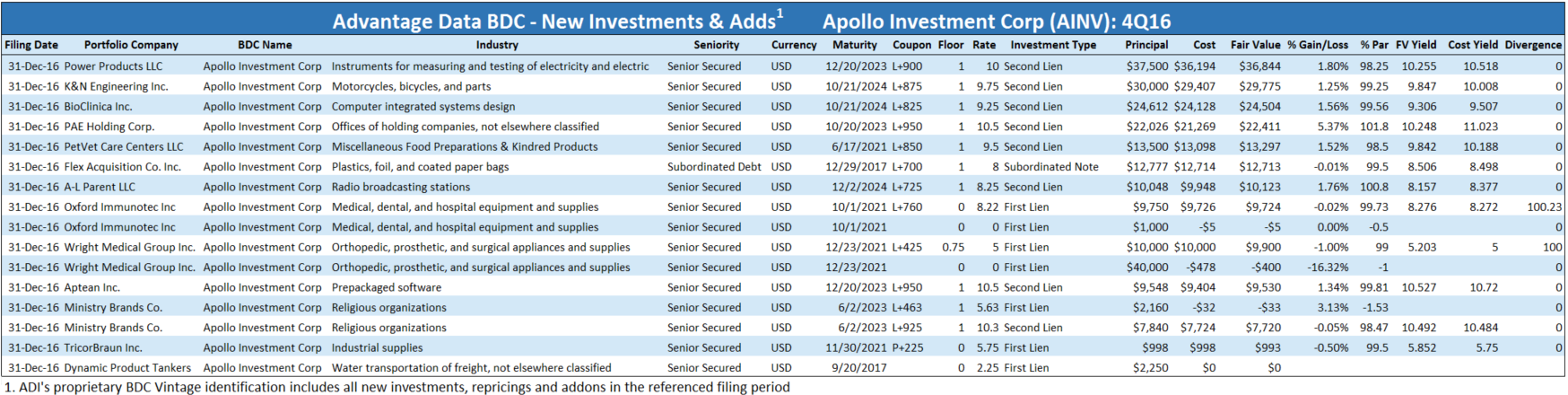

Apollo Investment Corp. (AINV) filed 4Q16 results yesterday including debt investments at 13 new portfolio companies. Click here to dive into Apollo New Investments courtesy of our BDC Database.

Topics: BDC, business development company, New Issues

North American Investment Grade debt was more than triple the amount of that issued in high yield this week, with investment grade debt totaling $24.85 billion and high yield debt totaling $8.26 billion. JPMorgan Chase & Co. (NYSE: JPM) and The Goldman Sachs Group Inc (NYSE: GS) led investment grade deals with JPMorgan having one issue of senior unsecured notes totalling $2.75 billion and Goldman Sachs with three new issues of senior unsecured notes totalling $5.0 billion. This represented 31.2% of total investment grade debt issued this week. Other stocks in the financial sector also had a big week as Capital One Financial Corporation (NYSE: COF) had two new issues of senior unsecured notes totaling $2.0 billion, BB&T Corporation (NYSE: BBT) with three new issues of senior unsecured notes totaling $2.6 billion, Royal Bank of Canada (NYSE: RY) with two new issues of senior unsecured notes totaling $1.75 billion, and SunTrust Banks Inc (NYSE: STI) with two new issues of senior unsecured notes totalling $1.3 billion. International Business Machines Corporation (NYSE: IBM) also had a busy week with four new issues of senior unsecured notes totalling $2.75 billion.

Topics: High Yield, Investment Grade, New Issues

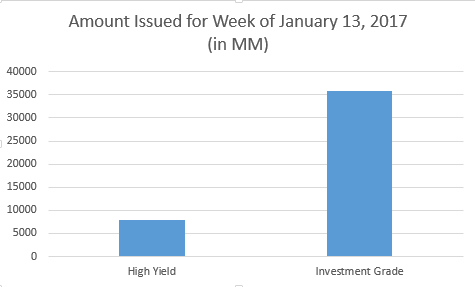

North American Investment Grade debt was more than quadruple the amount of that issued in high yield this week, with investment grade debt totaling $36.55 billion and high yield debt totaling $8.649 billion. The International Bank for Reconstruction and Development (IBRD) led investment grade deals with a new issue of unsecured notes totaling $5 billion. This represented 13.7% of total investment grade debt issued this week. Financial sector stocks also had a big week with Morgan Stanley (NYSE: MS) having three new issues of senior unsecured notes totaling $7.0 billion, Bank of America (NYSE: BAC) with four new issues of senior unsecured notes totaling $6.75 billion, and Wells Fargo Securities (NYSE: WFC) with two new issues of senior unsecured notes totaling $5.0 billion.

Topics: High Yield, Investment Grade, New Issues

The amount issued in North American investment grade debt was more than quadruple the amount of that issued in high yield this week, with investment grade debt totaling $35.25 billion and high yield debt totaling $7.97 billion. Broadcom Corporation (NasdaqGS:AVGO) led investment grade deals with four new issues of senior unsecured notes totaling $13.55 billion to replace an old credit facility. This represented 38.4% of total investment grade debt issued this week. General Motors (NYSE:GM) led high yield deals with three new issues of senior unsecured notes totaling $2.5 billion, about 31.4% of total high yield debt issued this week.

Topics: High Yield, Investment Grade, New Issues, General Motors

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)