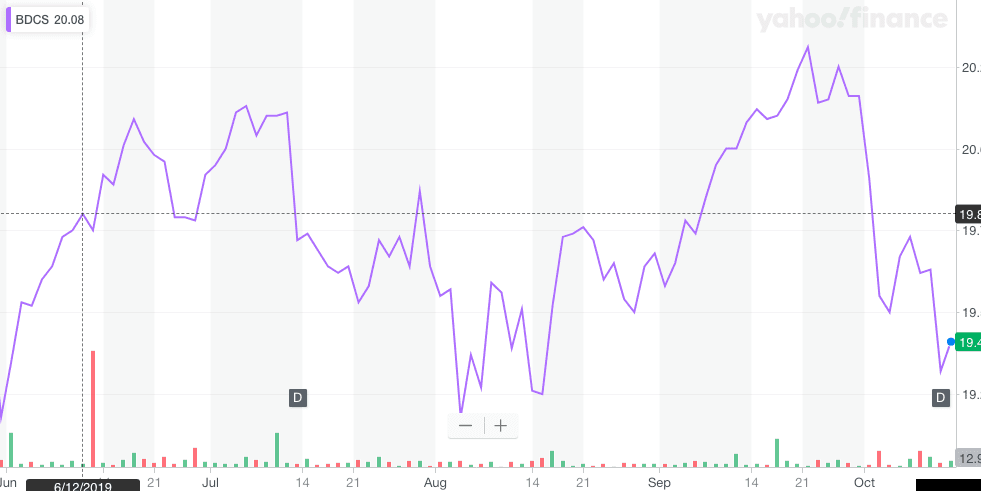

The UBS Exchange Traded Note with the ticker BDCS – which includes most of the sector’s public companies and which we use to measure price changes – was down (0.44%), closing at $20.16.

Likewise, the related Wells Fargo BDC Index – which provides a “Total Return” picture was off (1.01%).

31 individual BDCs dropped in price in the week while 15 were up or unchanged.

Read More

Topics:

Loans,

Analytics,

BDC,

market analytics,

business development company,

News,

bdc reporter,

research

DuBois Chemicals LBO to take out debt held by Audax, GSBD; ION Corporates to refi Wall Street Systems debt held by AINV

The crush of September loan and bond launches finally brought matters to a head in a week that offered the good, the bad and the just plain ugly. In particular, Friday brought deadlines for issuers working high-profile deals, especially those with concurrent bond executions, including LBO deals for Inmarsat, Shutterfly and Sotheby’s. Like a lot of current business, these deals are coming down to the wire — or heading into overtime — as accounts have been loath to commit early as they grapple with the full calendar of as many as 45 transactions on the go all at once.

Read More

Topics:

High Yield,

Analytics,

BDC,

market analytics,

business development company,

LevFin Insights,

News,

research

.png)