HIGH-YIELD BONDS REGAINED CLEAR-CUT FAVOR over their less-risky investment-grade counterparts, outpacing them in net price gains linked to trades. The move was underpinned in part by upbeat GDP growth data for Europe in the second quarter, in part by numbers showing a welcome return to profit by oil heavyweight BP PLC amid higher crude-oil prices. Corporate-bond traders took additional sector cues from a 10.7% gain in Rolls-Royce Holdings PLC shares, while Dutch chemical and pharma firm Royal DSM NV climbed 5.8%. Despite the previous trading sessions' gain in the materials group on stronger Chinese construction data, precious metal miner Fresnillo PLC pulled back 2.6%.

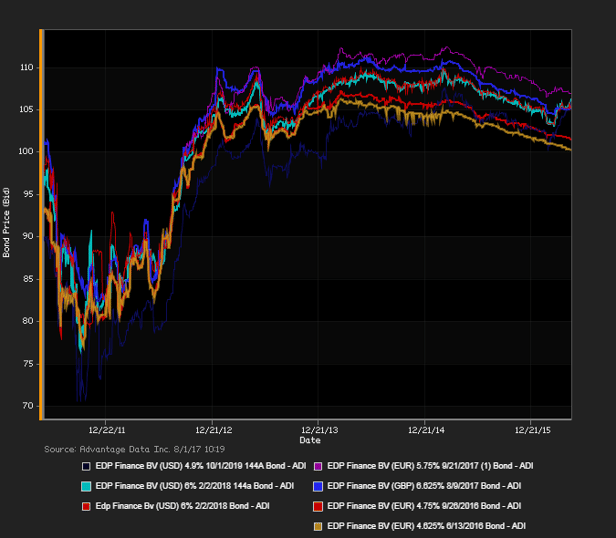

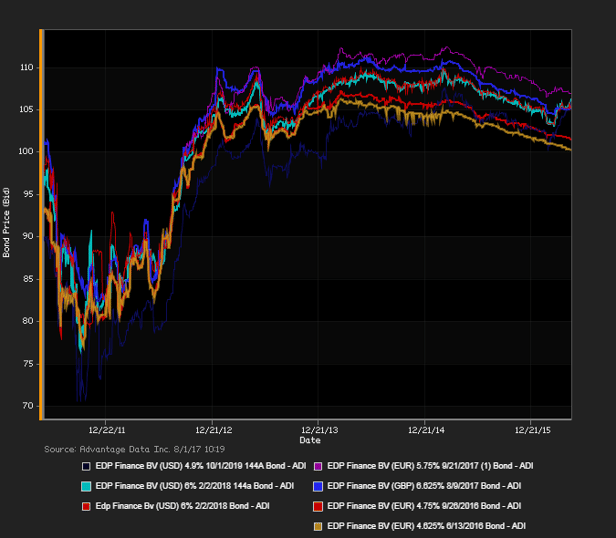

The shift out of yesterday's defensive bias was fed by multiple factors, chief among them a 0.6% rise in GDP in accord with estimates by several economists. Nordea Markets' Holger Sandte remarked that "The ECB expects solid, broad-based growth in the period ahead, and it’s pretty likely this will happen ... They will welcome these numbers but the focus will be on core inflation -- whether it picks up and how fast." Further reinforcing the upbeat picture were data showing fresh strength in Germany's labor market, as unemployment ramped down 9,000 in July, while those out of work remained at a record low 5.7%. Also supporting risk-on bias today were numbers showing strong second-quarter performance by oil giant BP PLC, while shares of Royal DSM NV added 5.6%, Rolls-Royce Holdings PLC were up 10.2%. ADI (Advantage Data Inc.) extensive corporate-bond index data showed a net daily yield increment for investment-grade versus high-yield constituents. High-yield bonds outpaced high-grade debt in net prices, as of 4 PM London time. Among European high-yield bonds showing a concurrence of top price gains at appreciable volumes traded, Intelsat Jackson Holdings SA 7.25% 10/15/2020 made some analysts' 'Conviction Buy' lists

.png)