European indices closed higher on Tuesday, rebounding from previous declines. Germany's monthly economic sentiment index came in below analysts projections on Tuesday, while the U.K. saw its first July surplus in 15 years and defied analysts' expectations of a £1 billion deficit. Fed Chair Janet Yellen and European Central Bank President Mario Draghi are both set to speak in Jackson Hole at the 2017 Economic Policy Symposium on "Fostering a Dynamic Global Economy" later this week.

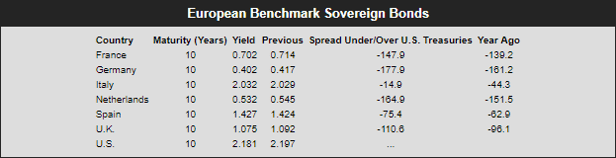

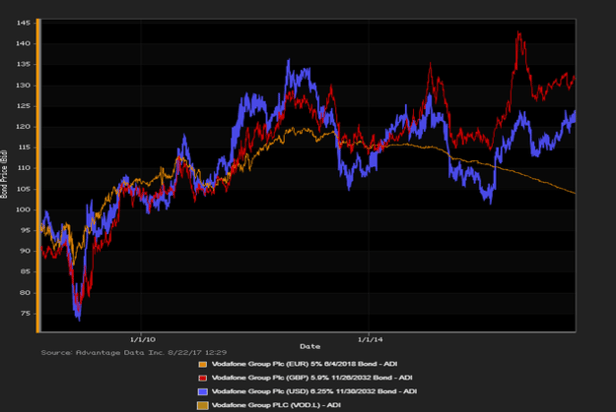

European indices closed higher on Tuesday, rebounding from previous declines. The pan-European Stoxx 600 ended the day up 0.8% with almost all sectors and major bourses in positive territory. The FTSE gained 0.86%, and the Dax jumped 1.35% as well with basic resources leading in gains after zinc prices hovered near decade-highs. Italian bond yields jumped after proposals to introduce a parallel currency in Italy added to political pressures. Italy's 10-year bond yield climbed 8 bp to a three-week high at 2.11%. Oil prices were higher on Tuesday as the U.S. commercial crude supply continues to tighten in an attempt to limit output and stabilize prices. U.S. commercial crude inventories have fallen by almost 13% from their March peaks, to 466.5 million barrels. Germany's monthly economic sentiment index came in below analysts projections, while the U.K. saw its first July surplus in 15 years and defied expectations of a £1 billion deficit. ADI (Advantage Data Inc.) extensive corporate-bond index data showed a net daily yield increment for investment-grade versus high-yield constituents. Investment-grade bonds outpaced high-yield debt in net prices linked to trades, as of 4 PM, London time. Among European high-yield bonds showing a concurrence of top price gains at appreciable volumes traded, Vodafone Group Plc (USD) 6.25% 11/30/2032 made some analysts' 'Conviction Buy' lists.

Sovereign-Debt Snapshot

Credit-Default Swap Market

LATEST NEWS: Top moves, daily sovereign tighteners (5Y): Finland 17 bp and Kazakhstan 142 bp. Daily sovereign wideners (5Y): Hong Kong 39 bp and U.K. 18 bp.

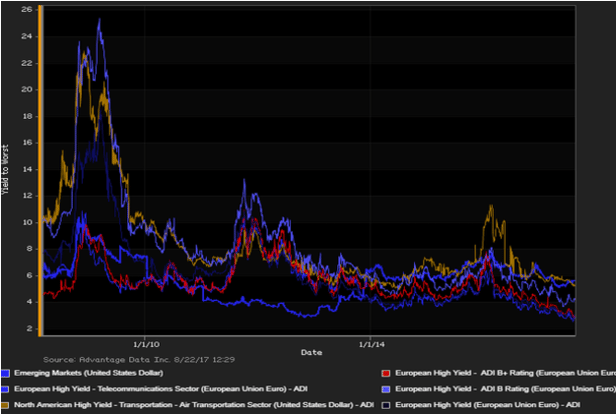

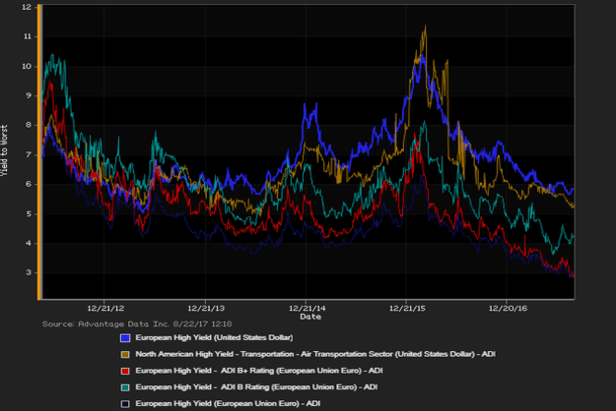

ADI Indexes

| iShares Core EUR UCITS | iShares Euro High Yield UCITS |

| NAV as of 8/21/2017, 130.15 | NAV as of 8/21/2017, 108.17 |

| Daily NAV Change (%) +0.01% | Daily NAV Change (%) +0.01% |

OVERALL EUROPEAN CREDIT MARKET:

The euro-zone economy shows some signs of improvement although beset by abnormally high unemployment in periphery nations, slow growth and a lack of consensus among leading officials as to how to resolve the region's long-standing debt crisis. CloseCutly watched indicators and rates:

- Eurostat's unemployment rate: currently 9.1% (June 2017)

- Eurostat's quarterly GDP: 0.6%, Q1 (Final Estimate)

- 6-month Euribor: current value -0.271%, as of 8/21/2017

- ECB main refinancing operations rate: 0.05%

.png)