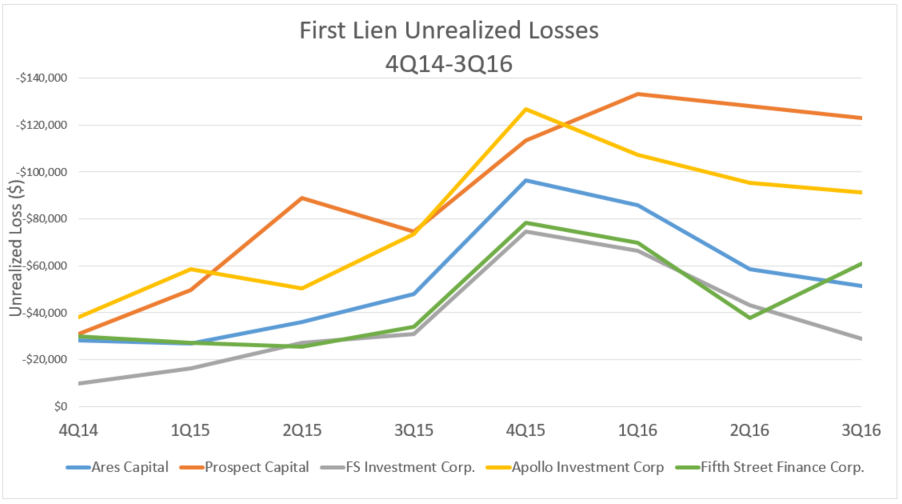

BDC Unrealized Losses and Percentage Loss - First Liens

Looking at the 5 largest public externally managed BDCs by AUM, first lien loans comprise over $9.8 billion or nearly 40% of their holdings as of 3Q16. The health of these loans is a potential indicator of overall BDC well-being given they are by nature the least risky investments they make.

Unrealized losses may reverse when credit markets improve or may become realized losses if they are a predictor of future credit problems. BDC fair values for 4Q15 would have been established in the middle of the market freeze in 1Q16, and the mood at that time is certainly reflected in first lien unrealized losses and percentage loss at that time.

Improving credit sentiment in 2Q16 is also depicted in unrealized losses at 1Q16 in all but Prospect Capital which experienced a continued increase for the quarter before finally leveling off.

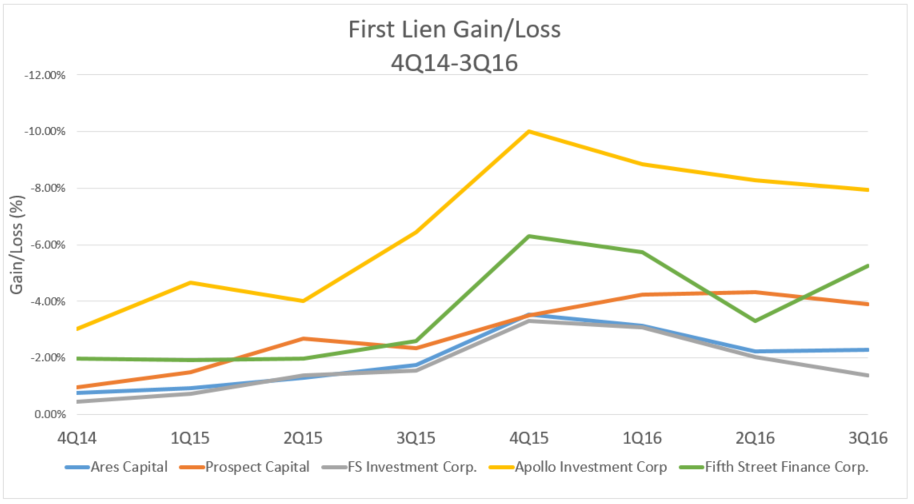

From a percentage loss perspective, at 3Q16 the average market weighted percentage loss for this group of 5 BDCs first liens was 3.6% vs. Apollo at the high end with 7.9% and FS at the low end with 1.4%.

At 3Q16, Fifth Street was the only BDC of the group that increased its percentage loss moving from 3.3% to 5.2%.

Earnings season awaits us...

To view more reports and analytics about BDCs and the Middle Market, request a free trial to AdvantageData.

.png)