Edgewood Partners, GoodRx adding to term debt; existing holders include AB Private Credit, SUNS, OCSI, OCSL

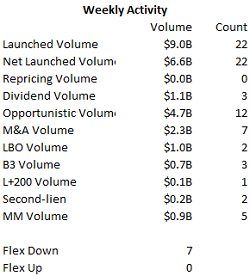

Last week’s loan market largely offered more of the same — more pushback on aggressive terms on sponsored M&A transaction and more opportunistic business with an emphasis on maturity extension — though late in week, issuer-friendly revisions on a string of well-known credits suggested that in the absence of a big uptick in volume, the market may be turning their way for all but the most challenging transactions. Bonds offered a mixed bag across ratings and purposes, but the themes were clear: oversubscribed offerings and strong performance on the break.

Read More

Topics:

High Yield,

Analytics,

BDC,

market analytics,

business development company,

LevFin Insights,

News,

research

Belk to extend maturity on 1L credit held by OCSL, Guggenheim and FSK-related entities; BDVC holds debt targeted for refi by Blackboard

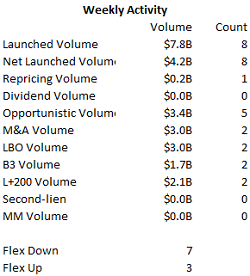

A more stable secondary helped move loan transactions across the goal line and even tighten terms, but the holiday-shortened week proved to be another grind as many transactions continued to lag, driving multiple rounds of changes as underwriters chased investor dollars. Flex activity, at least officially, was even at four each tightening and widening, though the undercurrent among deals in process favors investors.

Read More

Topics:

High Yield,

Analytics,

BDC,

market analytics,

business development company,

LevFin Insights,

News,

research

Market signals cautious tone as it enters 4Q; little activity in credits held by BDCs

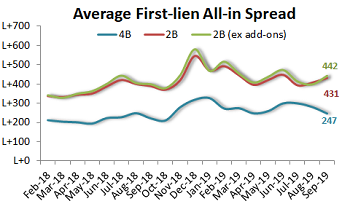

Global market volatility on the heels of an active September in loans and the biggest high-yield calendar in two years has injected a further air of caution into new issues heading into the final three months of 2019, particularly with respect to the mid-to-lower single-B segment of the market.

Read More

Topics:

High Yield,

Analytics,

BDC,

market analytics,

business development company,

LevFin Insights,

News,

research

DuBois Chemicals LBO to take out debt held by Audax, GSBD; ION Corporates to refi Wall Street Systems debt held by AINV

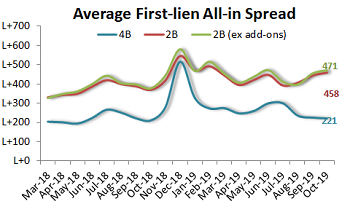

The crush of September loan and bond launches finally brought matters to a head in a week that offered the good, the bad and the just plain ugly. In particular, Friday brought deadlines for issuers working high-profile deals, especially those with concurrent bond executions, including LBO deals for Inmarsat, Shutterfly and Sotheby’s. Like a lot of current business, these deals are coming down to the wire — or heading into overtime — as accounts have been loath to commit early as they grapple with the full calendar of as many as 45 transactions on the go all at once.

Read More

Topics:

High Yield,

Analytics,

BDC,

market analytics,

business development company,

LevFin Insights,

News,

research

Increase in market activity brings wave of add-ons to BDC-held credits

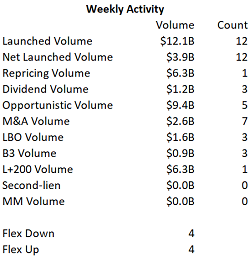

New-issue activity ramped up last week in both loans and bonds as increasingly robust conditions paved the way for well-rated and/or well-regarded issuers to speed through the market quickly despite the crowded calendar. For bonds, it was the busiest week this year with $15.5 billion of issuance, while loan arrangers rolled out another $8.1 billion in a mix of M&A and opportunistic business, much the same as the previous week.

Read More

Topics:

High Yield,

Analytics,

BDC,

market analytics,

business development company,

LevFin Insights,

News,

research

.png)