Sears Holdings (NYSE: SHLD) announced its concerns on Tuesday about its ability to stay afloat after years of losses and declining sales. The U.S. retail giant has failed to turn an annual profit since 2011. At the end of its fiscal year in January, the company had said that it was hoping to reduce its costs by $1 billion and cut its debt and pension obligations by at least $1.5 billion. It currently has liabilities totalling around $13.19 billion. In efforts to boost its liquidity, Sears said that it has taken action to sell its Craftsman tool brand for $900 million to Stanley Black & Decker Inc (NYSE: SWK).

U.S. Lower Middle Market Loan Review - Retail Sector

Posted by

Alex Buzby on Jan 11, 2017 2:59:48 PM

0 Comments Click here to read/write comments

Topics: Loans, Middle Market, retail

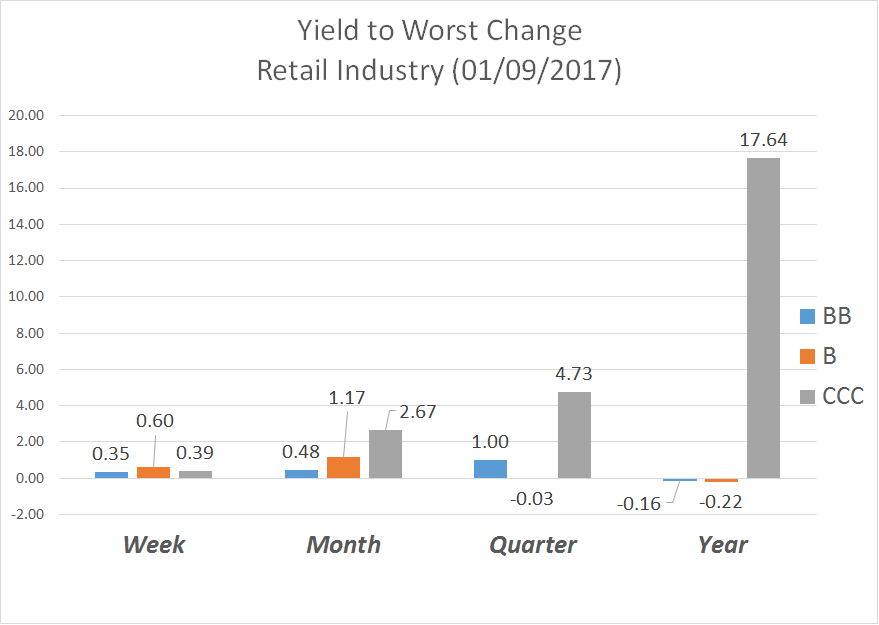

Shrinking historical “Yield to Worst” change shows that investor’s appetite for risk appears to be growing in the retail industry. This steady trend conforms with the post election rally that has taken place. The retail industry has been bolstered by a nice bump from a holiday season rush. While brick-and-mortar stores appear to be under acute pressure, many big retailers adapted and have established a strong online presence.

0 Comments Click here to read/write comments

Topics: High Yield, retail, YTW

Are you using AdvantageData?

AdvantageData is your fixed income solution for pricing, analytics, reports, and insight on approximately:

- 500,000+ U.S. and international corporate bonds

- Over 6,200+ CDS reference entities

- Over 22,000+ syndicated loans

- Over 100 equity markets worldwide

- One platform 16 products and services from debt to CDS to loans to mid-market

- Used by top buy and sell-side firms worldwide

.png)