SAFE-HAVEN BIDS ESCALATED, keeping European investment-grade bonds favored for much of the trading day. The higher-quality, lower-risk tiers of corporate debt easily outpaced junk bonds in net price gains linked to actual trades. Acute attention to global geopolitical and terrorism risk, stemming from U.S.-North Korean war rhetoric and an apparent terrorist act outside Paris, kept investors in a defensive state of mind. Gains in Scout 24 AG and Novo Nordisk A/S shares lifted Stoxx 600 equities initially, although the index remained mired in the red into afternoon London time.

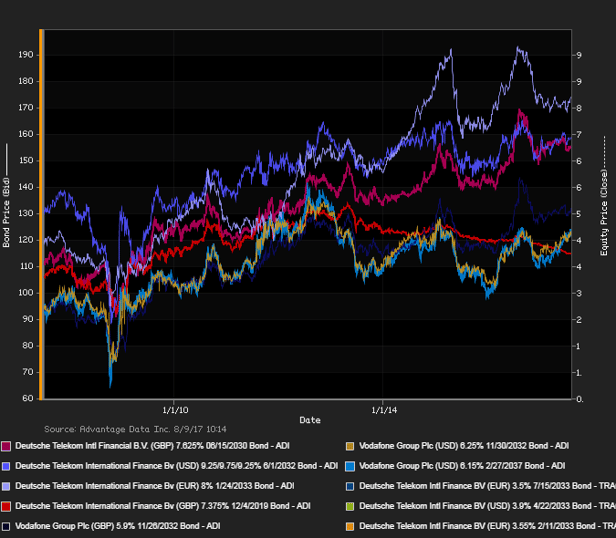

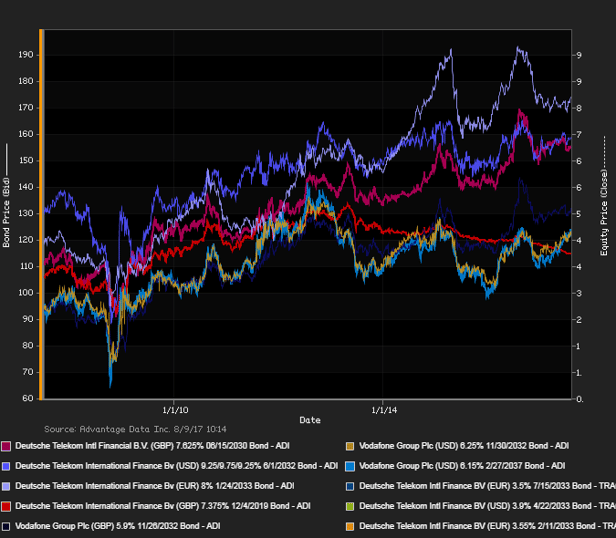

The prospect of increased global nuclear tensions led investors to rotate capital into traditional safe havens, particularly gold, the Swiss franc, and the Japanese yen. Accordingly low-risk government bonds and corporate bond in the gold mining group were among the few asset classes faring well today, as shares of Polymetal International PLC, Fresnillo PLC, and Rio Tinto PLC all stepped higher. Amid the nuclear sabre-rattling between the U.S. and N. Korea, analysts expressed concerns about the personalities behind the power; Pimco Europe's Geraldine Sundstrom remarked that "Given the nature of the threats, given the players are new, it makes the situation a little bit unusual." ADI (Advantage Data Inc.) extensive corporate-bond index data showed a net daily yield increment for investment-grade versus high-yield constituents. Investment-grade bonds easily outpaced high-yield debt in net prices linked to trades, as of 4 PM. Among European investment-grade bonds showing a concurrence of top price gains at appreciable volumes traded, Vodafone Group PLC 4.375% 2/19/2043 made some analysts' 'Conviction Buy' lists.

.png)