SOVEREIGN YIELD CURVE

in Europe have by and large fallen. The continued march of EU’s to go negative pressed on today.

FTSE 100 -0.41%,

German DAX -1.31%,

CAC 40 -1.16%,

STOXX Europe 600 -0.82%. The

10-year Gilt lost 3.1 basis points.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

FRENCH INDUSTRIAL OUTPUT FELL

2.3 percent month-over-month the fastest pace in over a year, a

significant reduction

in petroleum manufacturing caused the drop.

Germany’s exports slightly declinedin June as imports rose for the first time in three months.

FTSE 100 -0.41%,

German DAX -1.31%,

CAC 40 -1.16%,

STOXX Europe 600 -0.82%. The

10-year Gilt lost 3.1 basis points.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

EUROPEAN EQUITIES CONTINUE TO TUMBLE

ON MONDAY as the Chinese yuan breached the critical 7 per dollar level for the first time in a decade.

“The fact that they have now stopped defending 7.00 against the dollar suggests that they have all but abandoned hopes for a trade deal with the U.S.”Analysts suspect China is

controlling its currency as retaliation

for recent plans by the US to hike tariffs an additional 10 percent.

FTSE 100 -2.71%,

German DAX -1.93%,

CAC 40

-2.27%,

STOXX Europe 600-2.43%. The

10-year

Gilt lost 3.6 basis points.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

EUROPEAN INDICES PLUNGE

after a statement from the U.S. indicating an additional

10 percent in tariffs on Chinese goods

ending a brief trade truce. Asian and U.S. markets were also trading lower on the announcement.

Oil futures tumbled

more than 7 percent overnight marking the

largest drop in four years

before recovering losses.

FTSE 100 -2.38%,

German DAX -3.04%,

CAC 40-3.39%,

STOXX Europe 600

-2.47%. The

10-year

Gilt slipped 4.3 basis points.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

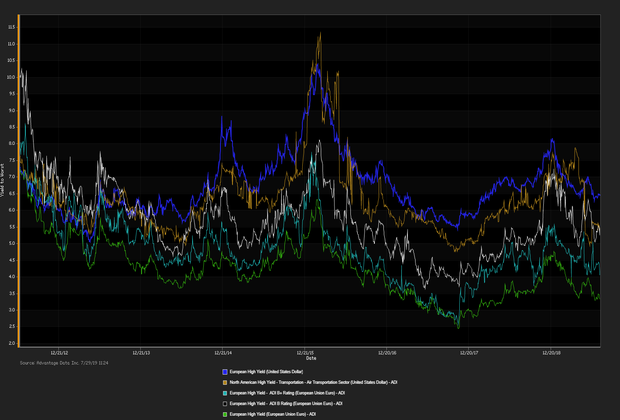

EUROPEAN INVESTMENT GRADE DEBT ROSE AGAINST JUNK BONDS

in net prices linked to actual trades. The Bank of England further

slashed its growth forecasts citing

Brexit is impacting the economy more than initially anticipated.

The bank gave no indication of a rate cut

as central bank globally are cutting rates most recently the

US Federal Reserve lowered rates by 25 basis points.

FTSE 100 -0.14%,

German DAX +0.38%,

CAC 40

+0.59%,

STOXX Europe 600

+0.38%. The

10-year

Gilt lost 2.6 basis points.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

EURO ZONE GDP GREW BY A DISMAL 0.2 PERCENT during the second quarter of 2019 down from 0.4 percent during the first three months of 2019.

Slowing GDP across the euro zone

strengthens a case for the European Central Bank to initiate additional monetary easing.

“We expect the ECB to respond to this broad-based economic weakness – which we think is likely to continue – with a round of extra policy easing, including restarting QE and cutting rates.”

FTSE 100 -0.81%,

German DAX +0.39%,

CAC 40+0.27%,

STOXX Europe 600

+0.18%. The

10-year

Gilt lost 1.1 basis points.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

EUROPEAN INVESTMENT GRADE BONDS ROSE against its high yield counterparts in net prices linked to actual trades. Euro zone economic

sentiment further declined

in July

indicating a

deteriorating economy supporting European Central Bank President Mario Draghi case for

monetary easing. The pound

dips to a 28-month low

meanwhile the dollar held near two-month high.

FTSE 100 -0.50%,

German DAX -2.38%,

CAC 40

-1.83%,

STOXX Europe 600

-1.60%. The

10-year

Gilt lost 2.1 basis points.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

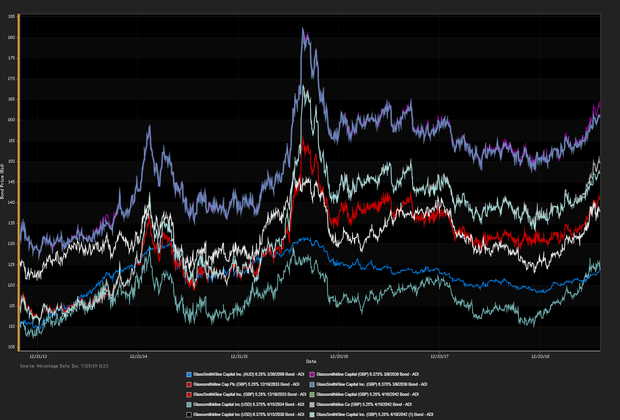

FRENCH PHARMACEUTICAL GIANT SANOFI RALLIED ON MONDAY following revised full-year earnings guidance suggesting 5 percent growth, the

stock

advanced 2.31 percent

.

Sanofi bonds

also traded notably higher in particular,

Sanofi (EUR) 1.25% 3/21/2034.

The growth was driven by the launch of a new brand Dupixent, in addition,

“Our increased focus in R&D delivered important results with several positive data read-outs and the achievement of regulatory milestones.”

FTSE 100 +1.87%,

German DAX +0.06%,

CAC 40

-0.06%,

STOXX Europe 600

+0.18%. The

10-year

Gilt lost 3.6 basis points.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

EUROPEAN JUNK BONDS SLIGHTLY edged out investment-grade debt in net prices linked to actual trades following a day after the

European Central Bank’s

decision

to hold interest rates. ECB President

Mario Draghi

said the economic outlook is

“getting worse and worse”

referring to manufacturing dragging the economy lower.

FTSE 100 +0.81%,

German DAX +0.44%,

CAC 40 +0.55%,

STOXX Europe 600+0.31%. The

10-year

Gilt lost 1.9 basis points.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

THE EUROPEAN CENTRAL BANK SIGNALED FOR ADDITIONAL MONETARY EASING in the months ahead resuming its

mass bond-buying program

in November. TD Securities Analysts say, The ECB

“is clearly preparing for a package of policy easing in September.” Negative interest rates have

rippled across Europe offering investors no incentives to purchase sovereign bonds.

FTSE 100 -0.20%,

German DAX -1.61%,

CAC 40

-0.82%,

STOXX Europe 600

-0.82%. The

10-year

Gilt advanced 2.1 basis points.

Read More

Topics:

Analytics,

bonds,

junk bonds,

bond market,

corporate bonds,

market analytics,

New Issues,

News,

research,

EU,

market update,

European

.png)