Loan market participants enter 2019 looking back at a miserable December. Senior secured loans traded off the most since early 2016. BB-rated loans were trading below $96.00 for the first time in the three-year span and nearly all loans fell below par.

Recent Posts

Topics: Loans, Middle Market, Analytics, BDC, market analytics, business development company, BDC Filings, Fixed Income

Primary market yields on first lien middle market loans rose to their highest levels since Q1 2017 with increases in each quarter of 2018. This movement was driven heavily by the steady increase in LIBOR of over 100 bps throughout the year along with modest increases in coupon spread, most notably in the fourth quarter. First and second lien coupon spreads widened 35 and 33 bps respectively in the quarter, marking the largest quarterly spread widening in 2 years.

Topics: Loans, Middle Market, Analytics, market analytics, Fixed Income, download, research

One Step Ahead: Identifying Distress In The Middle Market

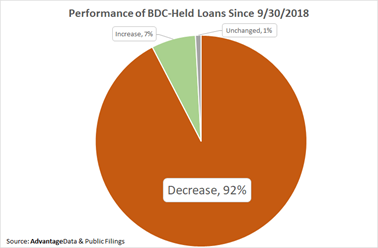

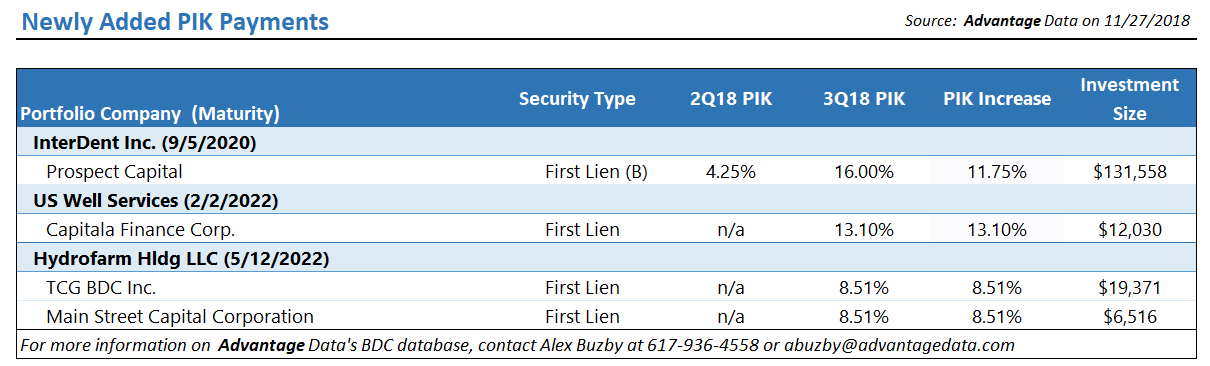

Analyzing PIK and Coupon Spread changes can be a great way to identify middle market companies that are beginning to feel pressure from lenders. Whether you're sourcing investments, consulting distressed borrowers or analyzing BDCs, utilizing alternative signs of distress as leading indicators is a great way to get ahead of the market - Download the data sample below!

Topics: Middle Market, BDC, Spreads, First Lien, Distressed Investments, debt, business development company, Distress, Distressed Debt, Finance, Restructuring, Fixed Income, download

The Hunt For Data: Middle Market and Illiquid Loan Valuation

Even in markets where established data infrastructure is limited, such as syndicated loans, reliable sources of data that are indicative of a liquid security’s value are available through market data vendors and broker quotes. When evaluating illiquid securities like middle market or directly originated loans, the effort of data aggregation becomes much more difficult and is often assumed to be an exercise in futility. We would disagree.

Topics: Loans, Middle Market, BDC, business development company, Valuation, Fixed Income, illiquid, download, Direct Lending, syndicated

Comparing quarterly filings, fund breakdowns and more...

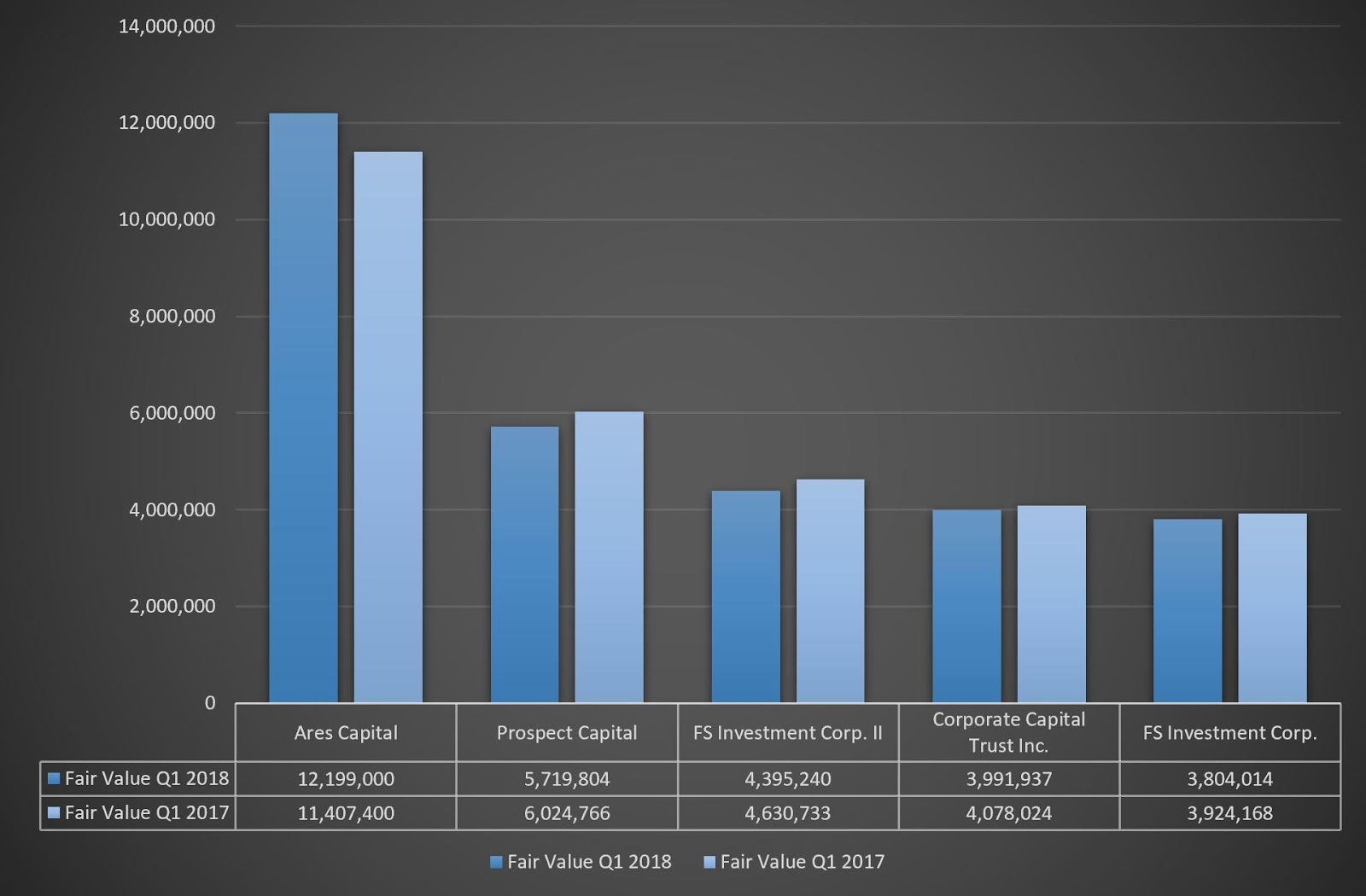

After the 2008 financial crisis and the subsequent regulatory changes, Business Development Companies (BDCs) skyrocketed in popularity, filling the funding gap in middle market companies. BDCs are closed-end funds that mostly invest in private, growing companies and, increasingly, larger later stage corporations.

BDCs are required to file quarterly reports to the SEC under the Investment Company Act of 1940. Aggregating the data from these reports is tedious, time-consuming, and lacks standardization. AdvantageData’s BDC Product gives investment professionals access to aggregated and standardized data (current and historical), allowing users to easily analyze data relevant to their firm's needs.

Topics: Middle Market, BDC Index, Analytics, BDC, AUM, market analytics, business development company, BDC Filings, Fixed Income

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)