FAVOR FOR INVESTMENT-GRADE BONDS carried over from yesterday's session, even as stocks in Europe's bourses stepped higher amid strength in the oil-and-energy sector. Royal Dutch Shell PLC shares, up 4.2% as of 3:40 London time, lifted a range of related European oil firms' stock and junk debt as well, including those of Tullow Oil PLC, Total SA, and BP PLC. A degree of optimism in the banking sector stemmed from data showing encouraging stress tests for U.K. banks, although gains in this sector remained spotty amid pullbacks in Barclays PLC shares, off 0.7%, and Credit Suisse Group, off 0.52%, while Societe Generale added 0.75%. Meanwhile the mining and materials sectors remained under pressure as shares of Rio Tinto PLC, Glencore PLC, and BHP Billiton PLC shares all extended yesterday's pullbacks.

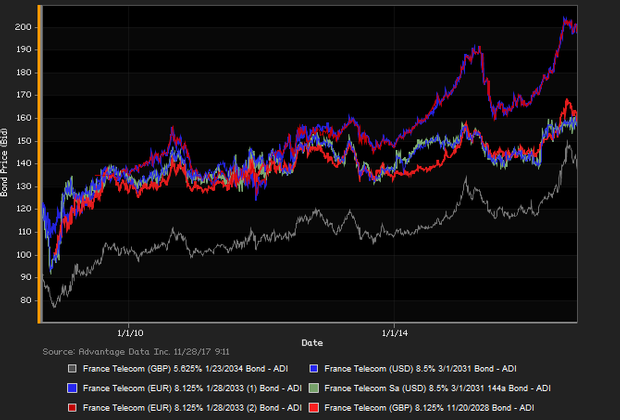

Overall risk-off sentiment prevailed among traders of European corporate debt, even as equities rebounded - although to a modest degree - from recent selloffs. The pan-European Stoxx 600 was lifted in part by gains in the oil-and-energy sector. A catalyst for some of these gains was to be found in news from Royal Dutch Shell PLC, whose shares advanced and led related stocks up (see notes above). Focus on capital requirements drew the attention of many investors, meanwhile, after results of BOE (Bank of England) stress tests hit the wires. Barclays PLC and Royal Bank of Scotland came in weakest among seven major banks tested, while the BOE noted "The combination of a disorderly Brexit, a severe global recession and stressed misconduct costs could result in more severe conditions than in the stress test." Of particular note, a 21% jump in Ocado Group PLC shares on M&A news lent additional sector cues. ADI (Advantage Data Inc.) extensive corporate-bond index data showed a net daily yield increment for high-grade versus high-yield constituents. High-grade bonds outpaced high-yield debt as of 4 PM London time. Among European investment-grade bonds showing a concurrence of top price gains, AstraZeneca PLC 2.375% 6/12/2022 made some analysts' 'Conviction Buy' lists. (See the chart for France Telecom bonds, above.)

.png)