EQUITIES DRIFTED LOWER following an announcement from Federal Reserve President Jerome Powell stating “my colleagues and I are grappling with is whether these uncertainties will continue to weigh on the outlook and thus call for additional policy accommodation“. Currently Wall Street believes there is a 65.7 percent chance of a 25 basis point cut and a 35.4 percent chance of a 50 basis point cut. The 10-year note fell 2.8 basis points settling below 2 percent. S&P -0.95%, DOW -0.67, NASDAQ -1.51%.

CONSUMER CONFIDENCE SLIPS TO A TWO-YEAR LOW IN JUNE amid rising trade tensions with China revealing a jolt among consumer. Despite the fall in confidence,

spending remains strong suggesting short term uncertainty with consumers; the index

declined to 121.5 from May’s reading of 131.5. Newly built

home sales suddenly dropped 7.8 percent in May despite a deterioration in mortgage rates making home ownership more appealing.

Pacific Gas & Electric bondholders propose a bankruptcy exit plan involving an

injection worth $30 billion to pay off obligations from the devastating wildfires. Bondholders claim PG&E is taking its time to action a plan and

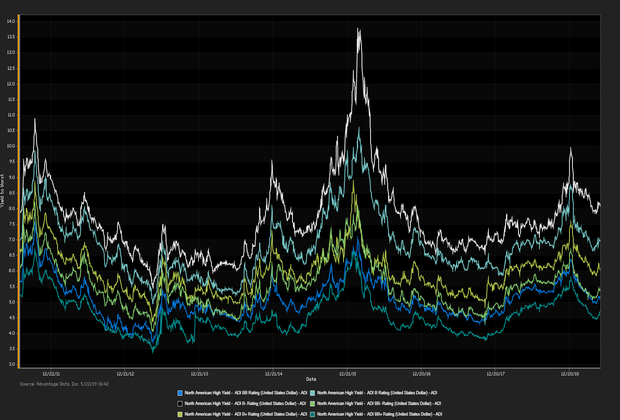

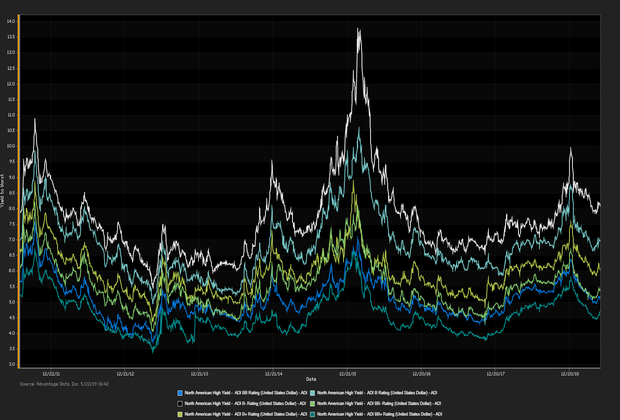

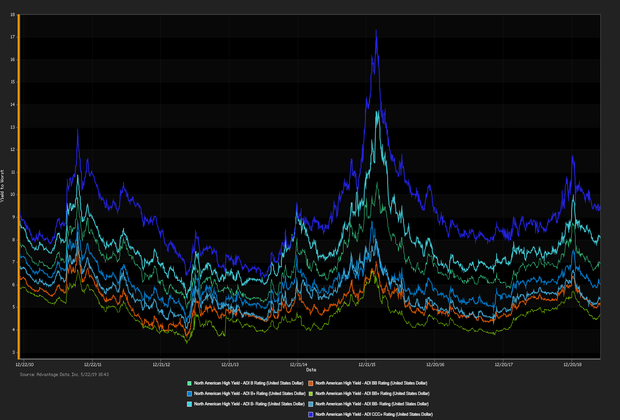

“the need to exit bankruptcy expeditiously is paramount”. ADI proprietary index data showed a net

yield increment for high-yield versus high-grade bonds. High-grade edged out high-yield. Among high-grade bonds showing topmost price gains at appreciable volumes traded,

American International Group Inc. (USD) 8.175% 5/15/2068 made analysts' 'Conviction Buy' lists. (See the chart for

ADI Indices above.)

Corey Mahoney (

cmahoney@advantagedata.com).

| Key Gainers and Losers |

Volume Leaders |

| + |

Pacific Gas & Electric Co. 6.25% 3/1/2039 |

+ 5.9% |

| |

Tenet Healthcare Corp. 8.125% 4/1/2022 |

+ 0.2% |

| - |

CNO Financial Group 5.25% 5/30/2025 |

-0.1% |

|

HCA Inc. 7.5% 2/15/2022

|

| Industry Returns Tracker |

| Industry |

Past Day |

Past Week |

Past Month |

Past Quarter |

YTD |

Past Year |

| Agriculture, Forestry, Fishing |

-0.13% |

2.14% |

5.83% |

4.78% |

11.64% |

13.39% |

| Mining |

0.09% |

1.67% |

-0.24% |

0.11% |

7.57% |

2.33% |

| Construction |

-0.10% |

0.77% |

2.27% |

4.25% |

10.24% |

7.94% |

| Manufacturing |

-0.04% |

0.88% |

1.60% |

2.33% |

8.82% |

6.74% |

| Transportion, Communication, Electric/Gas |

0.05% |

1.09% |

2.45% |

3.87% |

10.00% |

9.30% |

| Wholesale |

0.05% |

0.93% |

2.27% |

3.35% |

10.27% |

7.31% |

| Retail |

0.02% |

0.72% |

1.87% |

4.92% |

12.09% |

8.64% |

| Finance, Insurance, Real-Estate |

0.10% |

0.92% |

2.03% |

3.06% |

9.93% |

9.11% |

| Services |

-0.03% |

0.74% |

2.00% |

3.39% |

9.85% |

8.34% |

| Public Administration |

0.22% |

0.63% |

1.77% |

3.27% |

9.32% |

14.54% |

| Energy |

0.13% |

1.69% |

-0.30% |

0.17% |

7.40% |

2.15% |

| |

| Total returns (non-annualized) by rating, market weighted. |

|

| New Issues |

Forward Calendar |

|

1. Herc Hldg, Inc. (USD) 5.5% 7/15/2027 144A (06/25/2019): 1200MM Senior Unsecured Notes, Price at Issuance 100, Yielding 5.5%.

2. Post Holdings Inc. (USD) 5.5% 12/15/2029 144A (06/25/2019):750MM Senior Unsecured Notes, Price at Issuance 100, Yielding 5.5%.

|

1. Hexion Inc. : $450MM, Week of 6/24

2. E.W. Scripps: $1.85B term loans and unsecured debt, Expected Q2 2019

|

Additional Commentary

NEW ISSUANCE WATCH: on 6/25/19 participants welcome a $300MM new corporate-bond offering by William Lyon Homes The most recent data showed money flowed out of high-yield ETFs/mutual funds for the week ended 6/21/19, with a net outflow of $602MM, year-to-date $8.9B flowed into high-yield.

| Top Widening Credit Default Swaps (CDS) |

Top Narrowing Credit Default Swaps (CDS) |

Rite Aid Corp. (5Y Sen USD XR14)

Hertz Corp. (5Y Sen USD XR14) |

Cable & Wireless Communication (5Y Sen USD CR14)

SuperValu Inc. (5Y Sen USD MR14) |

Loans and Credit Market Overview

SYNDICATED LOANS HIGHLIGHTS:

Deals recently freed for secondary trading, notable secondary activity:

- Vici Properties LLC, Vidrala SA, Hilton Worldwide Finance LLC, US Renal Care Inc.

OVERALL CREDIT MARKET:Long-term bond yields are expected to hit a cyclical peak in 2019 given tight fiscal policy and lagging global economies. Europe remains checked by stubbornly low inflationary forces. Positive effects remained in force:

- TED spread held below 23 bp (basis points), as of 06/25/19

- Net positive capital flows into high-yield ETFs & mutual funds

Copyright 2019 Advantage Data Inc. All Rights Reserved. http://www.advantagedata.com

Information in this document should not be regarded as an offer to sell or solicitation of an offer to buy bonds or any financial instruments referred to herein. All information provided in this document is believed to be accurate. However, Advantage Data and its sources make no warranties, either express or implied, as to any matter whatsoever, including but not limited to warranties of merchantability or fitness for a particular purpose. Opinions in this document are subject to change without notice. Electronic redistribution, photocopying and any other electronic or mechanical reproduction is strictly prohibited without prior written permission from Advantage Data Inc.

.png)