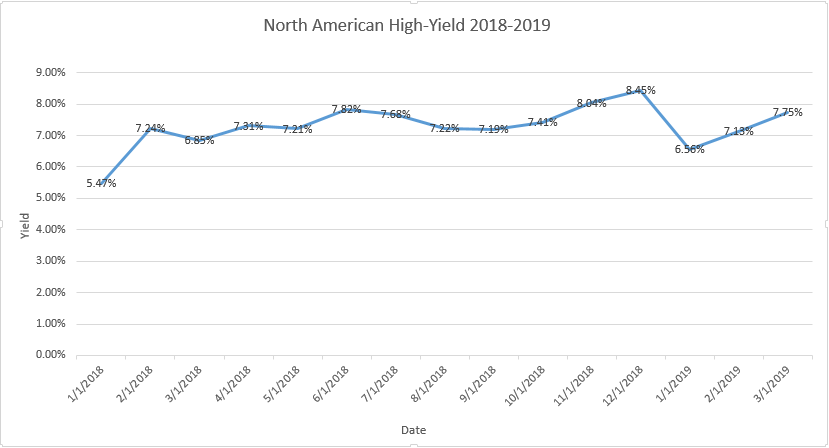

The new year has brought new growth to the High Yield space as average yield for North American High Yield new issues has steadily increased month over month.

Yields on the Rise for North American High Yield

The new year has brought new growth to the High Yield space as average yield for North American High Yield new issues has steadily increased month over month.

Topics: High Yield, bonds, junk bonds, bond market

Fed announces fourth rate hike of 2018, markets react

On Monday, President Trump criticized the Fed for even considering raising rates, yet on Wednesday the Federal Open Market Committee announced its decision to raise the Fed Funds rate ¼ of a percent from 2.25% to 2.5% -- the fourth such increase in 2018.

Topics: High Yield, Analytics, bonds, junk bonds, market analytics, New Issues, Finance, Equity, Fixed Income, News

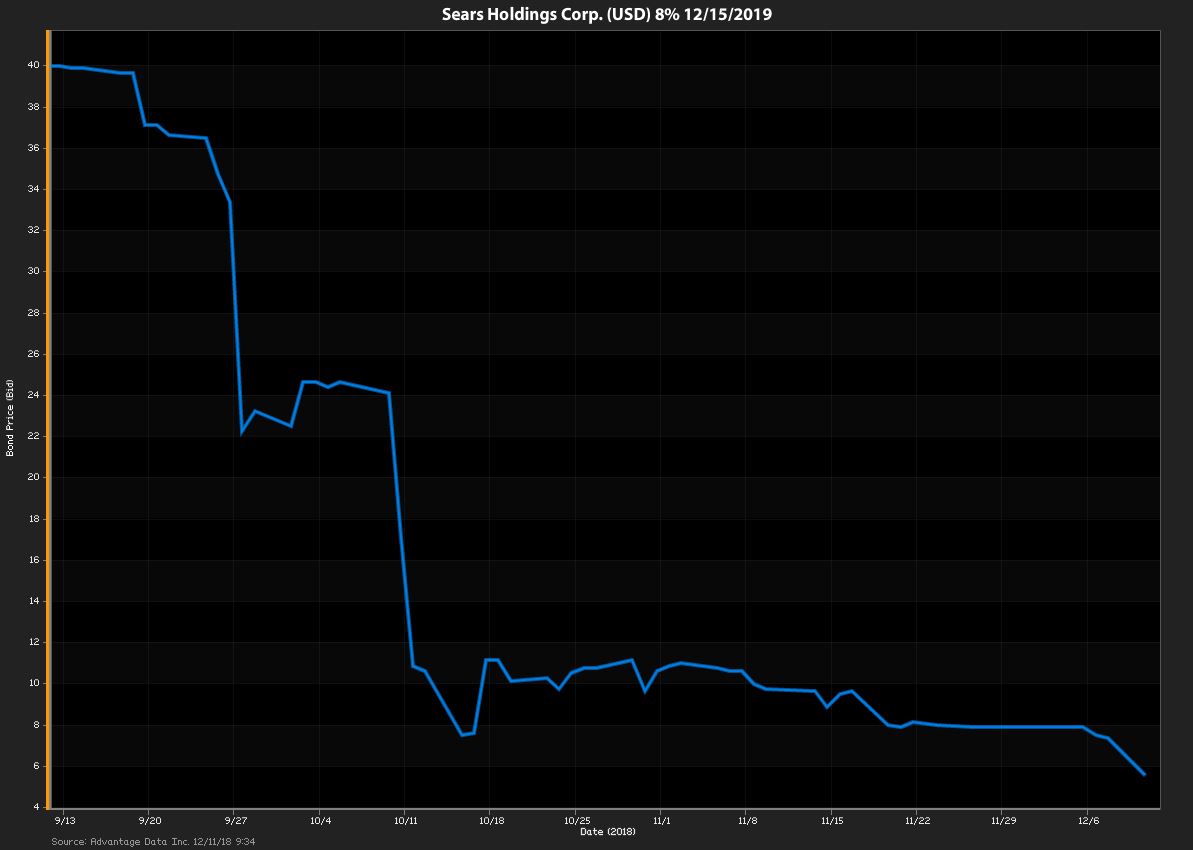

Sears CEO Places Hail Mary Bid to Save Company, And His Wallet

Sears CEO, Edward Lampert stands to lose a fortune if SEARS Holdings Corp. goes under. Analysts increasingly predict that will indeed be the case.

Topics: High Yield, bonds, Losers, Restructuring, sears, Fixed Income, News, bankruptcy

Many reports are claiming the death of Sears, but is it really dead or just dead as we knew it?

Sears started life in 1892 as a mail-order catalog that sold watches and jewelry. In 1894 the Sears, Roebuck and Company catalog had grown to 322 pages and included sewing machines, bicycles, sporting goods, automobiles and other new items. In the following years the catalog would eclipse 500 pages and adding dolls, stoves and groceries.

Topics: Loans, bonds, Distressed Debt, Restructuring, sears, News, default, bankruptcy

Download: LFI BDC Portfolio News 9-10-18

As promised, loan arrangers rolled out a big September calendar of M&A deals brimming with new money seeking to take advantage of the late-August lull and a favorable funds flow picture following the busiest month for CLO issuance since March 2015. High-yield, too, kicked back into high gear, driven in part by coordinated cross-border deals for some of the same issuers currently being reviewed by loan accounts, while restructurings drove some of last week’s lively secondary action.

Loan investors are kicking the tires on a trio of large M&A deals that will set the tone for the market in the coming weeks not only for the other transactions already launched but also for those to come later this month. Traders, too, are awaiting clearing levels on these jumbo deals—which are being talked wide of where single-B executions printed earlier in the year—as well as to see how the market absorbs the supply once these deals allocate.

Topics: Middle Market, BDC, bonds, market analytics, Fixed Income, portfolio, LevFin Insights, News

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)