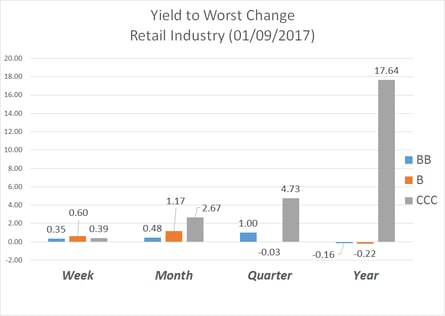

Shrinking historical “Yield to Worst” change shows that investor’s appetite for risk appears to be growing in the retail industry. This steady trend conforms with the post election rally that has taken place. The retail industry has been bolstered by a nice bump from a holiday season rush. While brick-and-mortar stores appear to be under acute pressure, many big retailers adapted and have established a strong online presence.

To view more reports about the credit markets and access our Market Analytics, request a free trial to AdvantageData.

.png)