AdvantageData wins Inside Market Data Best Market Data Newcomer 2017

AdvantageData was proud to be in attendance at the 15th Annual Inside Market Data and Inside Reference Data Awards. These awards recognize industry excellence within market data, reference data and enterprise data management.

I am pleased to announce that we have been chosen as the winner of the Best Market Data Newcomer Product for our BDC-Mid Market Loan Advantage. AdvantageData has always expanded our product line when we saw an opportunity to help our clients or solve a problem in the industry. Winning this award demonstrates our commitment to that mission.

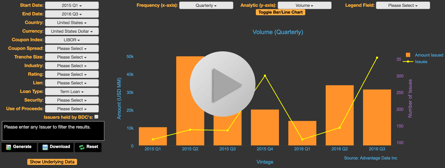

The BDC-Mid Market Loan Advantage is no different. It was developed in partnership with a group of BDC’s seeking to outsource data collection, data mapping and pricing across the thousands of US middle market companies currently held as portfolio companies.

Historically the public and private credit markets have been distinct entities. Over the last few years those lines have blurred as BDCs, Direct Lenders, and other alternative vehicles have taken on the role of the banks in originating debt securities. In order to get insight into this market that is expanding in size and scope, AdvantageData leveraged BDC filings to get a unique perspective on this opaque market.

With the lines blurring more every day between private/public and middle/broad market, this product applies to anyone involved in the credit markets. Bank and non-bank lenders alike use the BDC Mid-Market Loan Advantage to gain insight into this market of deals that fly beneath the radar of most other data providers. Specialized middle market loan comp sets, pricing sources, benchmarks/indices, holdings and more are not available elsewhere for these clients.

For BDCs and those who track them, AdvantageData now has the only adaptable and customizable database for BDC analysis. Performing portfolio analytics, peer group comparison and holdings screens can be done within hours of filing release. No other tools serve the BDC space as quickly and comprehensively.

Looking to the future, this data will become even more valuable as non-bank lenders continue to expand their footprint in the capital markets. Leveraging this broad data set with industry leading tools will allows users of the BDC Mid-Market Loan Advantage to have powerful market intelligence on deals ranging from $1MM to $10B+ all in one place while rounding out the AdvantageData loan offering, adding to our syndicated and leveraged loan services. In order to stay competitive in the capital markets landscape, lenders and originators will need to have the full picture as provided by AdvantageData.

Click here for a brief video about our BDC-Mid Market Loan Advantage

.png)