Allied Universal to widen margin on most 1L debt; existing holders include BDVC, OCSL

Bifurcated market conditions continued to reign in new-issue loans despite modest deal flow and a panoply of deal revisions that reflect the challenging nature of the current calendar; in the month to date B3 issuers comprise 44% of rated volume, the highest percentage since December. Bonds charged forward with a bunch of refi-related prints tight to talk, but the two buyout financings met some inevitable pushback on issuer-friendly terms.

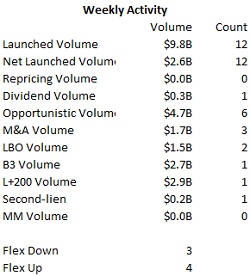

With few new M&A loans rolling out, issuers pushed forward with renewed opportunistic activity last week, largely refinancing related. Bolstered by a $2.72 billion refinancing effort from Allied Universal, opportunistic activity accounted for $4.7 billion of the week’s $9.8 billion of launches from 12 issuers, while net new money on offer shrank to just $2.6 billion.

Download: LFI BDC Portfolio News 6-17-19

Portfolios in brief: Holds reflect most recent reporting period available

Audax, BDCV, OCSL, Crescent, OHAI: Allied Universal (B3/B-/B) — refi

A Credit Suisse-led arranger group set price talk of L+400-425, with a 0% floor and a 99 OID on the $2.72 billion first-lien term loan strip for Allied Universal. The seven-year loan would include six months of 101 soft call protection. The covenant-lite loan is split between a $2.52 billion funded tranche and a $200 million delayed-draw component. The latter would be available for 12 months; a ticking fee of half the margin would kick in 46 days post-closing, rising to the full margin on day 91. The term loan is part of a broader refinancing effort for the security services provider that investors are being told also will entail $500 million of senior secured notes and $1.05 billion of unsecured notes. The capital structure would also include a $300 million revolver. Pro forma leverage runs 4.7x through the first-lien debt and 6.3x on a total basis. Commitments are due by 5 p.m. ET Wednesday, June 26. The issuer’s existing term debt due July 2022 is split between a $2.189 billion tranche (L+375) and an $800 million incremental loan (L+425). The company was last in market in October with the $800 million incremental term loan, proceeds of which, along with a privately placed $210 million second-lien term loan and $200 million of equity, were used to back the company’s acquisition of U.S. Security Associates from Goldman Sachs. The existing capital structure also includes $500 million of privately placed second-lien notes. Holders of the company’s existing L+375 debt include Business Development Corp. of America with $15M in principal amount and Oaktree Specialty Lending Corp. with $9.8M. Audax Credit BDC holds $2M of the incremental debt. Holders of the 2L debt due July 2023 (L+850) include Crescent Capital BDC with $750,000, Oaktree Specialty Lending Corp. with $1.15M and OHA Investment Corp. with $1.25M.

BBDC, ARCC, BCSF: U.S. Anesthesia Partners (B2/B) — add-on, M&A, repayment

A Goldman Sachs-led arranger group set a 99-99.5 offer price on the $200 million add-on first-lien term loan for U.S. Anesthesia Partners to fund acquisitions and repay revolver borrowings. The financing would be fungible with the issuer’s existing covenant-lite first-lien term loan facility due June 2024 (L+300, 1% floor). Goldman Sachs is the administrative agent. Commitments are due on Monday, June 17. In addition to the left lead Goldman Sachs, bookrunners include Barclays, J.P. Morgan, Morgan Stanley, BMO Capital Markets, Capital One and Antares. U.S. Anesthesia was last to market in November when it completed a $275 million add-on term loan, which funded a dividend. Meanwhile, the issuer in January 2018 repriced and upsized the first-lien term loan due June 2024 to $1.35 billion. Barings BDC $13.69M of the existing 1L debt. Ares Capital holds $71.8M of the company’s 2L debt due June 2025 (L+725), and Bain Capital Specialty Finance holds $16.52M.

Download LFI BDC Portfolio News 6-17-19 for BDC investment details provided by Advantage Data; click through links to view stories by LFI.

thomas.dunford@levfininsights.com

212.205.8552

.png)