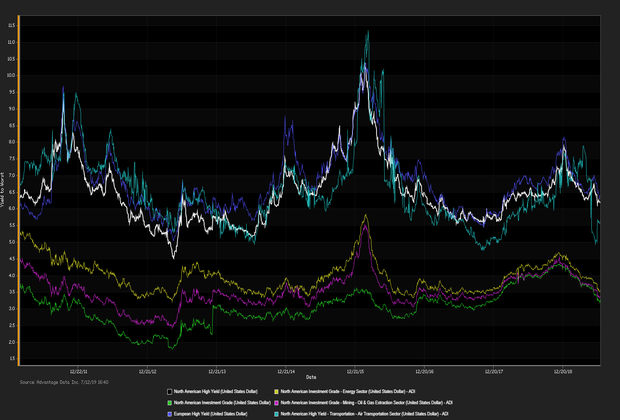

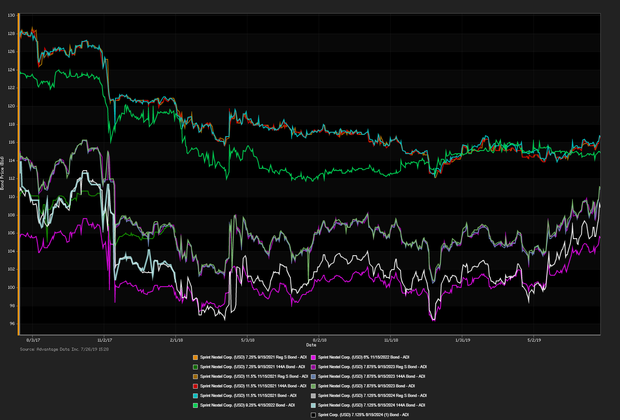

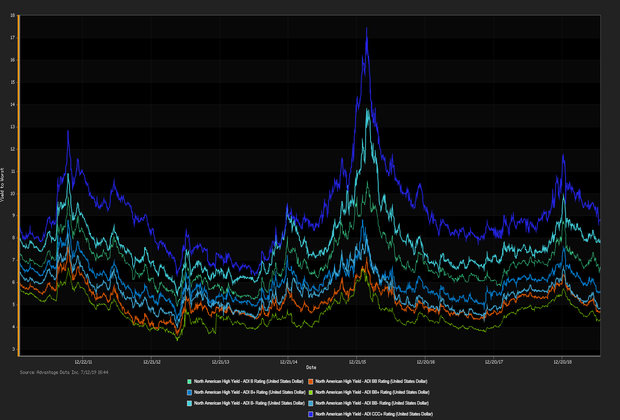

T-MOBILE AND SPRINT RECEIVE APPROVAL from the Department of Justice to continue with the merger of the two companies. Under the agreement, Sprint will have to divest its Boost Mobile and Virgin Mobile brands to Dish Network Corp. Subsequent to the agreement T-Mobile will not raise rates for at least three years and will increase 5G coverage to 97 percent of the U.S. population. ADI proprietary index data showed a net yield increment for high-grade versus high-yield bonds. High-yield edged out high-grade. Among high-yield bonds showing topmost price gains at appreciable volumes traded, Sprint Nextel Corp. (USD) 11.5% 11/15/2021 made analysts' 'Conviction Buy' lists. (See the chart for Sprint Nextel Corp. below.) Corey Mahoney

| Key Gainers and Losers | Volume Leaders | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

|

Sprint Nextel Corp. 7.875% 9/15/2023 Washington Prime Group LP 5.95% 8/15/2024 |

| Industry Returns Tracker | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| New Issues | Forward Calendar |

|---|---|

|

1. Mong Duong Finance Hldg BV (USD) 5.125% 5/7/2029 144A (07/25/2019): 678MM First Lien Notes, Price at Issuance 100, Yielding 5.13%. |

1. Sinclair Broadcast Group Inc.: $2.55B, seven-year senior secured notes; $2.325B eight year senior unsecured notes |

Additional Commentary

| Top Widening Credit Default Swaps (CDS) | Top Narrowing Credit Default Swaps (CDS) |

| Hertz Corp. (5Y Sen USD XR14) Hovnanian Enterprises Inc. (5Y Sen USD MR14) |

SuperValu Inc. (5Y Sen USD MR14) San Miguel Corp. (5Y Sen USD CR14) |

Loans and Credit Market Overview

Deals recently freed for secondary trading, notable secondary activity:

- Nascar Holdings Inc., NGPL Pipeco LLC, Whatabrands LLC, Electricite de France

- TED spread held below 16 bp (basis points), as of 07/26/19

- Net positive capital flows into high-yield ETFs & mutual funds

Copyright 2019 Advantage Data Inc. All Rights Reserved. http://www.advantagedata.com

Information in this document should not be regarded as an offer to sell or solicitation of an offer to buy bonds or any financial instruments referred to herein. All information provided in this document is believed to be accurate. However, Advantage Data and its sources make no warranties, either express or implied, as to any matter whatsoever, including but not limited to warranties of merchantability or fitness for a particular purpose. Opinions in this document are subject to change without notice. Electronic redistribution, photocopying and any other electronic or mechanical reproduction is strictly prohibited without prior written permission from Advantage Data Inc.

.png)