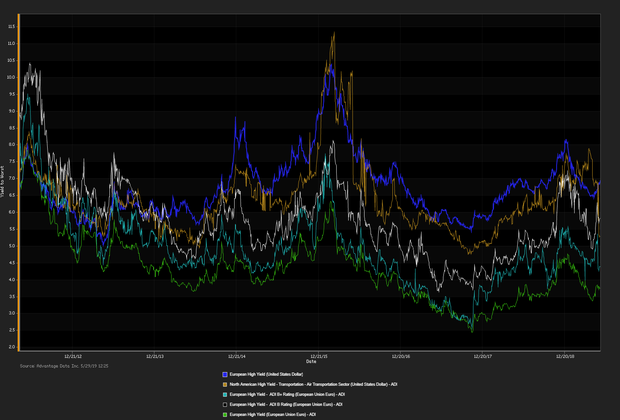

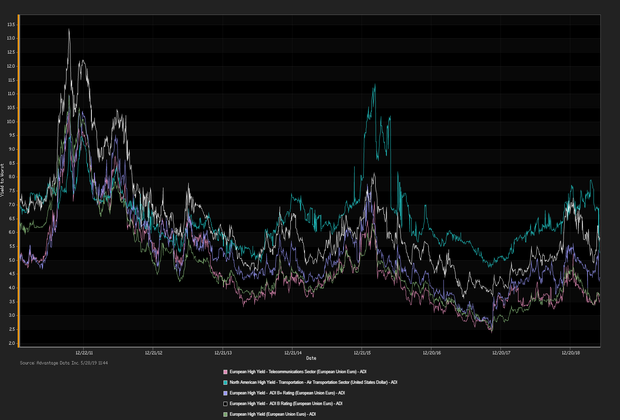

GERMAN CONSUMER CONFIDENCE SINKS amid concerns automotive manufactures will lay off thousands as Germany becomes entangled in trade tensions. Europe’s largest economy is showing signs of weakness despite record high employment. Economists fear the manufacturing slowdown could taint the robust service sector and strong labor market. “If the significant loss suffered by this indicator in June turns into a persistent downward trend, it will also be tough for propensity to buy to maintain its currently excellent level.” ADI (Advantage Data Inc.) extensive corporate-bond index data showed a net daily yield increment for high-yield versus high-grade constituents. High

Credit-Default Swap Market

New Issuance

| New Issues | New Issues [Continued] |

|---|---|

|

1. Medtronic Global Holdings S.C.A. (EUR) 0.25% 7/2/2025 (06/25/2019): 1000MM Senior Unsecured Notes, Price at Issuance 99.372, Yielding .356%. 2. BNP Paribas (EUR) 1.625% 7/2/2031 (06/25/2019): 1000MM Subordinated Notes. |

|

ADI Indexes

| iShares Core EUR UCITS | iShares Euro High Yield UCITS |

| NAV as of 06/26/2019, 133.89 | NAV as of 06/26/2019, 104.59 |

| Daily NAV Change (%) -0.08% | Daily NAV Change (%) -0.02% |

OVERALL EUROPEAN CREDIT MARKET:

The euro-zone economy shows signs of positive momentum, although conditions are expected to deteriorate hindered by the termination of quantitative easing, weakening credit rating quality, and uncertainty regarding the outcome of Brexit. Closely watched indicators and rates:

- Eurostat's unemployment rate: currently 7.7% (seasonally adjusted, March 2019)

- Eurostat's quarterly GDP: 0.4% (2019 Q1)

- 6-month Euribor: current value -0.311%, as of 06/25/2019

Copyright 2019 Advantage Data Inc. All Rights Reserved. http://www.advantagedata.com

Information in this document should not be regarded as an offer to sell or solicitation of an offer to buy bonds or any financial instruments referred to herein. All information provided in this document is believed to be accurate. However, Advantage Data and its sources make no warranties, either express or implied, as to any matter whatsoever, including but not limited to warranties of merchantability or fitness for a particular purpose. Opinions in this document are subject to change without notice. Electronic redistribution, photocopying and any other electronic or mechanical reproduction is strictly prohibited without prior written permission from Advantage Data Inc.

.png)