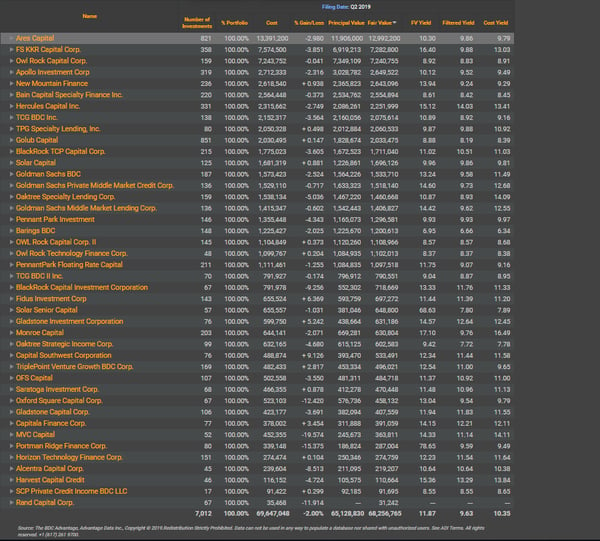

BDCs Filing season is in full swing. This report will utilize Advantage Data’s BDC workstation to analyze Q2 2019 filing data. As of Friday, August 9th, 2019 Aggregate Fair Value reported by BDCs that have filed in Q2 2019 is at 68 Billion USD (Fair Value) which is approximately 65% of aggregate AUM of all BDCs.

Please contact info@advantagedata.com for BDC Holdings Data.

Please contact info@advantagedata.com for BDC Holdings Data.

Non-Accruals

Out of 42 BDC’s that have filed so far, 29 BDC’s have reported at least one Non–Accrual in their portfolio. Aggregate Non-Accruals so far amounts to 1.3 Billion USD in Cost. Fair Value of these Non-Accruals are reported at a significant Mark Down of 563 Million USD.

Ares, FS KKR and Oaktree are leading the Non-Accruals list. Compared to Q1 2019, Ares has reported 3 more Non-Accruals while Oak Tree has reported 1 more Non- Accrual in Q2 2019.

Please contact info@advantagedata.com for a complete list of Portfolio Companies that are in Non-Accrual.

Please contact info@advantagedata.com for a complete list of Portfolio Companies that are in Non-Accrual.

BDCs Investments Maturing in the next 12 Months

In the next 12 months, the aforementioned BDC’s will have Investments worth 2.7 Billion USD in Fair Value maturating. Below table summarizes aggregate Investments by Fair Value of BDCs in portfolio companies that are maturing in the next 12 months.

|

BDC |

FV (1000) |

|

Ares Capital |

596,400 |

|

FS KKR Capital Corp. |

414,000 |

|

Goldman Sachs BDC |

197,259 |

|

Apollo Investment Corp |

188,776 |

|

Solar Senior Capital |

178,991 |

|

TPG Specialty Lending, Inc. |

169,739 |

|

BlackRock TCP Capital Corp. |

130,844 |

|

Golub Capital |

99,541 |

|

TCG BDC Inc. |

97,293 |

|

Monroe Capital |

75,804 |

|

Hercules Capital Inc. |

63,675 |

|

Capitala Finance Corp. |

63,139 |

|

Gladstone Investment Corporation |

57,495 |

|

MVC Capital |

53,926 |

|

TriplePoint Venture Growth BDC Corp. |

43,286 |

|

Oaktree Specialty Lending Corp. |

35,891 |

|

Fidus Investment Corp |

33,910 |

|

Owl Rock Capital Corp. |

26,644 |

|

BlackRock Capital Investment Corporation |

24,966 |

|

SCP Private Credit Income BDC LLC |

24,936 |

|

Harvest Capital Credit |

23,962 |

|

OFS Capital |

23,395 |

|

Saratoga Investment Corp. |

19,234 |

|

Solar Capital |

15,935 |

|

Gladstone Capital Corp. |

13,965 |

|

Capital Southwest Corporation |

12,522 |

|

Bain Capital Specialty Finance Inc. |

9,272 |

|

Horizon Technology Finance Corp. |

8,883 |

|

Alcentra Capital Corp. |

8,729 |

|

PennantPark Floating Rate Capital |

5,057 |

|

OWL Rock Capital Corp. II |

4,811 |

|

Portman Ridge Finance Corp. |

4,384 |

|

Pennant Park Investment |

2,373 |

|

Rand Capital Corp. |

1,920 |

|

Owl Rock Technology Finance Corp. |

631 |

|

Grand Total |

2,731,588 |

Where BDC are marking their Investments at?

Via below Table it can be inferred that while 93.4% of BDCs Investments at cost are marked at 91 and up, it is important to note that 3.92% of BDCs Investment at cost are marked at 80 or below.

|

Price Range |

Cost (1000) |

Cost |

Fair Value (1000) |

Fair Value |

|

>91 |

56,751,752 |

93.41% |

56,723,993 |

94.84% |

|

81-90 |

1,620,236 |

2.67% |

1,433,818 |

2.40% |

|

71-80 |

1,041,104 |

1.71% |

873,287 |

1.46% |

|

61-70 |

426,860 |

0.70% |

319,349 |

0.53% |

|

51-60 |

285,218 |

0.47% |

202,555 |

0.34% |

|

0-50 |

627,267 |

1.03% |

259,445 |

0.43% |

|

Grand Total |

60,752,436 |

100.00% |

59,812,447 |

100.00% |

Top 10 BDC Investments

BDCs portfolio quality can be measured by taking a deeper dive into BDC’s top ten investments. While these investments are small in number, these investments are primary determinants of BDC’s portfolio performance. Top 10 Investments of BDCs that have filed so far in Q2 2019 amount to 21.2 Billion USD accounting to 30% of their aggregate holdings.

Please click below to download data.

.png)