About half of the $1.5 billion in gross commitments Ares Capital made in the third quarter came from new lending relationships. LevFin Insights was able to identify 20 borrowers new to the lender, for $693 million in debt commitments (on a cost basis). LBO financing was identified as the use of proceeds on 11 of the new companies, each of which had a different sponsor.

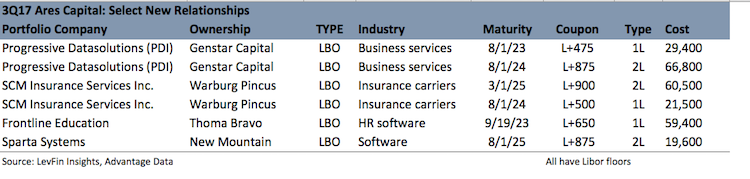

The quarter’s largest LBO commitment for a new issuer was $96.2 million in first- and second-lien term loans for Genstar Capital to back the buyout of Progressive Datasolutions (PDI). The table below shows the four largest LBO investments for new relationships. Open the download to view all new issuers and corresponding holds, pricing and sponsors.

Non-Accruals

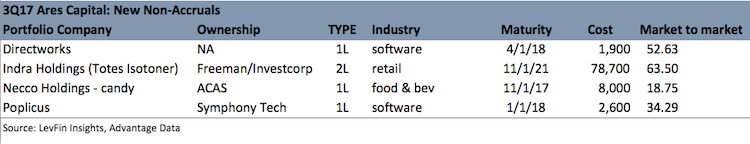

Non-Accruals for the third quarter rose to 3.4% of total investments at cost, from 2.7% at the end of June, and 2.9% at Dec. 31, 2016. Ares Capital added four issuers, bringing the total to 22.

Kelly Thompson

kelly.thompson@levfininsights.com

773.867.1080

Alex Buzby

alex.buzby@advantagedata.com

617.936.4558

.png)