JUNK BONDS REGAINED A SLIGHT EDGE over less-risky investment-grade debt, as stocks in Europe's bourses took a turn to the upside. The pan-European Stoxx 600 index reflected a string of gains among European equities, driven mainly by dovish comments from Mario Draghi, chief of the ECB (European Central Bank). In a more-or-less expected stance, Draghi pledged to move cautiously in scaling back stimulus measures, sending the euro lower and putting many investors in risk assets in a good mood. Corporate-bond traders took cues from early gains in Spanish banks, with Banco Sabadell SA shares up 4.7% at one point, BBVA up 3%, while Nokia Corp. was off over 17% as of 5 PM London time.

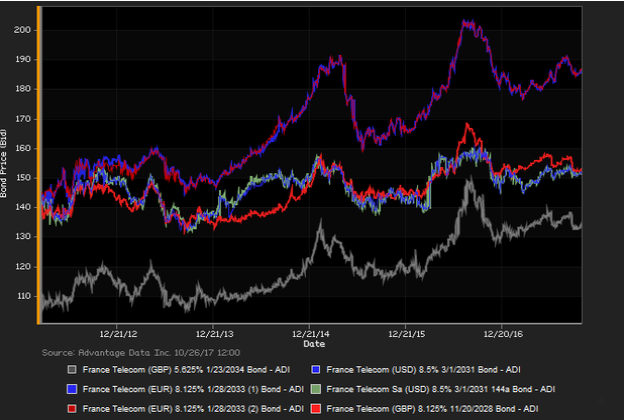

Sentiment showed slight favor for risk-on trades, leading high-yield bonds to outpace investment-grade securities in net price gains. Dovish statements from ECB chief Mario Draghi prevailed over less supportive factors on the European trading front. The latter included a 1.3% pullback in shares of Deutsche Bank AG, whose reported gains in third quarter profit was not sufficient to charm investors; Barclays PLC shares also tanked value, reporting a 5% year-on-year drop in revenue. Meanwhile stocks and junk bonds in the telecom sector took a hit on an 18% plunge in Nokia Corp. shares after reports of quarterly losses growing to 183 million euros. However, assurances of further accommodation from the ECB's Draghi supported a band of risk-on traders; TS Lombard's Ken Wattret noted, "The door is left open to extend the asset-purchase program yet again." Spain's banks (see note above) fluctuated higher initially on indications of a snap-election vote by Catalonians, although the vote was reportedly cut short. ADI (Advantage Data Inc.) extensive corporate-bond index data showed a net daily yield increment for investment-grade versus high-yield constituents. High-yield bonds outpaced investment-grade debt in net prices, as of 4 PM London time. Among European high-grade bonds showing a concurrence of top price gains at appreciable volumes traded, Barclays PLC 4.375% 9/11/2024 made some analysts' 'Conviction Buy' lists. (See chart for France Telecom bonds, above.) M. F. Brown mbrown@advantagedata.com

.png)